Report on supply and demand of synthetic rubber in Chinese market

Synthetic rubber refers to any artificial polymeric materials for elastomers.

It is a synthetic elastomeric polymer, with coal, petroleum and natural gas as raw materials, and the price is closely associated with the prices of the three.

Traditionally, it can be divided into synthetic rubber and special synthetic rubber with regard to performance, scale and number.

General rubber refers to those can partly or completely substitute natural rubber, such as styrene-butadiene rubber, isoprene rubber, and butadiene rubber, etc., for producing tires and general industrial rubber products.

The demand for such rubber is massive.

Special rubber refers to rubber with features such as thermostability, oil proof, ozone resistance, aging resistance, and high gas tightness.

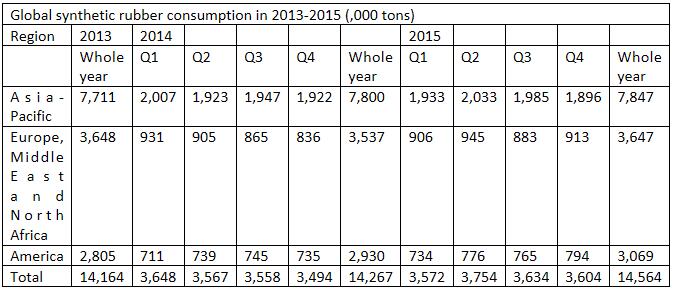

According to statistics released by International Rubber Study Group, the world’s synthetic rubber output and consumption were 14.46 million tons, and 14.56 million tons, respectively, in 2015.

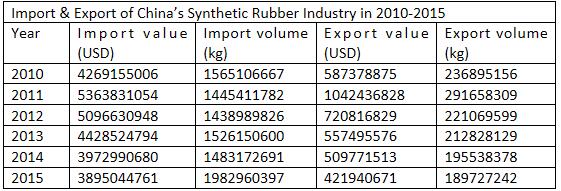

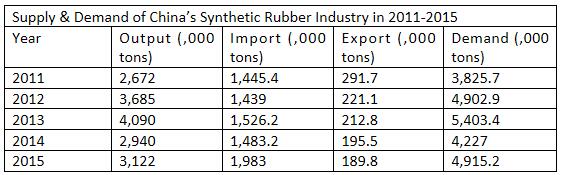

Over the past few years, China’s synthetic rubber capacity increased considerably. But impacted by contradictory output and demand, low-price imports, and trade policies, China’s import of synthetic rubber is still large. It is the world’s largest synthetic rubber (HS: 4002) importer, with the import volume hitting 1.98 million tons in 2015.

With respect to the categories, the imports of styrene-butadiene rubber and butadiene rubber were 397,000 tons and 249,000 tons, respectively, up 21% and 20.4% year on year; because of higher profitability, the import of SBCs grew 40.1%; and the import volumes of butyronitrile rubber and isoprene rubber also increased.

But due to greater supply and weaken demand, the import volumes of ethylene-propylene rubber, butyl rubber, and duprene rubber decreased year on year.

With respect to the origins of imports, South Korea is the largest origin of China’s synthetic rubber import, while the import volume from Thailand, Malaysia, Vietnam, and Singapore increased obviously.

Over the past five years, China’s import volume of synthetic rubber grew 4.8% annually. The import volume from Taiwan, Russia, Japan, and South Korea had declined by 3.6% annually. The decrement from Taiwan and Russia even dropped 9%-10% annually.

But the import volume for Southeast Asia surged over 20% annually.

The export destinations of China’s synthetic rubber are dispersed. They were exported to 139 countries and regions in 2015, including more than a half to the neighboring countries and regions, with Vietnam, Thailand, Hong Kong, and Indonesia among the top 4.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth