Capacity utilization of carbon black producers slides in May

1. Coal tar turns down, carbon black keeps high

As the environmental protection authorities started relevant inspections in localities, the capacity utilization of domestic carbon black producers began to slide, and market supply decreased.

In May, the demand of downstream tire producers was sluggish, carbon black producers were under pressure of de-stocking, and the price kept stable.

Currently, the price of N220 in Shanxi is about 6,200 - 6,500 yuan/ton, that of N330 is 5,800 - 6,100 yuan/ton; that of N220 in Shandong is 6,400 - 6,700 yuan/ton, and that of N330 IS 6,000 - 6,300 yuan/ton, and there is room for bargaining.

In terms of coal tar, domestic coal tar market couldn't stop dropping lately.

The bidding price of Hebei Huafeng coal tar was 2,875 yuan/ton in mid-May, down 25 yuan/ton from the previous week.

From then on, the major producing area of coal tar started to drop, and the decreasing momentum soon spread nationwide.

Low capacity utilization of deep processing companies in the downstream and lower demand pulled down coal tar price, which is about 2,500 - 2,800 yuan/ton.

2. Decline in capacity utilization of carbon black producers

Shanxi province, the primary producer of carbon black, suffered most from strict inspection of environmental protection, a large number of producers' capacity utilization was affected, and the equipment of some producers was overhauled in advance.

Capacity utilization of carbon black producers in May declined obviously, and the overall capacity utilization was below 60%. The inventory turned down.

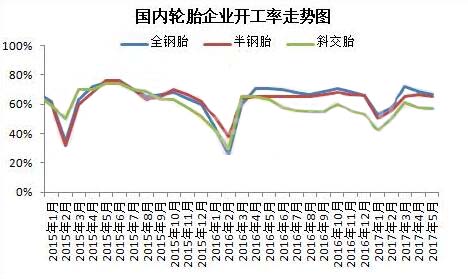

3. Low capacity utilization of tire producers

Affected by the Labor's Day vacation in May, some tire producers operated under low capacity.

As some distributors stocked large amount of tires when tire prices rose early this year, the inventory was high and the stocks in tire producers mounted up.

Currently, the capacity utilization of domestic tire market is 63%, that of all-steel tire producers is 67%, that of semi-steel tire producers is 65%, and that of bias tire producers is 57%.

An industry analyst said as downstream demand is sluggish, coal tar price drops, inventories in carbon black producers are high, the market sentiment is bearish.

But the capacity utilization of carbon black producers is low, which induces tight market supply, so the price of carbon black has been supported.

Related Article

- Black Cat Carbon Black Q1 net profit up 181%

- New materials widely used in tire-making industry

- Ningxia Dadi Circular Dev. Carbon black project starts construction

- Cabot Named Top Carbon Black Company in Energy Efficiency in China

- Research and Markets: Global and Chinese Silica (White Carbon Black) Industry Report, 2013

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth