China logs 22.5% slump in first-half homegrown PV retail sales

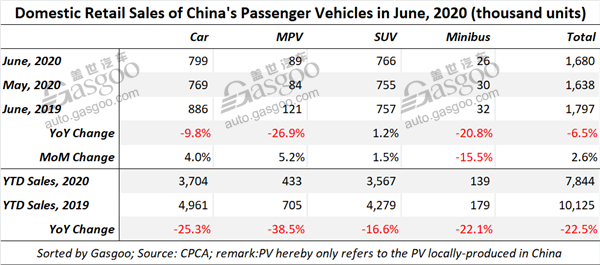

In the first half of 2020, the retail sales of China's locally-produced PVs (referring to cars, MPVs, SUVs and minibuses) totaled 7.844 million units, slumping 22.5% year on year, according to the China passenger Car Association (CPCA).

The PV deliveries reached roughly 1.68 million units in June, falling 6.5% compared to the prior-year period. The downturn was a combined result of the decrease that hit the car, MPV and minibuses units. However, SUV deliveries edged up 1.2% from a year earlier, which somewhat ease the overall sliding momentum.

According to the CPCA, the year-on-year change is of less significance to be analyzed as the year-ago base number was inflated by the clearance of the China Ⅴ vehicle inventories.

Compared to May, the PV retail sales still represented a 2.6% upward movement, making the overall performance accord with a V-shaped recovery for the first half of the year.

The month-on-month growth was quite an abnormal phenomenon since June is traditionally a slack season for car shopping. The answer to the increase involved both market and policy factors. The increasingly more kick-off of motor shows, the continuous implementation of incentives and the growth in the outputs and sales of major auto brands all contributed to the rise in PV deliveries, said the association.

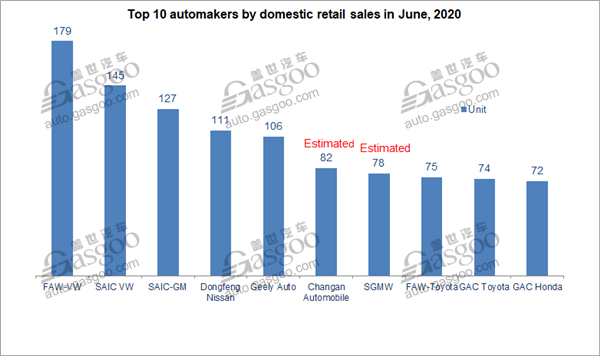

Regarding the June deliveries of China-built PVs, FAW-VW was still crowned the No.1 automaker. Compared to May, SAIC VW outnumbered SAIC-GM and moved up to the runner-up place. Dongfeng Nissan and Geely Auto were ranked fourth and fifth respectively, remaining unchanged from the previous month. Dongfeng Honda failed to enter the top 10 list last month, while Changan Automobile, SAIC-GM-Wuling (SGMW), FAW-Toyota and GAC Toyota all climbed one place.

The retail sales of locally-produced premium vehicles surged 27% year over year and grew 9% month on month. The CPCA noted that the rising auto replacement demands led by the consumption upgrades and the price cut stemming from the sales promotion are both contributing factors to the rebound in premium car deliveries.

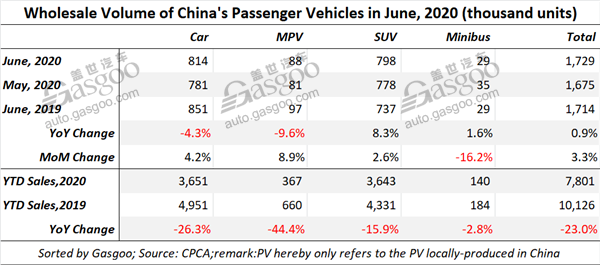

The wholesale volume of China's homegrown PVs slightly climbed 0.9% over the previous year to 1.729 million units, for the second straight month showing growth. The positive change is in part thanks to OEMs' and dealers' joint efforts to fulfill their mid-year sales goal.

The year-to-date wholesales amounted to 7.801 million units as of June, plunging 23% from a year earlier. The MPV sector posted the steepest decline of 44.4%.

Although excluded in the top 10 by retail sales, Dongfeng Honda was ranked ninth based on June wholesales. Compared to the previous month, the top three automakers were still FAW-VW, SAIC VW and SAIC-GM without any place change. Besides, both Changan Automobile and GAC Honda moved up two places to the sixth and seventh, while SAIC-GM-Wuling dropped four places to the tenth.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth