Trading volume of China's tire market was thin in Feb.

As the Spring Festival came in Feb., the capacity utilization of China's tire producers were small and the market demand was weak.

Many tire producers stopped production and were on vacation before Feb. 13, and the trading volume was thin.

China's environmental protection supervision is still strict, the operation of raw material producers was restrained, and the supply of some raw materials of tire is still tight and the prices are high.

As the vocation ends and tire demand rebounds, producers are expected to raise tire prices after the vocation.

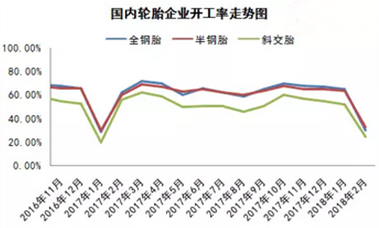

Low capacity utilization

Capacity utilization of tire producers was low in Feb.

Because of the Spring Festival vocation, logistics transport almost stopped in early Feb., and some producers' delivery was affected. Tire producers' product inventory slightly increased.

Most producers were on vocation in the middle of the month and the overall capacity utilization dropped. The agents were also on vocation and the trading volume was thin. Both capacity utilization and market demand went to the bottom of the year.

Tire producers resumed production from Feb. 23.

As of Feb. 27, domestic tire producers' capacity utilization was down to 29.33%, with that of all-steel tire producers at about 30%, semi-steel tire at 33%, and bias tire at 25%.

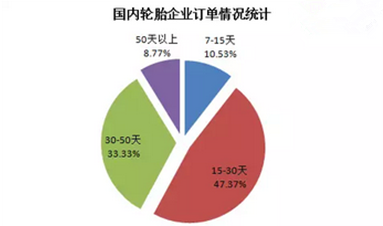

Long order cycle

Tire market demand came to a year low in Feb. but producers received more orders than in Jan.

About 10.53% producers' orders could be completed in 7 to 15 days; 47.37% in 15 to 30 days; 33.33% in 30 to 50 days; and 8.77% in over 50 days.

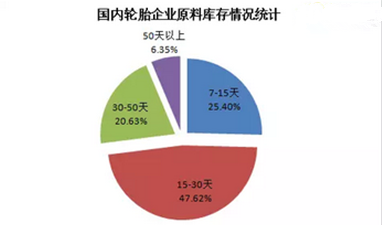

Calculation of raw material purchase cycle

Statistics show that in Feb., about 25.40% domestic tire producers' raw material purchase cycle is within 7 to 15 days; 47.62% within 15 to 30 days; 20.63% within 30 to 50 days; and 6.35% in over 50 days.

Tire producers' capacity utilization is expected to back to normal in Mar. and downstream demand will bottom out.

Although natural gas price turned to rational, carbon black and rubber additives' production pressure eased, raw material prices are still high due to environment protection supervision and market demand.

Some tire producers are lifting prices again and growing momentum is expected to continue.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth