China auto dealers under high inventory pressure amid overall sales decline

China's vehicle outputs and sales in October reached 2.334 million units and 2.38 million units respectively, edging down 0.9% and 0.6% over the previous month, while evidently dropping 10.1% and 11.7% from a year ago, according to the data released by the China Association of Automobile Manufacturers (CAAM).

A number of automakers also suffered YoY decline or saw slower growth in Oct. sales, which inevitably perplexed dealers who are striving to sell as much as vehicles in the rest time of the year.

The inventory turnover ratio for China’s car dealerships in October was 1.88, surging 41% over a year ago and edging up 3% over a month ago, which exceeded an official warning threshold, according to the China Automobile Dealers Association (CADA). The inventory ratio growth should be attributed to the overall stagnant market climate, consumers’ wait-and-see mood and the less shopping frequency caused by the busy farming season.

The Oct. inventory turnover ratio for the premium & imported car brands, the joint-venture car brands and the China-owned car brands reached 1.57, 1.79 and 2.33 respectively, which climbed 10%, 1% and 3% over a month ago.

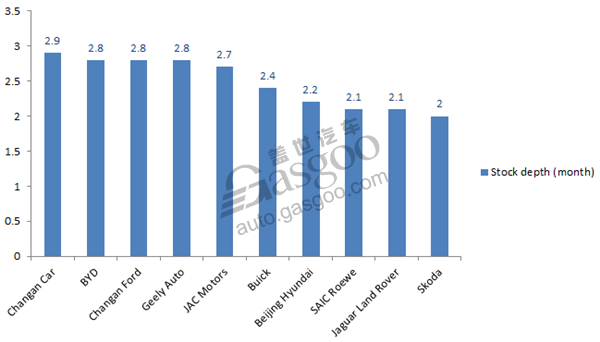

A total of ten brands saw their stock depth in October exceed 2 months. BYD, Changan Ford and Geely Auto all had stock depth up to 2.8 months.

The inventory turnover ratio exceeding the warning threshold of 1.5 or the stock depth surpassing 2 months suggest that dealers will face a higher inventory pressure. To boost sales and consume inventory before 2018 ends, dealers might cut vehicle prices, thus lead to lower profits and difficulty on capital turnover. However, it seems that the inventory stress for dealers cannot be significantly lightened by 2018.

Related Article

- Weaker China demand, regulation spell tough quarter for Europe's auto stocks: Goldman Sachs

- Top 4 Japanese automakers by June sales in China

- Brief on autonomous driving development in China

- Indian ATMA seeks dumping duty on radial tyre imports from China

- Over 17m automobiles sold in China since beginning of the year

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth