China records 5.5% decrease in April. homegrown PV retail sales

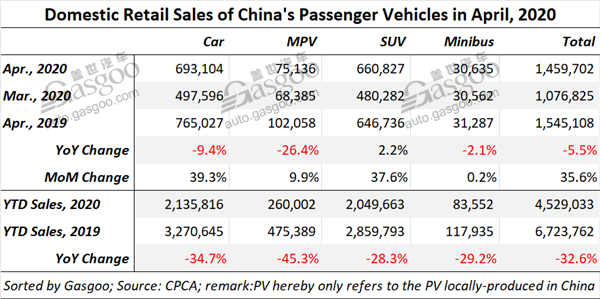

In April, the retail sales of China's locally-produced PVs (referring to cars, MPVs, SUVs and minibuses) reached 1,459,702 units, falling 5.5% year on year, while leaping 35.6% month on month, according to the China passenger Car Association (CPCA).

For the first four months, a total of 4,529,033 homegrown PVs were delivered to consumers, a 32.6% decrease compared to a year-ago period mainly attributable to the coronavirus outbreak and the Spring Festival holiday.

With the pandemic ebbing in China, normal operations were basically restored for dealerships in April. The association said the new car retails rebounded to a stable level after the second week of the month.

The retail recovery was driven by the justified travelling demands amid the pandemic and the local governmental incentives, even though consumers’ confidence was still suppressed by the rampant viral spread taking place abroad.

Besides, the price of refined oil product running low in April decreased the car using costs for consumers, which was a tailwind for car consumption growth.

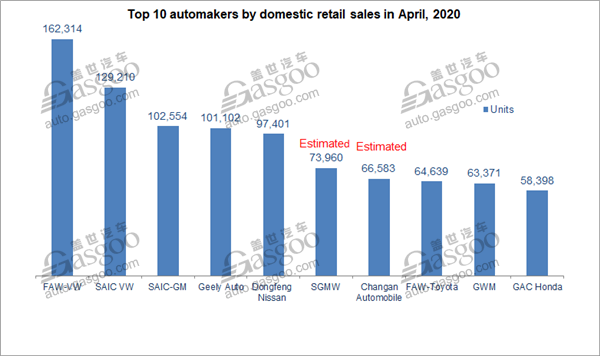

Compared to March, Volkswagen’s two joint ventures were still the occupants of the champion and the runner-up by April PV deliveries. SAIC-GM moved up to the second runner-up place. Geely Auto delivered 101,102 PVs with its fourth place still retained. Moreover, SAIC-GM-Wuling dropped three places to the sixth. GAC Honda, which failed to enter the top 10 list in March, was ranked 10th last month.

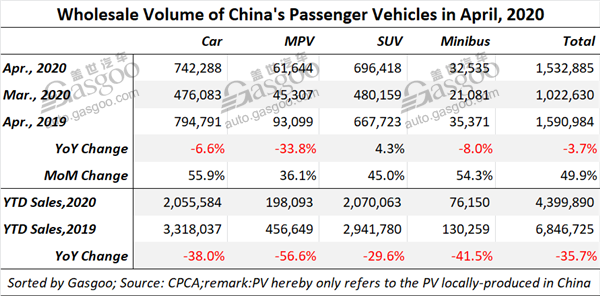

As for wholesales, automakers in China sold 1,532,885 locally-produced PVs, a year-over-year drop of 3.7%, but posting a remarkable growth of 49.9% from a month ago. Year-to-date PV volume still dwindled 35.7%.

Among the top 10 automakers by April PV wholesales, the occupants of the first five places were as same as that of the retail sales. Dongfeng Honda, FAW-Toyota and GAC Honda, which were ranked sixth to eighth, disappeared in the top 10 list in March.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth