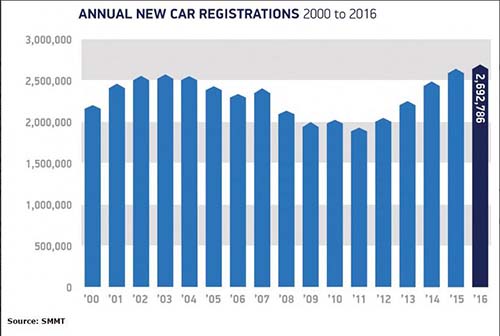

2016 car sales peak at 2.7 million units in UK

5 per cent drop predicted for 2017

The UK new car market achieved another record year in 2016, with annual registrations climbing for the fifth year in a row to almost 2.7 million, according to figures published by the Society of Motor Manufacturers and Traders (SMMT). The market has experienced uplifts in 10 out of the last 12 months, albeit finishing with a December down slightly by -1.1 per cent – with 178,022 new cars registered in the month. However, the SMMT also gave a negative prediction for growth in 2017.

In 2016 buyers were reportedly attracted by a range of new car models and attractive finance deals, pushing registrations up to 2,692,786 in 2016 – up 2.3 per cent on the previous year and broadly in line with expectations. The UK new car market is one of the most diverse in the world, with some 44 brands offering nearly 400 different model types – and 2017 looks set to be another competitive year with almost 70 new launches already planned over the next 12 months.

Fleets were responsible for most of the growth, with demand growing to a record 1.38 million units. The private market remains at a historically high level, with more than 1.2 million private buyers registering a new car in 2016, although demand did fall over the latter three quarters. The competitive range of affordable finance is a crucial factor driving private demand as consumers are able to take advantage of low interest rates and flexible payment options.

Diesel and petrol cars continued to be by far the most popular fuel types for consumers with market share at 47.7 per cent and 49.0 per cent respectively. However, alternatively fuelled vehicles (AFVs) experienced a strong uplift in demand, up 22.2 per cent across the year. Plug-in hybrids and petrol electric hybrids, in particular, experienced significant growth, with demand up 41.9 per cent and 25.1 per cent respectively. Meanwhile, more than 10,000 motorists chose to go fully electric in 2016 – up 3.3 per cent on 2015.

Car sales to fall in 2017

However, while 2016 sales were at a record high, most sources expect a correction in 2017. For its part, the SMMT sales are expected to fall by 5 – 6 per cent.

Mike Hawes, SMMT chief executive, said: “2017 may well be more challenging as sterling depreciation raises the price of imported goods but, with interest rates still at historic lows and a range of new models arriving in 2017, there are still many reasons for consumers to consider a new car in 2017. Looking longer term, the strength of this market will rest on our ability to maintain our current trading relations and, in particular, avoid tariff barriers which could add significantly to the cost of a new car.”

Prior to the release of the SMMT results, Glass’s predicted the UK new car market will fall by around 3.5 per cent during 2017 to around 2.6 million cars. However, while the figure looks disappointing in isolation, the vehicle data provider points out that this will still be higher than any year in the last decade except 2016.

Rupert Pontin, director of valuations, said: “We have become used to the new car market growing on a year-by-year basis and when that stops happening, there will inevitably be a feeling of some unease.

“However, if you look at the bigger picture, the fact is that a 2.6 million market in 2017 would still be a very good performance in recent historical terms.

“We should certainly not be feeling as though there is any kind of crisis underway and the underlying strength of the economy will be quite good. Conditions are simply likely to become a little more difficult.”

Chris Bosworth, Director of Strategy at Close Brothers Motor Finance comments suggested pre-registrations could augment the predicted drop in sales: “Nevertheless, despite the new car sector showing strong growth in the business, fleet and alternative fuelled markets, the success in these sectors have masked the continued fall in private sector sales in 2016, which has seen its ninth successive month-on-month drop in December. Additionally, a recent BBC investigation found that a fifth of new cars in the UK are estimated to be ‘pre-registered’ – if true, this could have profound implications on an already dwindling market. A key reason for there being so many pre-registered cars is that they are often the only way dealers can achieve monthly sales targets set by manufacturers. And so, with 20 per cent of new vehicles potentially not being on the roads for a further 90 days, this, in theory, has been skewing sales figures.”

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth