China’s PV sales likely to rebound by 4.6% in 2021

China's PV sales are expected to fall by 8% this year and grow by 4.6% next year, Roy Lu, director of Gasgoo Auto Research Institute (GARI), said at the 2020 Annual Global Auto Industry Summit co-held by Gasgoo and the national distinguished expert panel from automotive industry in late October.

The industry has come to a basic agreement that China will face a decelerating economic growth during the 14th Five-year Plan (FYP) period (2021-2025). Affected by coronavirus pandemic, geopolitical risks as well as instabilities and uncertainties in external environment, China's GDP is forecasted to grow by 1.9% in 2020, and accelerate to 8.2% next year thanks to faster-than-expected recovery, according to the International Monetary Fund. Over the next five years, China's Compound Annual Growth Rate (CAGR) is expected to stand between 5% and 5.5%.

Aside from the macro-economic climate, the growth of the auto industry and regional economy is largely associated with the migration and the development of city clusters. Currently, there are four ultra-large city clusters in China, namely, the Beijing-Tianjin-Hebei region, the Yangtze River Delta, the Pearl River Delta and the emerging Chengdu-Chongqing Megalopolis. The regional economic integration will not only further promote the division of labor and cooperation among different industries, but also significantly vitalize the domestic economic cycle and boost the national auto consumption as most cities included in those clusters are ranked pretty high in both population and economy.

As for the market development trend, China's PV market will grow at a low CAGR over the next decade with its focus shifting from product sales to deep mining of users' value, according to GARI's analysis and forecast.

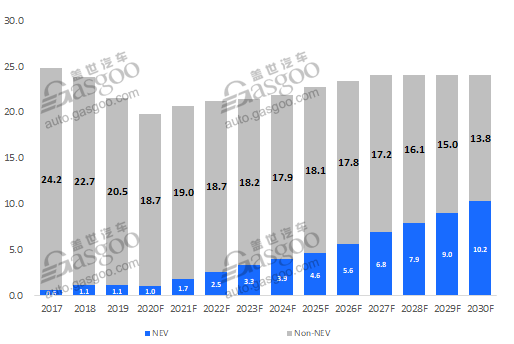

2017-2030 Domestic PV Outlook (mn. Units)

Based on the present market performance and the planning set for the auto industry, Gasgoo expects China's PV sales to decline 8% year on year to roughly 19.8 million units in 2020, while rise 4.6% next year. Besides, the CAGR of the auto industry probably will stand at around 2.5% for the next five years, while shrink to roughly 0.7% for the 2026-2030 period.

It is noteworthy that a certain number of brands are grabbing increasingly higher market share. The top 15 PV brands by Jan.-Sept. sales accounted for 72.1% of China's overall PV sales, which were 3.5 percentage points more than that of 2019.

From the angle of brand origin, Japanese brands have showed a comparatively strong presence. For instance, for the first nine months, the market share of Toyota still climbed 1.7 percentage points in spite of the downturn in overall PV market.

However, the issue of polarization still rests upon Japanese brands. Toyota, Honda and Nissan have performed well in both market share and brand reputation, and even threatened traditional rivals from Europe or the U.S. Nonetheless, others like Mazda and Mitsubishi lag far behind the three giants.

China's self-owned brands are severely polarized as well. The top 8 automobile groups—SAIC Motor, Dongfeng Motor, FAW Group, Changan Auto, GAC Group, BAIC Group, Geely Auto and Great Wall Motor—have took up roughly 80% of total sales of Chinese indigenous PV brands. Nevertheless, automakers like Haima Automobile have been almost marginalized due to dismal sales.

As for luxury brands, the German trio Audi, Mercedes-Benz and BMW are gaining rising market share. Within the so-called second-tier lineup, brands that mainly rely on locally-produced vehicles, such as Cadillac, Volvo, Jaguar Land Rover and Lincoln, are jostling for bigger share. Lexus, the Toyota-owned premium brand dedicated to imported cars, is a special one that targets different group of consumers.

It is also worth mentioning that almost all luxury and joint-venture brands are cutting their official guiding prices, by an average of 5% compared to the three-year-ago period. However, Chinese indigenous brands are rising prices and launching higher-priced products as they aim to go upscale.

The growing market share achieved by luxury brands should be partly thanks to the consumption upgrades and the surge in Chinese consumer's disposal income. Based on Gasgoo's analysis, luxury brands are forecasted to account for nearly 12.6% of China's overall PV sales in 2020, and the number may grow to 16% in 2030.

Joint ventures are caught in the middle mainly because a handful of brands, such as Volkswagen and Skoda, fail to differentiate their products and service. Their market share is likely to drop to 44.5% in 2030.

Starting from a low base, Chinese local automakers are trying to set themselves apart by launching more upscale brands. Their market share will perhaps rebound to 40% in 2025thanks to the efforts made to explore development models for intelligent vehicles and the greater acceptance by Gen Z and Gen Y consumers.

There will be huge survival pressure for startups over the next decade, especially for those whose cumulative sales have not surpassed 5,000 units yet. The biggest problem currently vexing startups is still the unsound capital chain.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth