Carbon black price can hardly grow

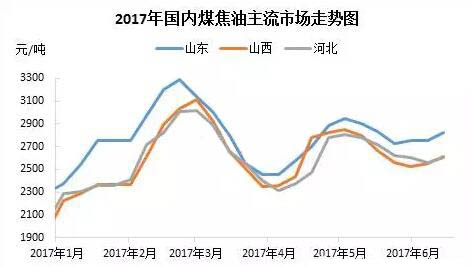

Starting from end-Apr., coal tar, raw material of carbon black, has tumbled in a narrow range.

In this period, the coal tar sector’s production was unstable and the price fluctuated. Meanwhile, the operating capacity of carbon black producers was low due to strict environmental protection requests and restriction on production.

Cautious purchase of tire producers

Coal tar price in the proarea rose 80-100 yuan/ton in mid-Jun., and the cost of carbon black increased 120-150 yuan/ton.

All-steel tire capacity utilization of tire producers in Shandong has been low and declined both on a yearly and a monthly basis.

Shandong tire producers shipped faster than in previous period and their inventories declined, but other tire markets in China hadn’t recover.

In general, tire producers are still cautious in purchasing carbon black.

New balance in supply and demand

Low price carbon black has quit Shanxi market due to tight supply, most orders are from old customers and new orders have enjoyed little discount.

The inventories of local carbon black producers have been low.

Moreover, some carbon black producers stopped production for maintenance to avoid the slack season due to low capacity utilization in the downstream.

The ex-factory price of carbon black N330 can hardly below 5,500 yuan/ton.

According to an analyst, the demand for carbon black is weak as the capacity utilization of tire and other rubber product manufacturers is low.

But some carbon black producers limited their production or stopped production for maintenance, the supply turned down, and the market reached a new balance.

Although crude oil slightly climbed up, the impact on carbon black producers is limited.

In the short term, China’s carbon black price can hardly grow and will stay sluggish for a while.

Related Article

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth