Chinese exports to U.S. continued ramping up in 2014

The Chinese “invasion” of the U.S. tire aftermarket continued with gusto in 2014, as imports of passenger, light truck and medium truck/bus tires from China jumped 9.5, 21.8 and 34.2 percent, respectively, last year over 2013.

As a result, China-sourced tires accounted for one-third of U.S. car tire imports, nearly a quarter of light truck tire imports and 63 percent of medium truck/bus tire imports, according to Tire Business’ analysis of data from the U.S. Commerce Department.

Comparing the import data with the most recent shipment estimates from the Rubber Manufacturers Association (RMA) shows that imports now account for seven out of 10 passenger, nine out of 10 light truck and three-fourths of medium truck/bus tires shipped to replacement market destinations.

China alone accounted for nearly one-fourth of U.S. aftermarket car tire shipments, the analysis reveals, 22 percent of light truck tire shipments and nearly half of medium truck tire shipments. In deriving these figures, Tire Business assumes imports go predominantly to the replacement market.

Some of China’s gain in the car tire segment can be chalked up to higher shipments in the fourth quarter as importers tried to get tires on shore before the U.S. antidumping and countervailing duties took effect in December.

Overall, car tire imports rose 3.6 percent last year over 2013 to 148.9 million units. The biggest gainer among the 10 largest countries exporting to the U.S. was Chile, which has only one tire plant —Goodyear’s in Santiago. (Detailed import/export statistics available for purchase from the Tire Business Data Store.)

Goodyear initiated a $500 million investment at that plant in 2011 to upgrade the factory and convert as much as 7 million units of annual capacity to “high value-added” production.

At the time, the Akron-based tire maker said it would supply both domestic and Americas markets from that plant’s upgraded capacity.

Car tire imports from Chile rose to 5.79 million units last year from 2.96 million in 2011, according to the government data, but light truck tire imports from that country fell 9 percent to 1.02 million.

Thailand also booked a double-digit increase last year, up 17.1 percent to 11.4 million car tires.

Otherwise, half of the top 10 import countries saw their shipments to the U.S. decline last year, the data show.

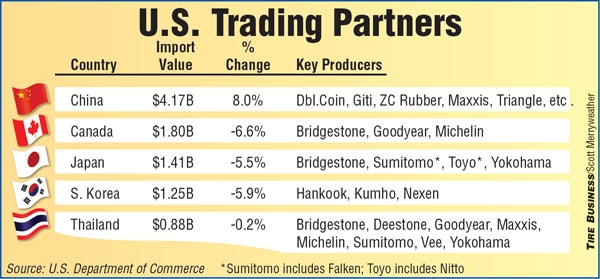

Value of Imports, 2014

(millions of dollars)

China $ 4,173.6

Canada $ 1,801.8

Japan $ 1,412.1

South Korea $ 1,245.8

Thailand $ 881.3

Mexico $ 649.1

Indonesia $ 487.7

Germany $ 461.4

Chile $ 393.5

Taiwan $ 372.5

TOTAL $14,281.6

Passenger import growth reflected the shift in the U.S. aftermarket, with shipments of tires up to 15 inches in rim diameter falling 4.2 percent collectively and imports of tires 16 inches and greater jumping nearly 16 percent. The biggest single increase was in the 17-inch category — up 22.8 percent.

The average declared customs value of a passenger tire last year was $51.55, down 5.4 percent from $54.47 in 2013, which in turn was 9.8 percent below the 2012 value.

The average value of the smaller sizes (up to 15 inches) was $41.70 while that of tires 16 inches and larger was $65.30.

Among the 10 largest car tire exporters to the U.S., Taiwan and China had the lowest values at $34.02 and $35.96, respectively, the data show. Both were lower than in 2013. Germany claimed the high ground at $101.58.

Canada remained the No. 1 source of imported light truck tires, the data show, but imports from the north fell 3.4 percent from 2013. By contrast, imports from China and Japan jumped 21.8 and 16 percent, respectively, while those from South Korea, Thailand and Mexico fell.

The average value of a light truck tire import last year was $75.61, down 6.7 percent from $81.01 a year ago. The values ranged from $55.97 at the low end (Vietnam) to $113.49 (Taiwan).

The medium truck/bus segment rebounded with vigor last year after declining slightly in 2013 vs. 2012.

Overall truck tire imports jumped 30.1 percent to a record 13.2 million units, led by China’s 34.2-percent jump. China’s growth was buoyed in part by the return of Roadmaster-brand tires from Cooper Chengshan Tire Co. Ltd.

That joint venture — Cooper Tire & Rubber Co. has since sold its share — had suspended shipmentsof Cooper’s Roadmaster-brand truck tires in mid-2013 in the throes of the protracted Cooper-Apollo Tyres Ltd. merger/takeover negotiations.

The venture, since renamed Prinx Chengshan (Shandong) Tire Co. Ltd., has agreed to continue supplying Cooper with Roadmaster truck tires until mid-2018.

Imports of truck tires were up across the board last year, including a sevenfold increase from Slovak Republic (where Continental A.G. is the sole tire maker), a near doubling from Spain (where both Bridgestone Corp. and Group Michelin have factories) and double-digit gains by all the other major players except South Korea.

The average price of an imported truck/bus tire last year fell 6.6 percent to $172.16 from $184.31, which in turn was nearly 10 percent lower than the 2012 average.

The average values ranged from $128.38 for a tire from China (down 9 percent from 2013) to $310.23 for one from Spain, the data show.

The U.S.-based tire makers turned up the wick a bit last year as well, expanding light and medium truck exports 11.7 and 33.9 percent, respectively, while passenger car tire exports slipped 5.3 percent.

Canada and Mexico dominate the export tables, accounting for 80 percent of car tire exports, 64 percent of light truck tires and 95 percent of medium truck tires.

Collectively, the value of tire imports last year hit $14.3 billion, up just 1.5 percent over 2013. The trade deficit — value of imports minus value of exports — shrank slightly to $9.32 billion as U.S. exports grew 8.4 percent.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth