China Tire Market Suffers Negative Growth Across the Board in 2015

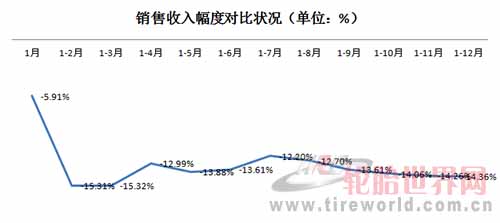

In 2015, 42 major members of the Tire Branch of China Rubber Industry Association (CAIA) realized a total of 172.016 billion yuan in tire output and 153.678 billion yuan in sales revenue, down 14.52 percent and 14.26 percent year on year respectively, according to the CAIA Tire Branch.

Declining Growth in Major Indicators

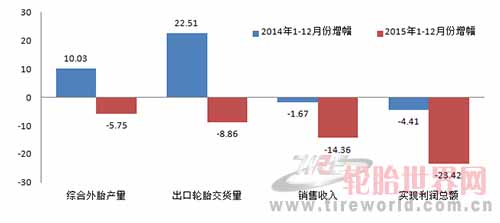

The growth rates of major indicators for Chinese domestic tire industry in 2014 and 2015 (Unit: %)

As the graph shows, all the major indicators for China’s tire industry including outer tire output, delivery of exported tires, sales revenues and total profits suffered negative growths in 2015. Among them, profits posted a striking 23.42 percent decline from 2014.

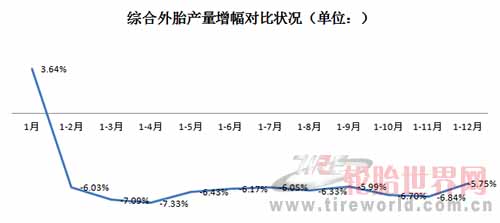

The following chart shows the year-on-year growth trend of outer tires output in 2015.

China produced 353,002,800 million outer tires in 2015, down 5.75 from 2014. In a breakdown, output of radial tires came to 318,327,800, down 5.26 percent year on year; and output of steel-belted radial tires arrived at 82,500,400 units, down 6.71 percent year on year. Radial tires accounted for 90.18 percent of total outer tires.

The following chart shows the year-on-year growth trend of tire sales revenue in 2015.

The following chart shows the year-on-year growth trend of total profits for tire companies in 2015.

According to the CAIA Tire Branch, China’s tire industry realized 6.531 billion yuan of profits in total in 2015, down 23.42 percent year on year. Its inventory stood at 15.738 billion yuan as of end-December 2015, down 8.11 percent year on year and 2.71 percent month-on-month.

The following chart shows the year-on-year growth trend of delivery of exported tires in 2015.

In terms of exports, China delivered 55.483 billion yuan of exported tires in 2015, down 15.92 percent year on year. The amount of exported tires delivered came to 154,679,600 million units, down 8.86 percent year on year. Of this, exported radial tires arrived at 143,988,600 million units, down 8.02 percent year on year.

The declining output and profits, to a certain extent, worsened the situation of most of tire companies.

Unoptimistic Outlook

In the beginning of 2016, the world’s three tire giants released their 2015 reports respectively. The figures from the reports show mixed results, but the overall operation did not seem to be optimistic.

Micheline reported 21.199 billion Euro of sales, up 8.4 percent from 19.553 billion Euro in 2014. Its operating profits came to 2.577 billion Euro, up 12.2 percent year on year.

Revenue for Bridgestone increased 8.2 percent to 517.2 billion yuan, but its net profits declined 5.4 percent year on year.

Goodyear posted 16.4 billion US dollars of sales, down 9.3 percent year on year. The company has suffered decline in sales for three years running.

Most tire manufacturers are not sanguine about the market in 2016. Some industry insiders said the situation may turn a bit better if they hold on for another year and wait for the phasing out of a group of small factories. However, there has been no signs for the market to fare better at the moment.

In terms of domestic demand, the downstream auto market in China has reduced its pace in growth. In 2015, China produced 24,503,300 cars and sold 24,597,600 ones, rising 3.25 percent and 4.68 percent year on year respectively. The growth rates declined 4.01 percent and 2.18 percent respectively from 2014.

In terms of the export markets, the United States and Brazil, among others, imposed anti-dumping duties on some of Chinese tire products, leading to the decreases of both export amounts and prices for Chinese tires.

In 2015, China exported 444,510,000 units of new pneumatic tires, down 6.6 percent from 2014. The exports value amounted to 85.854 billion yuan, down 15.1 percent form 2014.

Chinese domestic tire industry is faced with overcapacity, sluggish downstream demand and frequent hurdles for exports. Many industry experts said that Chinese tire industry, which developed too fast in the past, was bent on expansion without paying attention to product quality and branding. Now, as the industry slows down growth, it must think over about the future strategy.

It is generally held that the year 2016 will be a sensitive and difficult year. It remains to be seen which tire companies can survive after the tide recedes.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth