Bankruptcy run in Chinese wealthy privounce

A series of bankruptcy filings by major private-sector bond issuers in China’s third-wealthiest province is shining a spotlight on aggressive efforts by local governments to manage unsustainable debt loads.

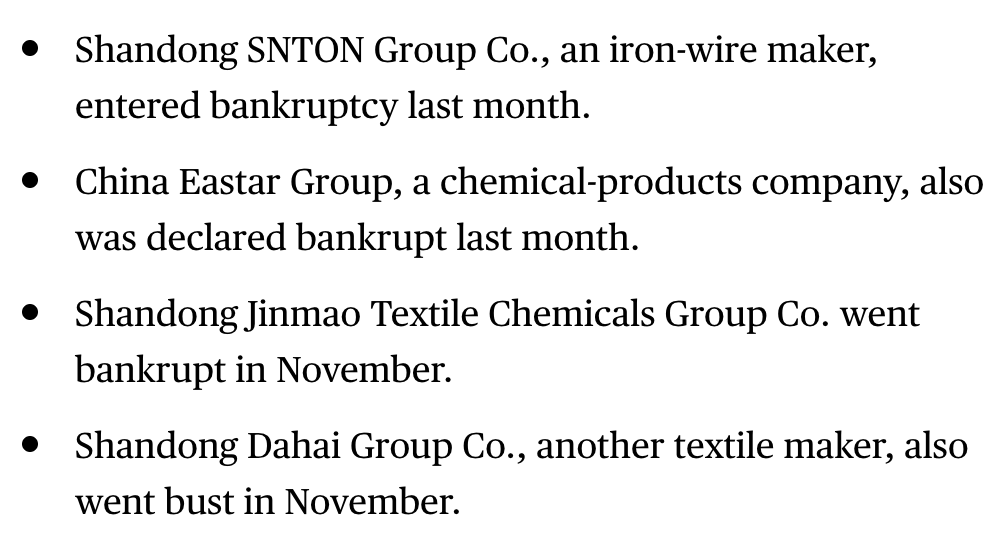

Four debtors have entered bankruptcy procedures since the start of November in Dongying, a city of 2 million in the eastern province of Shandong that once thrived with a booming tire-making industry. While China sees thousands of bankruptcies each year, instances of court-led restructuring of publicly issued bonds have been rare. Authorities in other cases have encouraged workouts with creditors, raising questions about the Dongying examples.

“The recent slew of bankruptcies sent shock waves through the bond market,” said Chen Su, a bond portfolio manager at Shandong’s Qingdao Rural Commercial Bank Co. “For bondholders, they can only expect to get a low repayment ratio through the bankruptcy reorganization -- besides which it’s quite a time-consuming process.”

Creditors would prefer direct talks with the company, Chen said. But authorities might have other ideas. Driving their potential concern: the pattern of private-sector companies guaranteeing each others’ debt. The maneuver helped encourage lenders to extend credit, but is now threatening systemic risks as one borrower gets in trouble, infecting others.

In the case of SNTON, local officials have moved to halt the spread of damage, assuming some 80 percent of the guarantees that another Shandong business -- China Wanda Group Co. -- had extended to SNTON, people familiar with the matter said earlier this week. China Wanda’s 2.4 billion yuan 5.2 percent bond due September 2021 jumped the most on record on Wednesday, according to Bloomberg-complied prices.

SNTON itself was a prolific debt guarantor, to the tune of 3.86 billion yuan ($575 million), the equivalent of 35 percent of its net assets as of June 2018. China Eastar, which together with SNTON form two of the largest private enterprises in Shandong, extended guarantees amounting to 25 percent of net assets as of January 2018. The two textile businesses also had made guarantees to peers.

That Shandong authorities were apparently comfortable with SNTON and China Eastar entering bankruptcy, yet intervened to alleviate the obligations of China Wanda, illustrates the varied and hard-to-predict decisions of local officials. (China Wanda is unrelated to the entertainment giant Dalian Wanda Group Co.)- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth