China Tire Industry May Run Less Than 60 Pct of Capacity in 2016

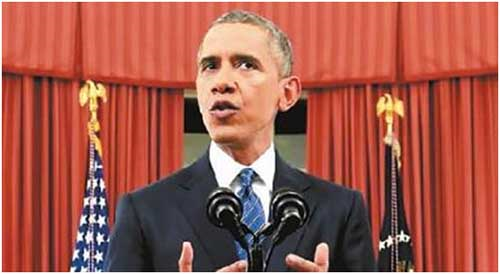

While addressing the National Governors Association on February 22, U.S PresidentBarack Obama said that China’s attempt to dump state-subsidized goods into the U.S. market is not going to work.

Tires fall into the category of what Obama termed as “state-subsidized goods.”

Probes Detrimental to China’s Tire Industry

The U.S. Department of Commerce launched anti-dumping and countervailing investigations into China’s truck/bus tires on February 19.

At the same day, the Chinese Ministry of Commerce (MOC) responded that the Chinese government will closely follow the progress of the case and will resolutely safeguard the proper interests of the Chinese industry by WTO rules.

In fact, the Chinese tire companies have get used to repeated anti-dumping andcountervailing probes by the U.S. in the past nine years. However, such investigations have become much more frequent this year due to certain factors.

The U.S. restrictions over many varieties of China-made tires after countervailinginvestigations will produce major repercussions on China’s tire industry, said an official of the MOC.

“China’s tire industry, which relies heavily on exports to the U.S. market, may have an operating rate of less than 60 percent following increased antidumping and countervailing probes, “ said a director of a component company.

He suggested that Chinese tire companies, whist upgrading their products, should adjust the orientation and the means of exports.

The U.S. recent antidumping and countervailing investigations into imports of truck/bus tires from China involved a total amount of U.S. $1 billion.

Before March 14, the United States International Trade Commission (ITC) will make itspreliminary determination on the impact of China’s tire exports on the U.S. tire industry. If the determination is affirmative, the Commerce will make a determination based on further probes.

The U.S. holds that in the past 18-24 months, the price of tires exported from China to the U.S. has kept declining to a level that is lower than that of retread tires, disturbing the market order.

According to U.S. statistics, the country imported 4.86 million truck/bus tires from China in 2011, accounting for 22.71 percent of its original and aftermarket tires. In 2014, the U.S. imports of truck/bus tires form China amounted to 8.38 million units, representing 36.25 percent of the aftermarket tires.

However, an official of the Trade Remedy and Investigation Bureau of the MOC pointed out that the U.S. Commerce’s investigations lacked factual and legal basis and in particular, showed serious problems in terms of the qualification of the petitioner and the representativeness of the industry.

Given the sound operation and good profits of the U.S. tire manufacturers, the Chinese side is of grave concern over the U.S. antidumping and countervailing investigations, he said.

Rough statistics show China and the U.S. experienced major trade frictions five times in the past nine years. Trade frictions became more frequent at the beginning of the year.

Shortly after it concluded antidumping and countervailing investigations probes into China-made OTR tires, the U.S. Commerce announced its new target on China truck/light tires.

“The tire industry has become a bargaining chip for U.S. interests groups, being associated with every election campaign, “ said Deng Yali, president of China Rubber Industry Association, calling for the whole industry to “stay vigilant as the year 2016 is the year for presidential election.”

Operating Rate May Fall Below 60%

The U.S. continuous antidumping and countervailing investigations into Chinese tire makers over the past nine years have seriously impacted the development of the industry.

Currently, China’s auto industry has slowed down its growth. Further hurdles for components exports may exacerbate overcapacity of the tire industry.

During H1 last year, China’s tire industry posted an operating rate of only 60 percent, down 10 percentage points year on year, as a result of the U.S. antidumping andcountervailing investigations, according to the Ministry of Industry and Information Technology.

China exported 40 percent of the tires it produced and of the exports, 50 percent arrived in the United States, according to data released by the National Bureau of Statistics and the Customs.

“In July last year, the U.S. started to impose antidumping and countervailing duties onpassenger and light truck tires from China. It started the investigations at the beginning of the year again. The operating rate of China’s tire industry may therefore fall below 60 percent,” predicted a component manufacturer.

“For China’s tire industry, the priority is how to address overcapacity,” said an industry official, adding that “upgrading the products is one of the ways out.”

Chinese tire manufacturers should shift the orientation of exports, reversing its reliance on the U.S. market, and realize the export of its output capacity, which will help reduce the influence of political factors, some others suggested.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth