China retains No. 1 trading partner status with US in tire business

Despite measurably lower exports of passenger and light truck tires to the U.S. last year, China was the U.S.'s largest trading partner in the tire sector for a second straight year, slightly ahead of Thailand.

Overall, the value of imports into the U.S. of tires of all kinds last year increased 7.8 percent over 2017 to $14.8 billion, while the value of exports jumped nearly 28 percent to $5.23 billion, according to U.S. Department of Commerce data.

As a result, the nation's tire-related trade deficit shrank 6.8 percent to $9.6 billion versus 2017. This is the second straight year the deficit has shrunk. Last year was the first time in decades.

China retained the title as the U.S.'s largest trading partner in tires as the value of its overall exports to the U.S. jumped 21.8 percent over 2017 to $2.37 billion.This article appears in the April 1 print edition of Tire Business.China's increase came largely from higher shipments of medium truck, OTR, farm and other non-highway tires, according to the Commerce Department data, including record shipments of truck/bus tires of 9.22 million units, a 42.1-percent jump over 2017. The value of truck/bus tire imports from China increased 56.2 percent to $1.11 billion.

By contrast, imports of passenger and light truck tires from China — which are subject to elevated U.S. import duties — fell 19.9 and 14.1 percent, respectively, from 2017.

Imports of truck tires from China are expected to fall off markedly this year after the U.S. government imposed elevated antidumping and countervailing duties on the products earlier in the year.

Thailand is a strong No. 2 with tire imports into the U.S. valued at $2.23 billion last year, up 20 percent over 2017. Canada ($1.58 billion), South Korea ($1.3 billion) and Japan ($1.17 billion) rank third through fifth. Mexico, Indonesia, Vietnam, Taiwan and Germany complete the top 10.

Thailand's status as a major source of tires for the U.S. is expected to keep growing, based on the amount of new capacity being installed there and the expected impact of the elevated import duties on Chinese truck/bus tires.

Germany's Continental A.G. recently commissioned production at its $265 million car and truck tire plant in Rayong, Thailand, and China's Shandong Yinbao Tyre Group Co. Ltd.has a plants under construction.

Shanghai Huayi (Group) — parent of Double Coin Holdings — started production this past year at its joint venture truck/bus tire plant in Rayong Province, and Prinx Chengshan Tire Co. Ltd. broke ground April 1 on a $300 million car/truck tire plant it expects to have on stream by mid-2020.

Shandong Linglong Tire Co. Ltd., Otani Tire Co. Ltd. and Vee Rubber Co. Ltd. have expanded capacities in recent years.

Of the U.S.'s major tire sector trading partners, surpluses were recorded with Mexico and Canada last year. In fact, Canada and Mexico accounted for 61.6 percent of the U.S. industry's tire-related exports last year.Mexico took in $1.64 billion worth of tires from the U.S. last year and exported $920.7 million to the U.S., resulting in a trade surplus of $723.8 million, more than double the surplus of $360.2 million in 2017.

Canada was the No. 1 export destination in 2018 for U.S.-made tires at $1.89 billion, an increase of 26.9 percent over 2017. Imports from Canada were valued at $1.58 billion, resulting in a surplus of $310 million.

The next largest export destination was Australia, which took in $315.6 million worth of products from the U.S., an increase of 22.5 percent over 2017.

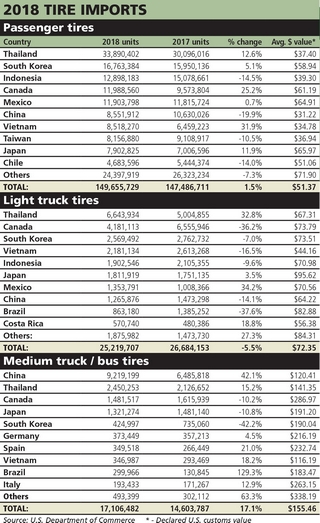

In passenger and light truck tire imports, Thailand stood head and shoulders above other countries, accounting for roughly a quarter of the category totals. China dominated the medium truck tire category, accounting for more than half of the 17.1 million tires imported last year.

In passenger tires, Thailand solidified its status as the No. 1 source of imported products with a 12.6-percent increase, to 33.9 million units, or more than twice the 16.8 million units imported from No. 2 South Korea.

Indonesia (12.9 million), Canada (12 million) and Mexico (11.9 million) rounded out the top five. Vietnam had the largest improvement, with units shipped rising 31.9 percent to 8.52 million, good for No. 7 on the list.

Overall, imports edged up 1.5 percent to a record 149.7 million units.

The average declared value per tire was $51.37, up 3.7 percent from 2017. Among the top 10 importing countries, the value ranged from $31.22 for China to $65.97 for Japan.

In light truck tires, Thailand took over the No. 1 spot from Canada with a 32.8-percent increase in exports to the U.S. to 6.64 million units, while shipments from Canada plunged 36.2 percent to 4.18 million units. South Korea (2.57 million units), Vietnam (2.18 million) and Indonesia (1.9 million) rounded out the top five.

Overall, imports of light truck tires fell 5.5 percent to 25.2 million units, Commerce Department data show.

The average declared customs value of an imported light truck tire improved 4.5 percent to $72.35. Average prices among the 10 largest importing nations range from $44.16 (Vietnam) to $95.62 (Japan).

Imports of medium truck/bus tires, led by China's 42.1-percent increase, jumped 17.1 percent to a record 17.1 million units. Imports from No. 2 Thailand rose 15.2 percent to 2.45 million units, while shipments from No. 3 Canada, No. 4 Japan and No. 5 South Korea all declined by double digits.

Truck tire imports from Brazil more than doubled last year over 2017 to 299,966 units.

The average declared customs value of an imported truck/bus tire rose 1.6 percent to $155.46. Prices among the leading import countries ranged from $116.19 (Vietnam) to $286.97 (Canada).

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth