Exports of Chinese nine public tire fims

There are nine public tire manufacturers in China, which can represent the Chinese tire industry. This article mainly analyzes the export statistics of the nine firms.

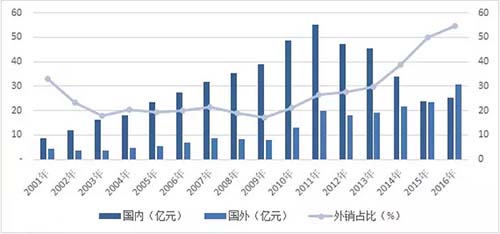

Aeolus Tyre

The export of Aeolus Tyre has basically kept a rising trend since 2003.

In 2008-2009, under the influence of the global financial crisis, the export of Aeolus Tyre declined. After that, the company’s export maintained an upward trend with fluctuations.

Aeolus saw its export more than domestic sales for the first time in 2014, and drop in 2015 due to the anti-dumping and anti-subsidy investigations in the export destinations.

The export-domestic sale ratio increased from 20 percent in 2003 to 38.4 percent in 2006, and kept at around 35 percent in 2007-2011. From 2011, the ratio kept rising to 50 percent in 2014, and hit a peak of 53.44 percent in 2015.

Guizhou Tyre A

The export of Guizhou Tyre Co. has maintained an upward trend in terms of operating revenues, which was hit by the global financial crisis in 2008-2009 but resumed quickly after that.

The company saw its export surge 63.39 percent and 50.67 percent, respectively, in 2010 and 2011.

The export-domestic sale ratio of Guizhou Tyre slumped in 2001-2003 to 20 percent, and maintained that level from 2003-2009, and started increasing quickly from 2010 to reach 54.74 percent in 2016.

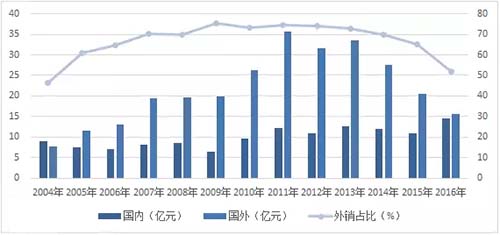

S Giti Tire

Giti Tire saw its export keep increasing from 2004 to peak at 3.569 billion yuan in 2011. From 2011 on, its export mainly maintained a downtrend, except in 2013 there was a slight resumption.

Over the past 12 years, Giti’s export was always higher than its domestic sale except in 2004.

The export-domestic sale ratio of Giti has been above 50 percent since 2005, which peaked at 75.39 percent in 2009 and has turned downward since then and dropped to 51.77 percent in 2016.

Qingdao Doublestar Tire

Qingdao Doublestar Tire kept an increasing export from 2003 to 2012.

From 2012, its export was hit by the anti-dumping and anti-subsidy moves by the foreign countries. The downward trend was not ended until 2016.

The export-domestic sale ratio of Qingdao Doublestar stood at 30 percent in 2016, after a few years of increase and a few years of decrease.

Sailun Jinyu

Sailun Jinyu has higher overseas revenues than domestic revenues. From 2011, its revenues from overseas kept increasing except that in 2015.

In 2014, Sailun Jinyu saw its overseas revenues surge by 106.25 percent from 2013, a much larger increase than any other year.

The export-domestic sale ratio of Sailun Jinyu kept at around 60 percent in 2011-2013, which rose to 77.11 percent in 2014 and kept at around 80 percent from then on.

Shanghai Huayi Tire

Compared to the above companies, Shanghai Huayi Tire gained relatively low revenues from overseas markets. In 2012, its overseas revenues hit the highest of 2.419 billion yuan.

The export-domestic sale ratio of Huayi Tire has never surpassed 10 percent, suggesting the company has a smaller reliance on export than its peer companies.

In 2016, its export-domestic sale ratio dropped to 4.63 percent from the peak of11.51 percent in 2012.

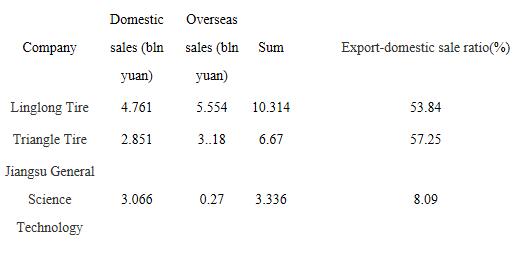

Other companies

Linglong Tire, Triangle Tire and Jiangsu General Science Technology only publishedtheir operating statistis for 2016.

Statistics showed that export of Linglong tire and Triangle tire was higher than domestic sales, and Jiangsu General Science's export share was only 8.09%.

2016's statistics showed that export share of Huayi Group and Jiangsu General Science Technology was less than 10%, and Sailun Jinyu was 78.43%, deep dependence on foreign trade.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth