China’s powertrain industry should opt for diversified tech route to go electric

New energy vehicles (NEVs) and hybrid electric vehicles (HEVs) will each account for 50% of annual new car sales in China by 2035, according to the 2.0 version of Technology Roadmap for Energy Saving and New Energy Vehicles (called “2.0 Roadmap” for short) issued in late October. The target indicates China's resolution to achieve complete electrification across the auto industry.

Certainly, there are multiple tough challenges for the auto powertrain industry amid the transition towards electrification. Limited to the bottlenecks in safety, range, development cost, battery service life and infrastructures, it will still take more time for electric vehicles to be truly popularized. At the China Vehicle Powertrain Electrification International Summit 2020 held by Gasgoo earlier this month, many experts and corporates’ senior executives share their viewpoints about how the powertrain industry goes electric, which technical routes should be chosen, and what challenges confronting the industry and players.

To diversify the roadmaps for powertrain roadmaps

With automobile energy-saving technologies improving, average PV fuel consumption keeps falling in China and has almost reached the target value of 5L per 100km set for 2020. Thanks to the wide usage of high compression ratio, the Miller cycle, variable displacement engine and low-friction technology, the thermal efficiency of gasoline engine is approaching the world's leading level of 40%. As for transmission, the 7DCT (7-speed dual clutch transmission) and 8AT (8-speed automatic transmission) have gone into volume production.

However, it is still unlikely to reach the increasingly strict emission standards by merely enhancing thermal efficiency of gasoline engine. Wang Binggang, Chairman of China's New Electric Vehicle Project Consulting Committee, said diversified auto-related technologies and energy sources will better befit China's national conditions, and the transition of traditional oil-fueled vehicle industry should be highlighted while developing electrification. Thus, the expert panel of the project agreed China's conventional auto industry should promote the full transition towards HEV.

At the summit, Zhang Guoguang, chief engineer of the technical center at Dongfeng Motor Corporation, said the energy-saving technical routes of Dongfeng Motor pivot on the technologies of electrification, intelligence, connectivity and lightweight. The electrification efforts are primarily for powertrain solutions, including all-electric vehicle (BEV), HEV and fuel cell vehicle (FCV). Regarding intelligence, many endeavors are made for the management of electronic systems and other components excluding powertrain.

“From the standpoint of an OEM, we believe that electrification is the basic point where we should start. We began with mild hybrid electric vehicle (MHEV) and then discovered that there is a huge gap between the fuel consumption limits and the actual value. What we have done is insufficient to handle future challenges. Thus, we must develop HEV, PHEV and BEV. Different technical routes can co-exist well, and there will never be a route directing to the end,” Mr. Zhang added.

Jiang Hengfei, senior manager of the product development unit and the powertrain & new energy department at Chery Jaguar Land Rover (CJLR), said that he, serving as an engineer of traditional powertrain, is looking for the balance among power performance, fuel economy and emission. To develop vehicle models that better meet the demands of Chinese market and users, CJLR has hammered out a development strategy on the electrification of powertrain, namely “xEV” strategy, which covers 12-/48-volt start-stop system, 300-volt (and above) plug-in hybrid system, and all-electric system. Besides, Jaguar Land Rover wishes to electrify all of its models from 2020 onwards.To develop more efficient core technologies of powertrain electrification

The diversification of technical routes and energy sources also pose new challenges and demands to suppliers.

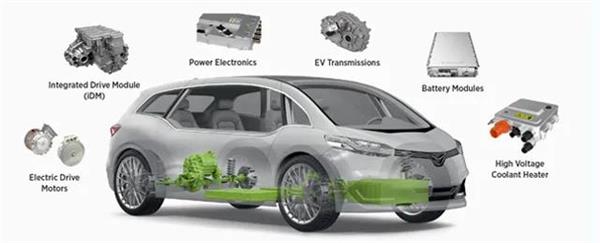

Gong Xi, chief engineer who leads advanced engineering China of BorgWarner, noted the future drive system takes the basic elements like torque, air pressure, thermal force and software into account. In addition, the next-generation drive system will comprise not only BEVs, but also ICE (internal combustion engine) vehicles, therefore how to handle air pressure is of much importance.

“A supplier who can provide great solutions for the aforesaid elements is able to develop the next-generation drive system. However, it requires suppliers to possess complete product matrix, have profound insights into their products, offer flexible services and perform reliably in goods delivery,” said Gong Xi.

Peng Peng, vice president of Huawei Digital Power product lineup's car-borne power source business, gave his insights into the next-generation electrical/electronic architecture (EEA). “A company can gain a head start in the next century only if it grasps core technologies. Through the R&D of such technologies as the next-generation electric-drive EEA, Huawei expects to lead the overall industrial trend and ultimately bring digital to every vehicle,” said Mr. Peng.

At the Auto China 2020, Huawei launched the seven-in-one electric drive system “DriveONE”. The company claims that DriveOne is the industry’s first hyper-converged power domain solution, and is designed to offer an open platform and new-generation technologies. It integrates seven mechanical and power components — Micro Control Unit (MCU), Motor, Reducer, DC Converter (DCDC), On-board Charger (OBC), Power Distribution Unit (PDU), and Battery Control Unit (BCU).

The system is aimed at achieving simple development, simple adaptation and simple layout. “The high integration of power domain will help simplify the vehicle evolution and layout. Under the converged architecture, the innovative design for functional safety will enable the integration of both components and systems more highly-integrated and safer,” Mr. Peng added.

Promising market prospect for powertrain electrification

There is a great potential for the market of powertrain electrification despite numerous challenges.

China PV market has been amid in downturn for nearly two years, while the sales of electrified PVs kept rising in recent months, according to Roy Lu, director of Gasgoo Auto Research Institute (GARI).

“NEV (referring to BEVs, PHEVs and FCVs) sales in China have been retaining an upward movement in spite of the downturn for the first half of the year. The year-on-year increase in annual HEV sales stood above 50% in recent years. It is very estimable for HEV sales to maintain such a high growth without policy supports,” said Lu.

According to the China Passenger Car Association (CPCA), the wholesales of locally-produced new energy PVs reached 180,000 units in Nov., surging 128.6% year on year and rising 24.8% month on month. According to Lu, the penetration rate of electrified vehicles has reached roughly 9% in PV market, and is expected to top 9.5% in the near future.

Speaking of the option over the HEV technical roadmap, Mr. Lu perceived that such factors as market concentration, production R&D cost, policy uncertainties and maturity of the industrial chain should be prioritized. However, most importantly, companies should make decisions based on a correct evaluation over their own strengths and resources, rather than blindly jump on the bandwagon.

Related Article

- Shanghai Zhenhua Heavy Industries : Three Tyre Cranes Delivered at Port Said, Egypt

- MCX launches futures trading in natural rubber

- Shanghai natural rubber futures close lower on Dec. 29

- India to extend anti-dumping duty on carbon black used in rubber industry

- Shanghai natural rubber futures close lower on Dec. 25

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth