Chinese own brand passenger automobile manufacturers in September

Having suffered from poor sedan sales and facing a constantly decreasing market share, own brand manufacturers managed to finally recover a bit in September. According to statistics compiled by Gasgoo.com (Chinese), a total of 553,100 own brand passenger automobile were sold in September, representing year-on-year growth of 12.2 percent. That growth rate is well above the market average rate of 7.85 percent. Likewise, own brands' combined share in the Chinese passenger automobile market grew to 34.7 percent in the month, 1.4 percent than similar figures reported a year ago.

This change in performance is due mainly to increased SUV sales and newly introduced minivan models, as well as favorable government subsidies for own brand new energy vehicles. Own brands' performance in the sedan segment is still quite poor, with their combined sedan sales in the month a full 16.6 percent less than sales volumes reported in September 2013. By comparison, sales of own brand SUVs and minivans were 51.8 percent and 44.4 percent higher, respectively.

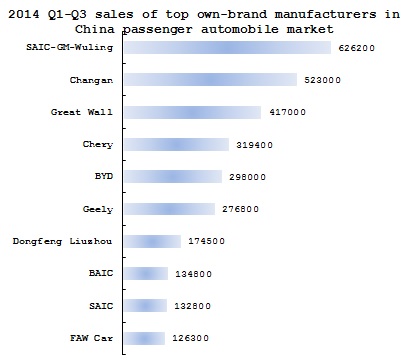

A total of 4.29 million own brand automobiles have been sold over the firsts three quarters of the year, representing year-on-year growth of 10 percent. That growth rate is slightly less than the market average growth rate of 13.2 percent. Own brands sales accounted for 32.7 percent of all passenger automobiles sold in the country over the first three quarters of the year.

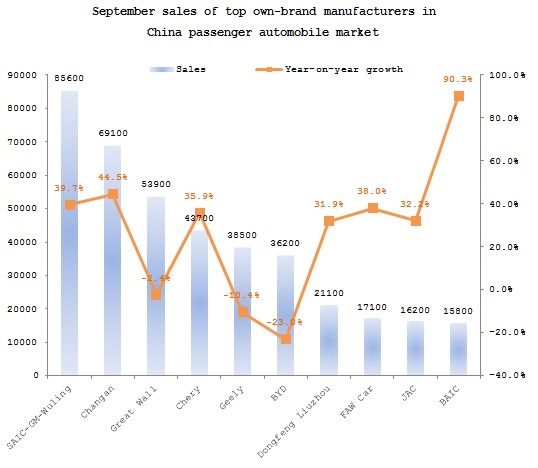

SAIC-GM-Wuling remained September's best performing own brand manufacturer (while technically a joint venture, it relies mainly on own brand product sales). It was followed by Changan Automobile, Great Wall, Chery, Geely, BYD, Dongfeng Liuzhou, FAW Car (whose sales didn't include those of Mazda vehicles), Jianghuai and Beijing Automotive.

Both Great Wall and Geely saw their sales fall noticeably from August to September.

Great Wall sold 53,900 vehicles over the course of the month, down 3.4 percent from last September. That growth rate, while still negative, is still better than its cumulative negative year-on-year growth of 8.8 percent so far this year. The new Haval H2, which made its market debut in July, and the hot-selling Haval H6 have helped keep Great Wall in the race. September sales of the two models were 8,288 units and 27,700 units, respectively.

Geely, meanwhile, sold 38,500 vehicles in September. That figure represents negative year-on-year growth of 10.4 percent, better than its cumulative growth rate of negative 26.3 percent. Sales of its flagship Emgrand EC7 recovered, with a total of 18,900 units sold in September.

BYD also reported a negative year-on-year growth rate in September. Its sales of 36,200 vehicles was 23 percent less than the amount sold a year ago. Poor sales of its key S6 and Surui models were attributed as reasons for its weak showing in September.

The remaining seven entries on the September sales chart not only reported positive year-on-year growth rates, those rates were all above the 30 percent mark. SAIC-GM-Wuling's monthly sales of 85,600 vehicles was 39.7 percent higher than last year's figures. The JV owes a lot of this to the success of its new Baojun 730, whose sales in September, its second month on the market, totaled 21,000 units.

Changan Automobile's sales grew a full 44.6 percent from September 2013 to September 2014, totaling 69,100 units. Thanks to its new models, Jianghuai also performed strongly, selling a total of 16,200 vehicles over the course of the month. This represents a major turning point for the own brand, whose prior performance this year has been lackluster at best.

SAIC-GM-Wuling is the best performing own brand passenger automobile manufacturer for the first three quarters of the year, followed by Changan, Great Wall, Chery, BYD, Geely, Dongfeng Liuzhou, BAIC, SAIC and FAW Car.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth