U.S. high-performance tire sector hit harder than overall market

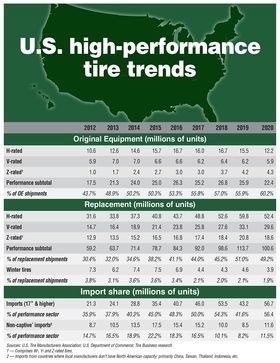

The U.S. market for high-performance tires topped 100 million units last year for a second straight year even though shipments were off 11.5% versus 2019, according to data from the U.S. Tire Manufacturers Association (USTMA).

The dip in demand for high-performance tires (those with speed ratings of H or higher) was slightly more severe than that for replacement market passenger tire shipments overall (down 8.6%), dropping the performance share of the aftermarket to 49.4% from 51% in 2019, the USTMA data show.

Shipments declined by double-digits in all three high-performance categories (H, V and Z speed ratings), according to Tire Business' analysis of the available data, which appears in the 2021 Market Data Book, part of the magazine's Feb. 15 issue.

The decline lends weight to observations by a number of tire companies that aftermarket demand last year skewed more heavily to non-Tier 1 brands during the economic downturn.

Well over half of the performance tires shipped to the aftermarket came from factories outside of the U.S. According to Tire Business' analysis of the USTMA and Department of Commerce data, 56.4% of the 100.6 million high-performance units were imported, the highest concentration ever, with shipments from Thailand, South Korea and Mexico accounting for half of the imports in this category.

On the OE side of the ledger, shipments of high-performance tires slipped 13.5% to 22.4 million units, but the penetration of such tires in the OE sector increased to 60.2% from 56% as OE car tire shipments overall slid 19.2%, reflecting a drop in car, SUV/CUV and light vehicle production of 18.9%

The shift at OE also is reflected in the breakdown of OE tire sizes, where the 10 most popular sizes now are all 17-, 18-, 19- or 20-inch rim diameter sizes — including three new 20-inch sizes, accounting for nearly 36% of all OE shipments.

Six of the 10 most popular replacement tire sizes are 50-, 55- or 60-series, the USTMA data show, and seven are 17-, 18- or 20-inch rim diameters.

During 2020, the number of accepted sizes grew by five low-profile dimensions, according to the Tire & Rim Association: 195/60R17; 235/60R19; 195/50R19; 295/55R20; and 235/50R21. The new sizes expand the list of accepted sizes to 370.

Sales of new light vehicles (cars, SUVs/CUVs, light trucks, vans, etc.) were off 14.4% in the U.S. and 20 in Canada in 2020, according to data from Automotive News, a sister publication of Tire Business under the Crain Communications umbrella.

Ford and Toyota remained the top-selling car/light truck/van brands in both countries last year, with the Ford F-150 the single most popular vehicle in both nations.

Related Article

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth