China auto sales show first growth after 21-straight-month YoY decline

After 21 consecutive months of year-on-year downturn, China posted first growth in monthly auto sales.

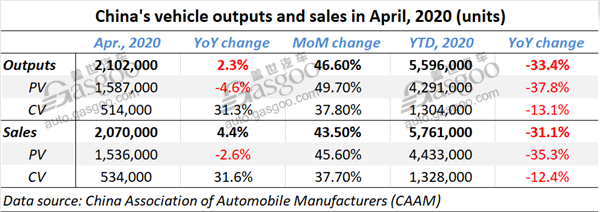

In April, automakers in China sold roughly 2.07 million new vehicles, a year-on-year growth of 4.4% and a month-on-month surge of 43.5%. During the same period, the country's auto outputs edged up 2.3% from a year ago to 2.102 million units, according to the China Association of Automobile Manufacturers (CAAM).

The small but significant increase completely owes to the blooming surge in CV outputs and sales. Within the CV unit, truck's production and sales volumes vigorously rose 33.8% and 34.2% to 475,000 units and 496,000 units respectively.

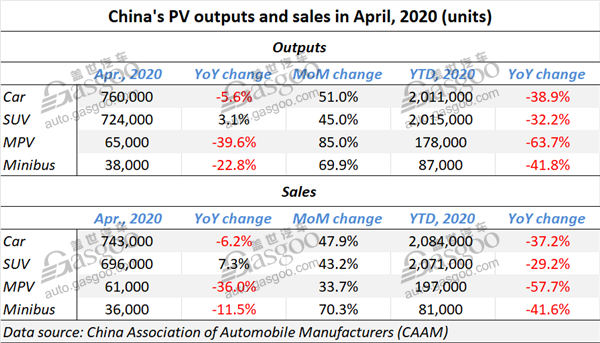

However, the growth in April PV sales still remained negative, which substantially curbed the increase in overall sales. The sales volumes of cars, MPVs and minibuses were all lower than the prior-year levels, but SUV sales were still up by 7.3%.

Bruised by the coronavirus pandemic and the Lunar New Year holiday, the year-to-date auto sales of China slumped 31.1% to 5.761 million units, of which 4.433 million units (-35.3%) were PVs and 1.328 million units (-12.4%) were CVs.

Although the coronavirus is abating in China, a great uncertainty of the pandemic still exists as the viral spread has been effectively contained abroad, said the CAAM. On the one hand, the consumption demands of commodities are still weak because the domestic macro economy still needs time to regain growth, which particularly makes life harder for those enterprises with high dependence on export business. On the other hand, the shutdown of overseas plants brings more risks to the auto parts supply for China's automakers.

The NEV sales in April fall 26.5% compared with the same period in 2019 to around 72,000 units. With 9,000 units sold, the new vehicle CV sector posted a 23% year-on-year jump, which somewhat counteracted the 30.4% decrease the PV unit suffered.

To revive NEV sales, China's policy makers announced last month two-year extension for both NEV purchase tax exemption and subsidies. The latter, which was supposed to be stopped by the end of 2020, will be phased out at a slower pace.

Related Article

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth