Special Report: China's Natural Rubber Market in 2012

Part One. Review of domestic natural rubber market

China’s domestic natural rubber market has experienced ups and downs in the first half of this year, with the backdrop of persistent euro zone debt crisis, changing monetary policy of theUS, and the slowdown ofChina’s economy as well as seasonal factors.

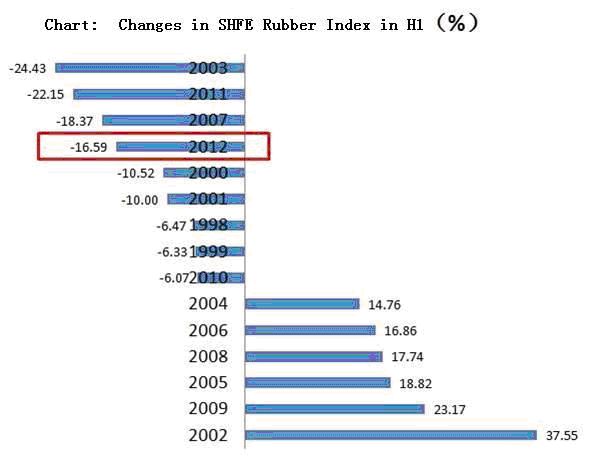

The natural rubber price index of the Shanghai Futures Exchange (SHFE) has seen increasingly volatile movements since the outbreak of the global financial crisis in 2008: after falling by as much as 53% in 2008, the index surged by some 113% and 53% respectively in 2009 and 2010, and then saw sharp retreat again in 2011, down nearly 36% in the year.

Natural rubber prices, after climbing to the apex of 43,000 yuan/metric ton in February 2011, dropped to 21,000 yuan/metric ton in June 2012, a sharp decline of nearly 49%.

Statistics show since March of 2012, the SHFE rubber price index had been on the drop for four months in a row, falling to the average level in 2011.

In the light of the domestic rubber market since the beginning of 2012, the trajectory could be divided into five parts:

I. January -- quick upwards movement: the SHFE rubber index rebounded in January, boosted by the expectation of a supply decline due to the halt of rubber tapping in China and heavy rainfalls in major rubber producing regions in Thailand. Shanghai rubber surged to its peak before the Spring Festival,China’s lunar New Year, up nearly 4,500 points as traders rushed to replenish stocks ahead of the long Chinese holidays.

II. February -- upward movement amid volatile trading: tire demand was tepid due to the Spring Festival factor; rubber inventory at the domestic bonded zones stayed at a historical high level, and consequently soothed the upside momentum of rubber prices. The SHFE rubber index saw volatile movements in the light of the Thai government’s stockpiling program and crude oil tensions inIran, with short-term resistance at 30,000 yuan/tonne.

III. March-April – slow downward path: investor confidence was dampened afterChinalowers its target of GDP growth for 2012 to below 8%. Rubber inventory at theQingdaobonded zone was on the decrease at a slower clip due to demand fears. Meanwhile, market expectations for theUSgovernment to launch QE3 faded away, which resulted in a strong dollar and exerted on commodity prices. Moreover, the relief inIran’s nuclear tensions led to a fall in crude oil prices, which deprived the upside momentum of natural rubber. The SHFE rubber index went back to 27,000 yuan/tonne during the period, down nearly 3,000 yuan/tonne.

IV. May-June – downward movement amid volatile trading: the rekindled euro zone crises aroused panic in the market; investor’s risk-aversion appetite pushed up the greenback and thus exerted downside pressure on the commodity market. Meanwhile, supply increased as major rubber producers began tapping in May; rubber prices experienced a sharp fall during the period as downstream demand from the automobile industry remained tepid and rubber inventory at the Qingdao Bonded Zone steadily on the rise. The tumble in crude oil prices also dragged down the prices of synthetic rubber products. The failure of theUSgovernment to introduce the QE3 inlate June further hammered the market. The SHFE rubber index fell to the gauge of 22,000 yuan/tonne during the two months, down nearly 5,000 points.

V. July-August – quick rebound & corrections: the commitment of the European center bank to improve the regional economy and the better-than-expectedUSeconomy data sent an upbeat note on the market. Rubber prices rebounded following the price-intervention measures introduced by major producing countries. However, the persistent euro woes sent the rubber prices down to a new low in late July, leaving the commodity to fluctuate near the gauge of 22,000 yuan/tonne thereafter.

(Contributed by Huo Bing, vice general manager of Yunnan Gaoshen Rubber Co; edited by Olivia, olivia@tireworld.com.cn)

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth