Summary of 8 major China-based automakers’ profitability in Q1, 2019

For the first quarter of the year, China’s vehicle outputs and sales were 6,335,700 units and 6,372,400 units, falling 9.81% and 11.32% over a year ago respectively, according to the China Association of Automobile Manufacturers (CAAM).

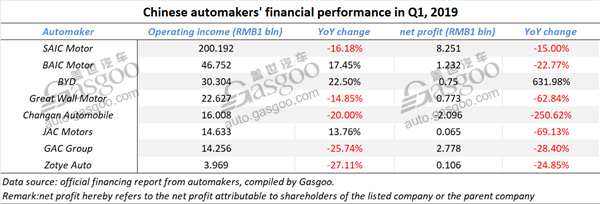

The continuous year-on-year sales downturn also reflected on the financial performance for automaker in this country. By compiling the data announced by eight China-based automakers, Gasgoo found out that most of them recorded double-digit decrease in Q1 net profit attributable to shareholders of the listed company or the parent company. Nevertheless, there was still an eye-catching number on the above table—631.98%, an astonishing year-on-year surge for BYD.

SAIC Motor

As China’s most lucrative auto group, SAIC Motor saw its net profit attributable to shareholders of the listed company in the first quarter slide 15% year on year to RMB8.251 billion, according to its Q1 report released on April 29.

Meanwhile, the automaker generated a total of operating income of RMB200.192 billion from January to March, down by 16.18% over the previous year.

The drop of quarterly operating income and net profit were relevant to its Q1 sales drop to a great extent. SAIC Motor saw its Q1 sales apparently slide 15.88% from the previous year to 1,533,005 vehicles, among which the March sales shrank 14% to 558,558 units, the seventh month in a row for the company facing year-on-year downturn.

BAIC Motor

BAIC Motor Corporation Limited (BAIC Motor) stated that its operating income for the first quarter totaled RMB46.752 billion, growing 17.45% compared with RMB39.806 billion a year earlier.

The Q1 net profit dropped 12.73% year on year to RMB3.552 billion, among which the net profit attributable to owners of the parent amounted to RMB1.232 billion with a double-digit decline of 22.77%.

Besides, total operating costs by the end of March this year jumped 17.83% to RMB40.236 billion. To be specific, the quarterly operating costs (RMB33.649 billion), selling expense (RMB4.451 billion) and R&D costs (RMB98.433 million) surged 23.36%, 41.44% and 29.69% respectively from the year-ago period.

BYD

BYD reported on April 26 that its operating income in the first quarter jumped 22.5% year on year to RMB30.304 billion and the quarterly net profit attributable to shareholders of the public company skyrocketed 631.98% to RMB749.732 million.

The automaker expected the net profit for the first half of 2019 to surge over 50% over the year-ago period buoyed by strong demands for new energy vehicles (NEVs), the soon-to-be-finished upgrade of the Dynasty series models and the increasingly rich new energy commercial vehicle lineup. From January to June, the total net profit attributable to shareholders is likely to reach RMB1.45 billion to RMB1.65 billion, soaring 202.65% to 244.40% compared with RMB479.1 million earned in the same period last year.

For the second quarter, BYD said it is expected to face year-on-year downturn in fuel-burning vehicles affected by the sliding market demands and phase-out of outdated models, and record net loss in photovoltaic business due to the depressed market needs.

Great Wall Motor

Great Wall Motor’s total operating income in the first quarter shrank 14.85% over the previous year to RMB22.627 billion, the automaker announced on April 30.

The quarterly net profit attributable to shareholders of the public company reached RMB773.283 million, plunging 62.84% year on year. Excluding the non-recurring gains and losses, net profit was RMB643.462 million, still presenting a sharp decline of 69.72%.

Besides, the weighted average return on assets and the basic earnings per share for the first quarter were 1.46% and RMB0.08.

For the first three months of the year, the automaker’s expenses of sales, management and R&D amounted to RMB596 million, RMB307 million and RMB362 million, slumping 46.2%, growing 10.83% and leaping 27.92% respectively year on year.

Changan Automobile

Chongqing Changan Automobile Co., Ltd said on April 30 that its operating income in the first quarter of the year slumped 20% over the previous year to RMB16.008 billion.

Meanwhile, the quarterly net profit attributable to shareholders of the listed company reached –RMB2.096 billion, a year-on-year nosedive of 250.62%. The net profit excluding non-recurring gains and losses sharply plunged 341% from the year-ago period to –RMB2.161 billion.

Besides, basic earnings per share for the first quarter were –RMB0.44, compared with RMB0.29 for the same period a year earlier. Weighted average return on net assets amounted to -4.62%, down by 7.5 percentage points from a year ago.

As at the end of reporting period, the company’s total asset was RMB95.867 billion, with 2.54% increase compared with the beginning of the year. The total liability was RMB51.528 billion, with 8.86% growth over the beginning of the year. The debt asset ratio was 53.75%, which was 3.12 percentage points higher than the beginning of the year.

JAC Motors

JAC Motors saw the operating income grow 13.76% to RMB14.633 billion for Q1, 2019 from RMB12.864 billion for Q1, 2018.

However, the Jan.-Mar. net profit attributable to shareholders of the listed company violently decline 69.13% year on year to RMB64.636 million. Excluding the non-recurring gains and losses, the company even came across a net loss (attributable to shareholders) up to RMB34.133 million.

The weighted average return on assets for the first three months was 0.5%, dropping by 1.00 percentage point, while basic earnings per share plunged 72.73% year on year from RMB0.11 to RMB0.03.

It is noteworthy that as of the reporting date, the net cash flows from operating activities were increased by RMB2.537 billion to RMB28.556 million mainly thanks to the growth in received payment of goods during this reporting term.

GAC Group

GAC Group’s operating income for the first quarter reached RMB14.256 billion, slumping 25.74% compared with the same period last year, the automaker reported on April 29.

Meanwhile, the company saw its quarterly net profit attributable to shareholders of the public company tumble 28.4% year on year to RMB2.778 billion. Excluding non-recurring gains and losses, the Q1 net profit amounted to RMB2.21 billion, plunging 41.87% over a year ago.

In addition, the weighted average return on equity was 3.56%, compared with 5.44% for Q1 in 2017. Basic earnings per share declined to RMB0.27 from RMB0.38 a year earlier.

Zotye Auto

China’s privately owned carmaker Zotye Auto generated RMB3.969 billion in Q1 operating income, suffering a double-digit decrease of 27.11%.

In the meantime, the net profit attributable to shareholders of the listed company also fell 24.85% over the previous year to RMB105.922 million. The non-recurring-excluded net profit was RMB100.382 million, showing a decrease of 28.19% compared with the same period a year earlier.

The automaker also reported that the net cash flows from operating activities from the beginning of year to the end of report term were –RMB927.902 million, down from –RMB569.431 million a year ago.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth