China to import less, export more BD amid massive capacity expansion

China may import less butadiene (BD) and export more of the material in view of massive capacity expansions coming on stream in 2021.

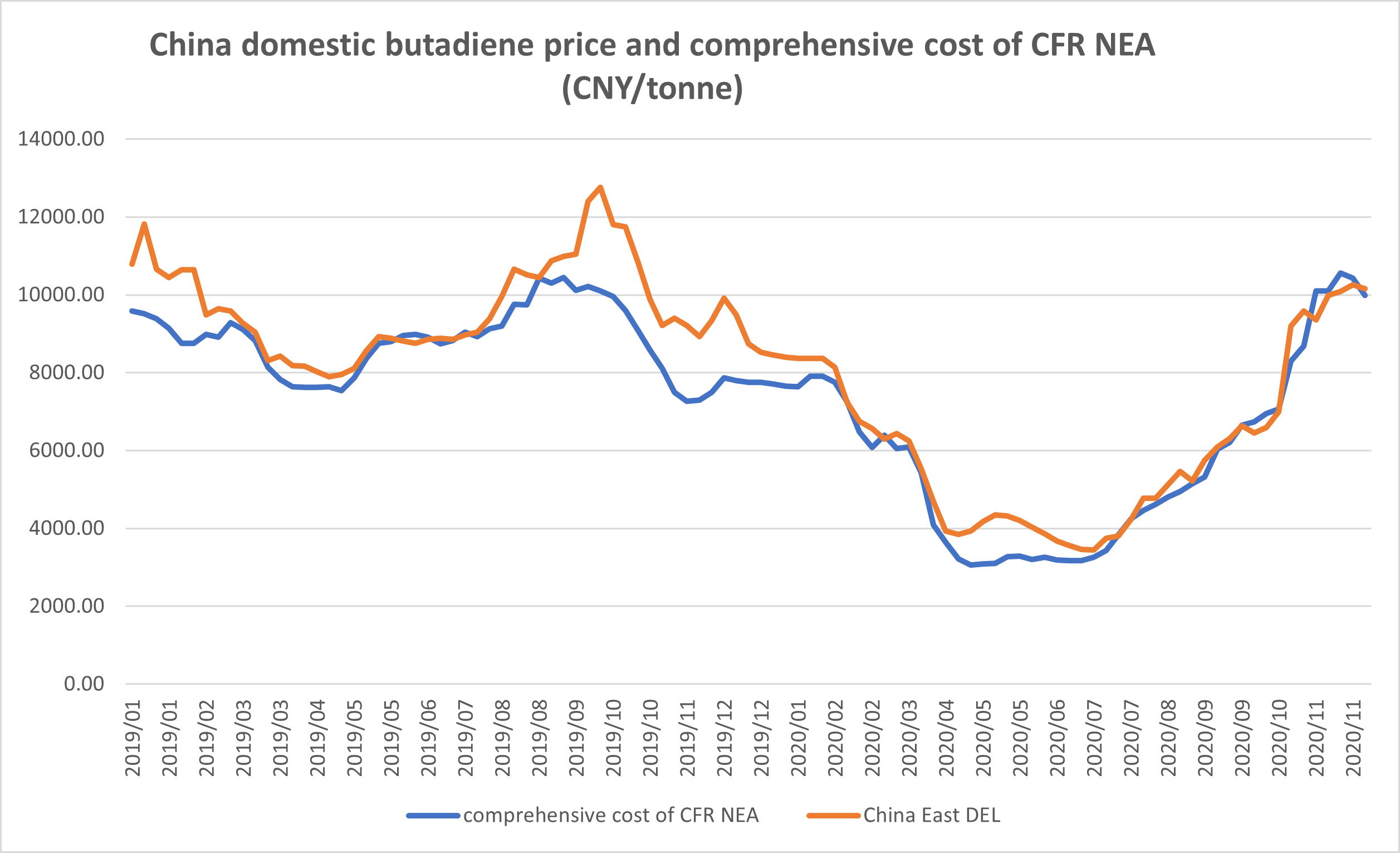

Import prices had been lower than domestic prices for years until the second half of 2020 following the strong supply expansion in the country, which coincided with Asia’s shortage of the material following a prolonged shutdown of a South Korean cracker.

*Comprehensive cost of CFR NEA= CFR NEA price assessment* exchange rate on assessment day*1.02*1.13+200

China’s BD capacity in 2020 grew by 13.5% - the fastest growth registered in nearly a decade - to 4.2m tonnes.

Most Chinese buyers have shown little interest in imports in the fourth quarter due to availability of cheaper domestic BD cargoes, which consequently dragged down import prices of the material.

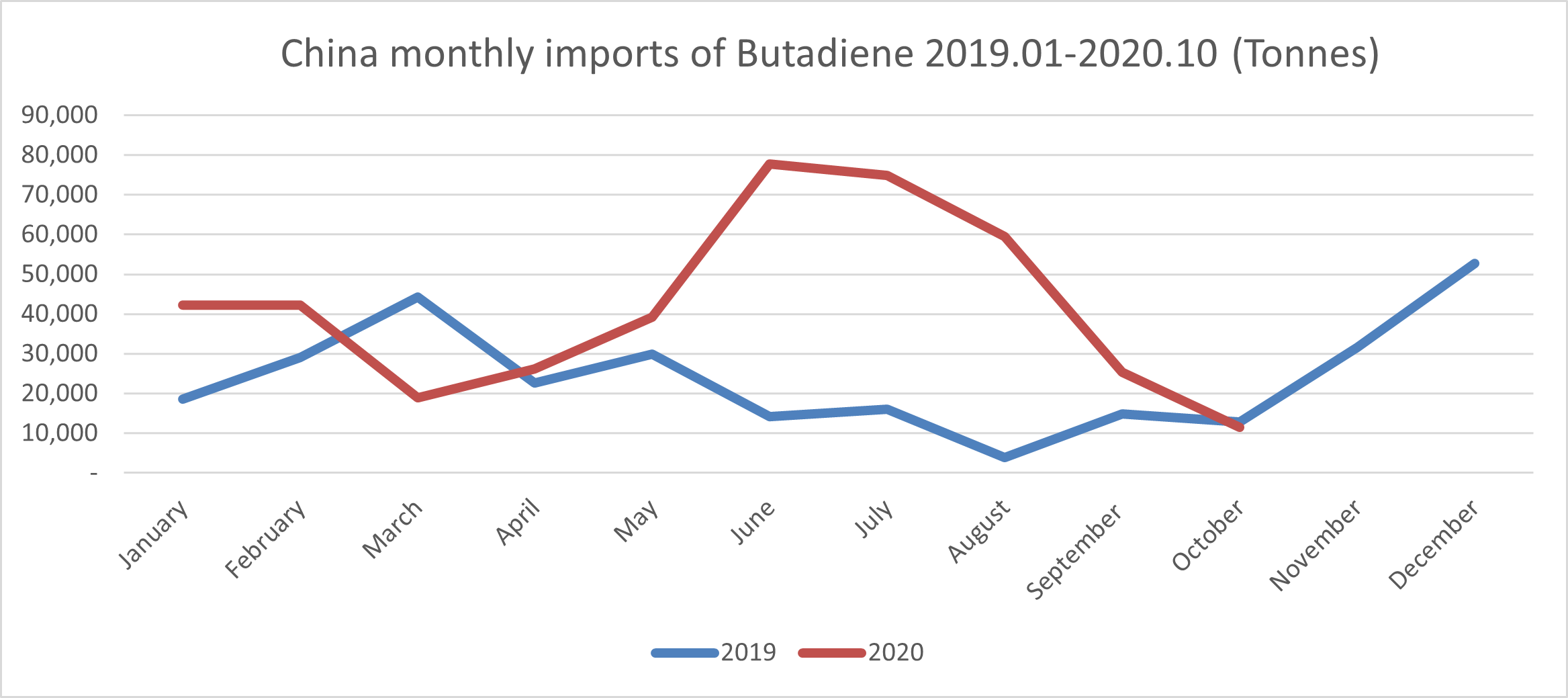

China’s export volumes of BD had spiked to around 10,000 tonnes in November, according to estimates from market sources, as South Korea-based LG Chemical actively sought Chinese following unexpected plant shutdown.

In January-October 2020, the country’s total BD exports stood at 3,958 tonnes, while for the whole of 2019, the figure was 3,963 tonnes, according to customs data.

Domestic BD supply may continue to outpace demand in 2021, despite a heavier plant turnaround schedule compared with the previous years.

Around 500,000 tonnes of new BD capacities are expected to come on stream in 2021, according to the ICIS Supply and Demand Database.

In the second half of 2020, capacity additions stood at 410,000 tonnes, about 55% of the full year’s total of 750,000 tonnes, the data showed.

High prices in the second half of the year has also encouraged many domestic oxidative dehydrogenation plants to restart, further augmenting China’s BD supply.

Effective BD capacity in mainland China may stand at 4.7m tonnes/year in 2021, well above the combined capacity of South Korea, Japan and Taiwan.

A huge domestic capacity will enhance China’s capability to withstand risks on the supply side, while market players in northeast Asia will have to import more cargoes whenever regional supply tightens due to unexpected plant shutdowns.

Amid progress on coronavirus vaccines and overseas demand recovery, a massive sell-off of BD by Europe and the US which happened in April-June 2020 amid pandemic-induced lockdowns is not expected to recur.

In downstream synthetic rubber markets, producers have either cut run rates or shut their plants for maintenance in October-November when BD prices surged due to limited spot availability.

Synthetic rubber producers in Japan and South Korea are more resilient to high feedstock prices since they have more differentiated products - including high-end environmentally friendly grades - which are priced higher compared with general grades.

Related Article

- Shanghai exchange approves PetroChina overseas storage for low-sulphur fuel oil

- Michelin to connect all its car tyres by 2023

- ZC Rubber unveils billboards in Times Square, 3 other countries

- Chinese startup tackles 2bn tons of slag with new technology

- ZC Rubber Unveils Massive Billboards in 4 Countries for Westlake and Arisun Tire Brands

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth