E-tailers of Own Brand Tires Perform Well in H1

The Tire E-commerce Analysis Report in H1, 2016 has been released lately.

The report was based on prices of 140 million products recorded in the first half of this year and the sources included China’s largest e-commerce platforms, such as Tmaill.com and Taobao.com.

According to the report, sales of tire e-tailers kept sound growth in the first half of 2016.

Two aspects were particularly noteworthy – emerging of own brand tires and increasingly important role of tire intermediaries under Internet patterns, such as B2C and O2O. Tire intermediary may become a driving force in the sector of tire e-commerce in future.

1.Product Analysis

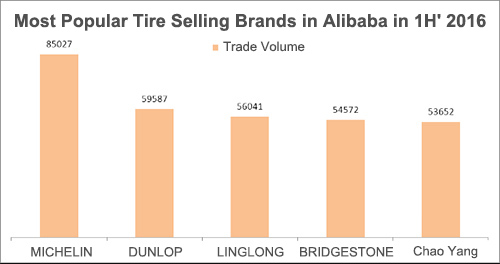

A.Most Popular Brands

In the first half of 2016, Michelin turned out to be the most popular tire brand with a total sales volume of 85,000 on Alibaba Group’s e-commerce platforms. Dunlop won the second with a sales volume of 60,000; and Bridgestone ranked the fourth with a sales volume of 54,000.

Also in the first half, China’s own brand tire emerged with a growing momentum –Linglong Tire became the third most popular tire brand on Alibaba platforms with a sales volume of 56,000.

Chaoyang Tire ranked the fifth with a sales volume of 53,000.

Fast growth of Linglong Tire and Chaoyang Tire shows that their product quality and services were recognized by more consumers.

B.Most Popular Products

In the first half, Michelin Energy XM2 205/55R16 91V, Dunlop SP T1 205/55R16 91H, and Bridgestone EP200 205/55R16 91V turned out to be the three most popular tires.

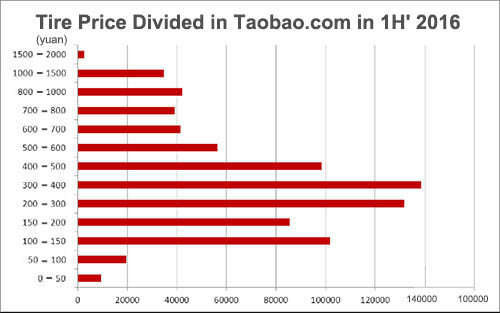

C.Tire Price Distribution

Tire price is one of the key elements affecting the sales volume.

Statistics show that in the first half, consumers preferred tires ranging from 300 yuan to 400 yuan most and more than 138,000 tires within the pricing range were sold.

Online prices of popular tires showed an upmarket trend, signifying that in the context of higher level of consumption, the pricing effect on consumption of car owners has decreased.

Consumers are expected to focus more on tire quality and performance, traditional “price war” may won’t be effective.

2.Store Analysis

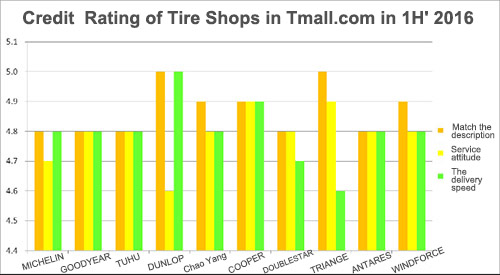

A.Credit Rating for Tmall.com Flagship Store

In the first half, credit ratings for flagship stores on Tmall.com were generally well. The ratings for consistency of product description with real product, attitude of service providers and product delivery were high.

With regard to the rating and comment, consumers trusted more in official flagship stores and product quality, and they were generally satisfied with the query, purchasing and post-sale process.

In view of the comments, most consumers expected greater promotion, diverse online services, and better services.

B.Brand Popularity in Searching

Visibility of brands affected their popularity in searching ranking on Tmall flagship stores.

Tuhu Auto Flagship Store turned out to be the top search term in the first half of this year, while Doublestar Tire and Linglong followed suit.

Comparatively lower prices as well as one-stop purchasing and aftermarket services provided by Tuhu made it the top brand on the searching list. Consumers expected to buy tire products with quality and reasonable prices as well as better services on Alibaba platforms.

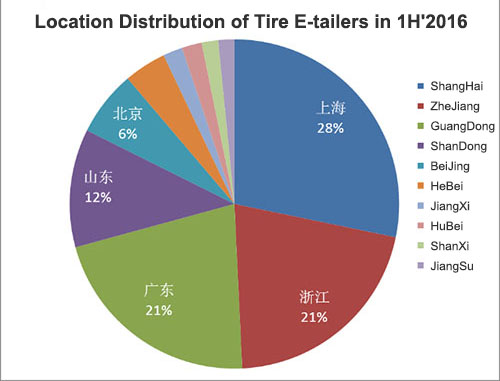

3.Location Distribution of Tire E-tailers

In the first half, e-tailers from Shanghai, Zhejiang and Guangdong provinces all exceeded 160,000, much more than from other places.

About one third retailers were from Shanghai, and Zhejiang and Guangdong provinces each took up a 21% share in e-retailers.

In addition, Shandong and Beijing ranked the fourth and the fifth places.

Except a few remote areas, tire e-tailers came from a variety of localities across China.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth