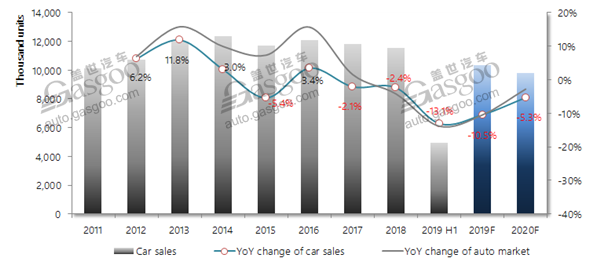

China's car sales in 2019 predicted to fall 10%

After outlining the current and future landscape of China's PV capacity utilization, Gasgoo's Data Talk will start a new chapter from a PV category perspective. This series will consist of three parts—car, SUV and MPV.

Now, let's begin with the car. All data hereby refer to the wholesale volume offered by the China Association of Automobile Manufacturers (CAAM). Besides, to shorten the term of a car brand's origination, we will use such expressions as China-owned brand, Japanese brand, European brand, etc.

For the year of 2018, car sales dropped less than that of the overall PV market. Impacted by the slower new model roll-out pace than SUVs and the sluggish performance of French cars, annual car sales in China for the year of 2019 are projected to present a year-on-year drop of roughly 10%, remaining flat as that of the entire PV market.

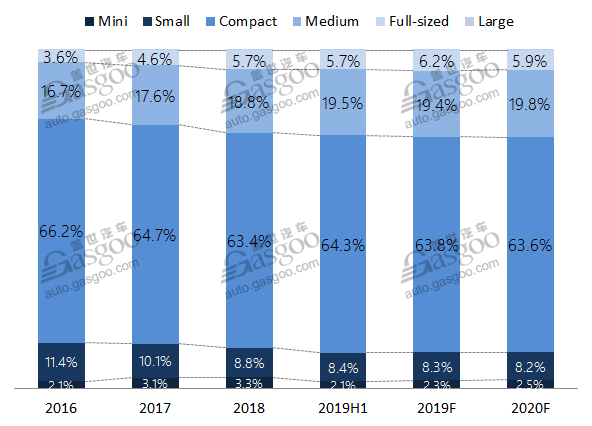

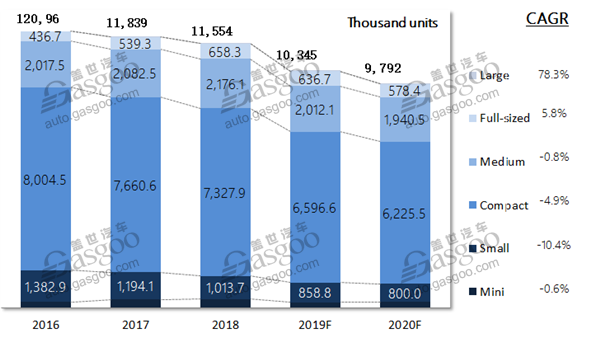

Market shares of small cars have been declining year by year since 2016. The weakened market demands are making automakers whittle down the product launch over the small-sized cars.

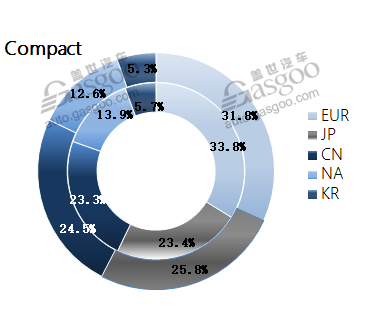

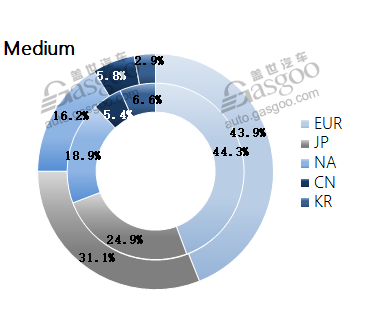

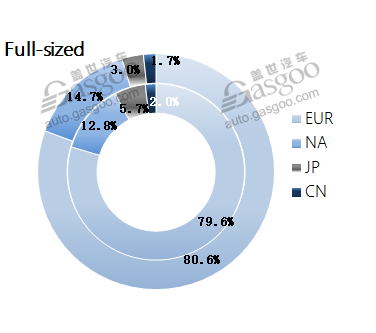

Thanks to the increasingly stronger demands to replace cars driven by the upgraded consumption, consumers prefer to buy compact and bigger cars. Besides, the sales growth of full-sized cars for recent years has been significantly benefitted from the rising premium car sales (the inner ring means annual market shares for 2018, the outer ring means the market shares for the first half 2019).

For the first six months of 2019, China's self-owned cars accounted for 95.5% of total mini car sales, which presented a year-on-year slump of 35%. In the meantime, BEVs made up roughly 95% of China-owned mini cars sales. Affected by a new NEV policy with stricter technical thresholds and less subsidies, sales of all-electric BEV significantly took a hit, which indirectly led to the decrease for overall mini car sales.

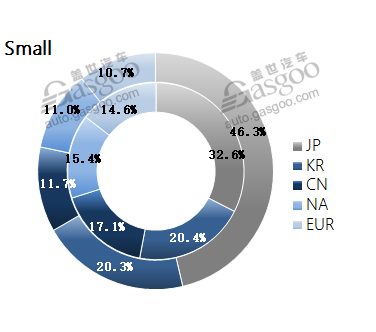

Although Jan.-Jul. sales of small cars fell 20% from a year ago, Japanese car brands gained a year-over-year jump of 22%, primarily thanks to Honda and Toyota's new product deployments. Since July, the existing Fit cars are no longer available for sale in regions that implement the China Ⅵ emission standard, and the all-new Fit is said to hit the market in the first half of 2020, which may further boost the sales of small cars.

In the compact segment, China-owned car brands saw its market shares edge up to 24.5% for the first half of 2019 from 23.3% for the year of 2018. Although the Geely Emgrand was the only China-owned model among the top 10 locally-produced car models by Jan.-Jun. sales, China's self-owned car brands are blunting the sales downturn by speeding up the roll-out of new models.

Regarding the medium car segment, Japanese car brands posted the biggest market share growth. Sales of mid-sized cars originated from Japan are steadily climbing with such new models as the TNGA-based Camry's change-over, the all-new Avalon and the tenth-generation Accord going on sale.

Premium cars made up around 90% of total full-sized car sales. Due to the intensified offensive of German luxury car brands, sales of the Crown, the only full-sized car model for Japanese car brands, showed downturn gradually. From the above rings, you can also discover that the full size was the only segment in which Japanese car brands suffered market share decrease.

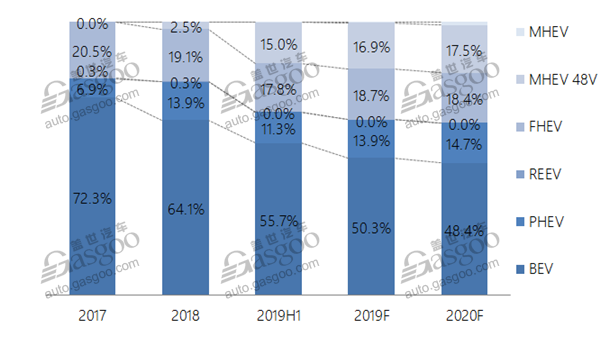

Cars assisted by 48-volt mild hybrid system are projected to gain 17.5% shares in electrified car market in 2020 as the stricter regulations on fuel consumption are promoting increasingly more carmakers to develop 48-volt systems.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth