Data Talk: North American PV brands take a hit in China

North America, the continent that breeds auto giants such as General Motors and Ford, is another brand origin boasting considerable deployment in Chinese auto market and is certainly worth a study for Gasgoo's Data Talk.

To simplify the expression, we use terms like “NA brands” and “NA PVs” to refer to those brands and PVs jointly build with or solely created by North American automakers.

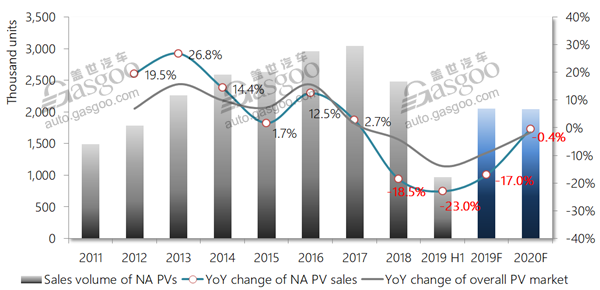

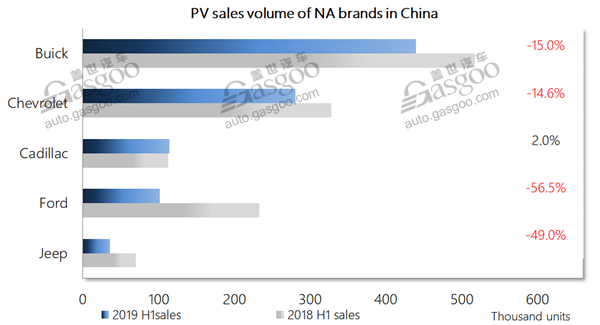

The NA PV sales volume presented significant downturn for both the year of 2018 and the first half of 2019, and much of blame has been laid on the comparatively long upgrade cycle and insufficient coverage in terms of segment. Particularly, the slump in Ford- and Jeep-branded PV sales volume has also been blamed for the overall NA sales decrease.

Considering the current performance and near-future product planning, the Gasgoo Auto Research Institute (GARI) forecasts a 17% year-on-year decline in full-year sales of NA PVs in 2019.

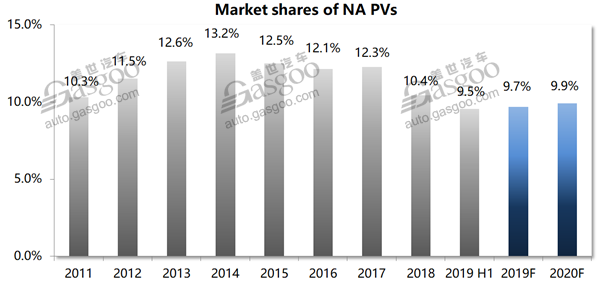

Market shares of NA PVs have been declining for recent years and recorded below 10% for the first six month of 2019. It may be hard to see an evident growth in the near term.

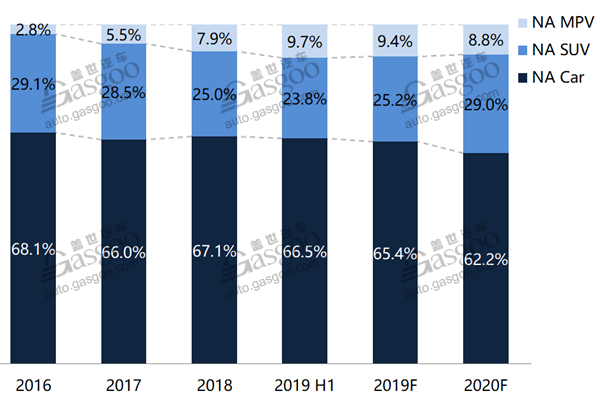

Among NA PVs sold, the share of SUVs was sliding year by year since 2016 due to the relatively weak product roll-out and increasingly richer lineup operated by rivals.

The SUV's percentage is expected to rise with General Motors and Ford intensifying their SUV offensive in China in the second half of the year.

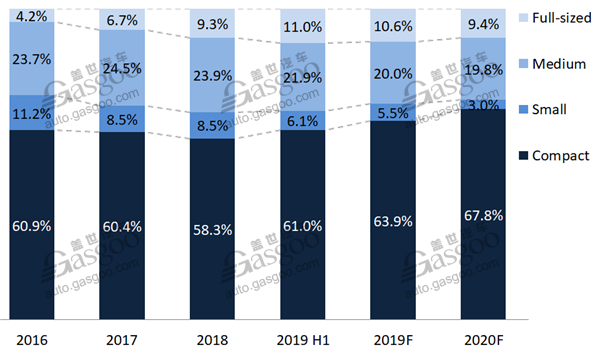

Shares of NA small-sized vehicles shrank to 6.1% for the first half of 2019 from 8.5% for the year of 2017 as the consumption upgrading trend whittled down market demands over lower-priced vehicles. However, the percentage of NA medium vehicles didn't climb with the overall growth of this segment since its space was somewhat squeezed by Japanese counterparts.

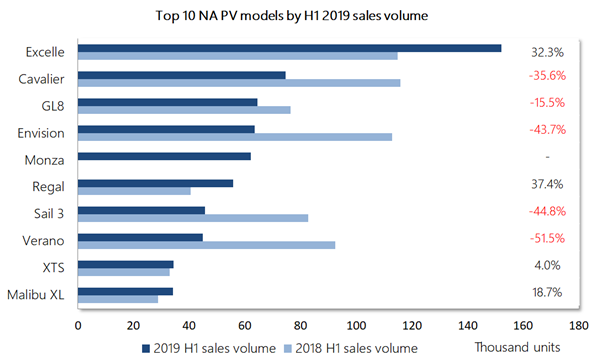

Here are the top 5 NA brands and the top 10 NA PV models by Jan.-Jun. sales volume:

(Data source: wholesale volume of the China Association of Automobile Manufacturers)

Related Article

- Data Talk: gap among European PV brands widening in China

- Tokyo rubber inches lower on Aug.22

- Chinese Tire Industry Update: Focus on Overseas Expansion Amid Geopolitical and Economic Uncertainty

- Bridgestone Wins Design Patent Infringement Lawsuit in China

- Natural rubber production declining as demand grows

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth