Tireworld Insight: Domestic tire makers eye overseas expansion

A few days ago, Double Coin general manager Zhang Wanyou went to the US on business, where he was surprised to encounter with quite many Chinese peer competitors, even more than he could meet in some event back in his home country.

“It seems that domestic enterprises are making a desperate fight in the international market. Everyone is vying for a share,” said Zhang, attending an annual conference of the China Rubber Industry Association (CRIA) in Shanghai on April 22.

According to a survey initiated by Tireworld, about a half of the domestic tire production is now for overseas market delivery, as more tire producers set their eye on international markets.

-- Surge in exports: SEMA show to China show

“Every year we attend the SEMA show in the US. At the beginning there were only few Chinese at the show, but in recent years, the foreigners, or the locals there, have already been outnumbered by us Chinese people,” a vice general manager of a Shandong-based tire firm told Tireworld.

“Soon in the future the SEMA show will become an exclusive show for Chinese brands, there seems no question of that,” the vice general manager shrugged.

Confronted with pressure from overcapacity of low-end products, many tire firms in China have shifted focus onto overseas markets in the hope of finding new growth points.

China’s tire exports expanded 9.6 percent in 2012, and 13.3 percent in 2013. Specifically, passenger car tire exports to the US reached 43.57 million units in 2013, accounting for 32 percent of the US’ total tire imports in the year, according to Xu Wenying, deputy head and secretary general of the CRIA.

The export value, however, keeps falling. Market observers say the price war in the domestic market is getting so fierce that it has already affected their competition in overseas markets.

-- Going international: product exports to investment making

Heated competition in the domestic market and the high potentials in overseas markets have led a growing number of domestic market players to set their foot in the international arena.

Companies including Double Coin, Zhongce Rubber, and Linglong have planned substantial investments in Southeast Asia, the world’s largest rubber producing region.

In 2013, domestic firms’ radial tire exports retained steady growth, registering an increase of 1.03 percentage points from that in 2012.

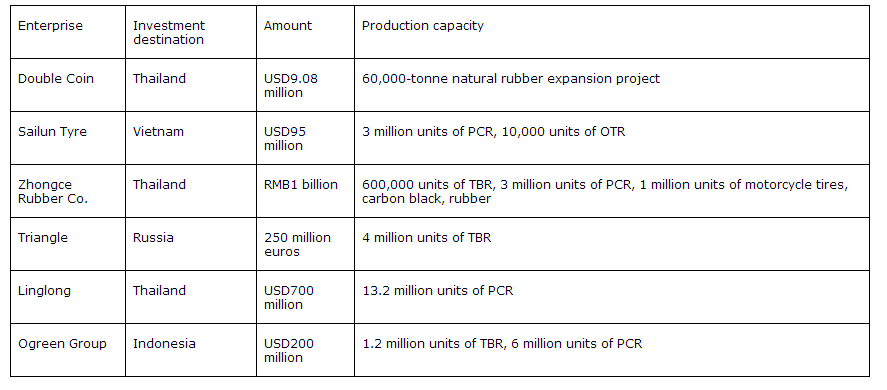

The following table specifies recent investment projects initiated by domestic tire makers in overseas markets.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth