Premium auto brands’ sales in China for July 2019

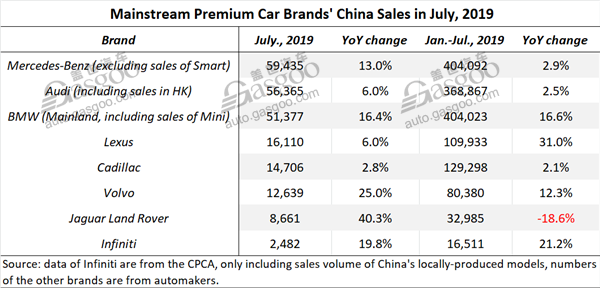

In July, premium vehicle market still remained positive despite the overall downturn in Chinese auto market. Gasgoo hereby compiled the sales data offered by eight mainstream premium vehicle manufacturers. All of them accomplished year-on-year growth in July sales. Except Jaguar Land Rover, the other seven all posted increase in year-to-date sales.

German luxury auto brands

Last month, Mercedes-Benz won a 13% year-on-year growth in its China sales (excluding the sales of Smart-branded cars), outselling BMW who consecutively took the championship by monthly sales from April to June.

Its July blooming performance also made itself the champion in terms of year-to-date sales, while only 69 units more than that of the runner-up BMW. Up until now, it is still hard to see who will be honored the No.1 premium car automaker in China for 2019.

According to the statistic from the China Passenger Car Association (CPCA), the retail sales volumes of the Mercedes-Benz C-Class and the GLC-Class reached 14,165 units (+14.5%) and 12,357 units (+19.3%) respectively, ranked 15th and 10th on the list of locally-produced car and SUV models by July deliveries.

Including the sales volume of Mini brand, BMW delivered 51,377 new vehicles across China in July, boasting the biggest year-on-year growth among three German luxury car giants.

Meanwhile, combined sales volume of BMW and Mini brands for the first seven months also jumped 16.6% to 404,023 units thanks to a comprehensive segment coverage and the fresh energy injected to its product lineup.

In the first half of 2019, BMW rolled out two flagship models—the X7 large-sized SUV and the 7 Series facelift—which were quite popular among Chinese consumers.

In China, Audi's biggest single market in the world, the automaker ended July with a year-on-year increase of 6%. With 56,365 new vehicles sold, Audi also achieved its best-ever July sales figure in this country.

The brand's flagship, the Audi A8 L (+21.2%), partially accounted for this increase. Demand for the top-selling Audi model in the world's largest auto market, the A4 L, remained strong, up by 3.7%. In the first half of the year, the A4 L had already managed to race ahead of the competition in China as the best-selling premium sedan.

Second-tier brands

Lexus outperformed Cadillac in July sales with its sales in China climbing 6% to 16,110 units, of which 5,721 units were contributed by its hybrid models.

Meanwhile, 109,933 customers took delivery of Lexus-branded vehicles, a year-on-year jump of 31%. Deliveries of hybrid models surged 43% to 37,518 units.

As of June, 2019, Lexus achieved the milestone of 1 million vehicles in China, using only 15 years.

Cadillac was still the champion second-tier premium car brand by year-to-date China sales. Its July sales volume also climbed 2.8% year on year.

Its SUV sales in July reached 12,102 units. Of that, sales of the Cadillac XT5 remarkably rose 23.7% from the prior-year. Besides, the monthly sales volume of the CT6 sedan represented a year-on-year surge of 90.1%.

Volvo attained double-digit growth in both July sales and Jan.-Jul. sales thanks to the strong demands of the China-made XC60 and the S90.

The 2020 Volvo S90 luxury sedan went on sale on July 2, added with two new sports trim levels. Last month, the sales volume of the S90 amounted to 4,575 units, up by 12.4% compared with the same period a year ago.

Jaguar Land Rover said its China sales in July soared 40% over the previous year, laying a sound foundation for the company to strengthen business reform during the second half of the year.

The UK premium carmaker saw its monthly sales in China grow month over month for two consecutive months during the second quarter—sales in April, May and June reached 7,049 units, 7,743 units and 9,532 units respectively, according to data announced by Jaguar Land Rover.

On the final day of July, the all-new Land Rover Evoque went on sale in China with four trim levels. Suggested retail prices range between RMB355,800 and RMB417,800.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth