Chinese compact SUV market from January to April

The compact SUV market in China continues to maintain strong growth in 2015. According to statistics from Gasgoo.com (Chinese), a total of 139,300 compact SUVs were sold in China in April. That figure was 185.9% higher than the 48,700 compact SUVs sold the previous April. That growth rate is not only the highest in the SUV segment, it is also far above the average market growth rate of 171.1%. A total of 555,300 compact SUVs were sold from January to April, 205.9% above the 181,500 compact SUVs sold in the first four months of 2014. Compact SUVs made up 31.6% of all SUVs sold in the country, nearly double the 15.4% proportion they made up last year.

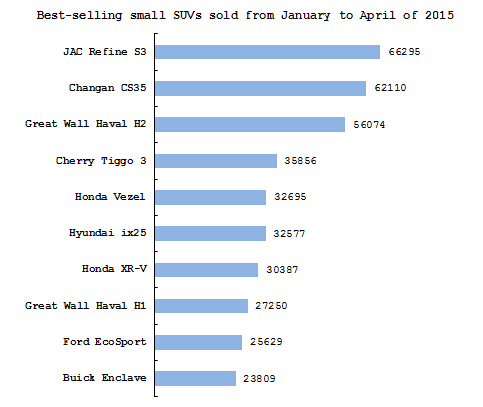

New models have played a crucial role in leading the compact SUV segment, with newer vehicles outperforming older ones. Jianghuai Motor’s Refine S3 was the best-selling SUV for the time span between January and April of this year. It was followed by the Changan CS35, Great Wall Haval H2, Chery Tiggo 3, Guangqi Honda Vezel, Beijing Hyundai ix25, Honda XR-V, Great Wall Haval H1, Changan Ford EcoSport and Shanghai GM Buick Enclave. Over half of those vehicles are new models.

The best performing compact SUV so far this year, the JAC Refine S3, has only been on the market for eight months. A total of 66,300 Refine S3s were sold from January to April. The S3 was the third-best selling SUV in the country overall, surpassed only by Great Wall’s Haval H6 and the Volkswagen Tiguan. The S3 has been able to capitalize on its sporty design, which was developed specifically to meet the interests of younger buyers and allowed it to capture a huge share of the market.

The second best-selling vehicle, the Changan CS35, managed to attain a sales volume of 62,110 units over the first four months of the year, representing commendable year-on-year sales growth of 71.2%. As one of the most popular own brand SUVs, the CS35 has managed to perform very well in the Chinese market. The CS35 was the best-selling compact SUV in the country in 2014 and played a crucial role in helping Changan to become the best-performing domestic own brand manufacturer.

The Great Wall Haval H2 also performed strongly, with a total 56,074 units sold from January to April. Meanwhile, Great Wall’s other compact SUV model achieved a sales record of 27,250 units over the same time period. Both models have been on the market for less than a year and have been two of Great Wall’s best sellers.

By comparison, the Great Wall M1, previously its best-selling compact SUV, has performed very poorly this year. Sales of the M1 totaled 19,316 units over the first four months of the year, representing negative year-on-year growth of 51.4%.

Other strongly-performing new models include the Honda Vezel and Honda XR-V, whose sales totaled 32,695 units and 30,387 units, respectively. The two SUV models, which placed fifth and seventh in the sales charts, contributed strongly to Honda’s sales growth in the country.

The Hyundai ix25, Ford EcoSport and Buick Enclave were also very successful, with their sales volumes totaling 32,577 units, 25,629 units and 23,806 units, respectively.

With the rising popularity of the compact SUV segment in China, the number of new models that manufacturers are releasing continuing to increase. The segment has offered a valuable opportunity for domestic own brand automotive manufacturers to boost their sales volumes. Whether or not this trend will continue into the future will remain the subject of intense focus for everyone in the industry.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth