ChemChina buying polymer machinery firm

Even as it continues to digest its acquisition last year of Pirelli & C. S.p.A., state-owned China National Chemical Corp. (ChemChina) is adding to its portfolio with the buyout of KraussMaffei Group, a major global plastics and rubber processing machinery company.

In announcing the $1.01 billion deal, ChemChina called KraussMaffei (KM) “the Rolls-Royce” in the polymer machinery industry.

KM, ChemChina and Onex Corp., the Toronto-based private equity firm that has owned KM since 2012, announced the acquisition Jan. 10.

ChemChina highlighted that this is the single largest investment a Chinese company has ever made in Germany.

KM currently has 4,500 employees globally, including 2,800 based in Germany. The company has had its headquarters in Munich since 1838.

In their announcements, both ChemChina and KM CEO Frank Stieler described the prospective new owner as a long-term investor — a contrast from KM’s last two private equity ownership groups.

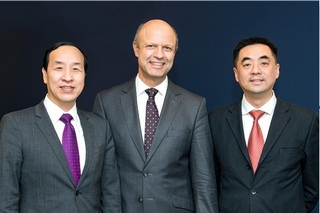

(KraussMaffei/ChemChina photo)

Ting Cai (left), chairman and CEO of China National Chemical Equipment Co. Ltd., is flanked by Frank Stieler, CEO of KraussMaffei Group and Chen Junwei, CEO of the ChemChina Finance Co. Ltd.“With ChemChina, we have found a strategic and long-term oriented investor who has been interested in our company for many years,” Mr. Stieler said in the release.

Earlier this month the boards of directors of Pirelli & C. S.p.A. and Marco Polo Industrial Holding S.p.A. approved the merger plan of Marco Polo Industrial Holding into Pirelli and confirmed plans for a Feb. 15 extraordinary shareholders' meeting to approve new by-laws governing the merged entities.

KM will continue to operate in its current corporate structure, and will remain in Munich, Mr. Stieler said.

ChemChina, a state-owned-enterprise, said its existing machinery subsidiary — China National Chemical Equipment Co. Ltd. — and KraussMaffei have complementary product portfolios and markets. In addition, they are strategically and organizationally aligned with compatible management and cultures, allowing for significant synergies.

ChemChina Chairman Ren Jianxin said in a statement: “We are strengthening our company with one of the leading global engineering groups, encompassing a 178-year corporate history. In doing so, we expect that KraussMaffei Group will maintain its identity and independence.”

ChemChina claims to be China’s largest exporter of rubber machinery.

Mr. Ren said the deal is also an implementation of China’s “One Belt One Road” and “international production capacity cooperation” initiatives.

Mr. Stieler said Onex had a “very successful year” in 2015; according to the company, it will report 10 percent sales growth for the year.

He predicted that as part of ChemChina, KM will “considerably accelerate our growth strategy, especially in China and Asia, and to further strengthen the company in Germany and Europe.”

In China, the company will benefit from a trend toward processors buying higher quality and more efficient plastics machinery.

As a result of the transaction, KM will “accelerate its planned expansion in China,” the companies said in the release, adding that the company’s operating and corporate responsibility “will stay in Europe.” The company plans to increase its employment in Germany in 2016.

“All existing collective agreements and location-based commitments will remain unchanged,” the company said in the release.

ChemChina is China’s largest chemicals group, with sales of 37 billion euros and 140,000 employees. The company ranks 265th on the Fortune 500 list, and No. 9 in global chemicals.

ChemChina’s publicly listed subsidiary, Tianhua Institute of Chemical Machinery and Automation, said in a filing that KraussMaffei’s business has a certain competitive relationship with its plastics processing technology business — extrusion and reaction molding. Tianhua said ChemChina will follow the non-competition agreement that was previously reached to handle the issue.

Terms of the deal

The cash value of ChemChina’s purchase is 925 million euros ($1.01 billion), a 62-percent gain from the 568 million euro ($731 million) deal in 2012 when Onex bought KM from Madison Capital Partners. Onex highlighted KM’s improved financial performance in its announcement.

China Reform Holdings Corp. Ltd., an investment firm charged with revamping state-owned enterprises, and leading Asian-European private equity firm AGIC Group, also took shares in the transaction, ChemChina said.

The deal is pending antitrust approval.

In 2011, private equity firm Oncap, part of Onex, bought Davis-Standard L.L.C., a maker of extruders, blow molding machines and related equipment. Last year it added Gloucester Engineering Co. to the Davis-Standard portfolio.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth