Asia SM prices under downward pressure, outlook mixed

Asia styrene monomer (SM) prices remained under downward pressure this week despite relatively strong performance in crude oil futures with mixed signals about the future outlook, traders said on Thursday.

Buying momentum has eased with buyers expecting prices to drift down further in the near term.

Some pick-up in orders for finished goods as the Chinese manufacturing season enter a typically stronger second quarter failed to sustain prices of resins and SM.

“There are some improvement in finished goods orders for the second quarter, but overall volume is still lower compared to last year,” said a resins user in China.

Recent bearish sentiment has sent spot prices in the key Chinese market to below $1,100/tonne CFR (cost & freight) China.

Some deals were concluded at $1,080-1,090/tonne CFR China, according to information collated by ICIS.

SM is a liquid chemical used to make plastic resins like polystyrene (PS) and acrylonitrile-butadiene-styrene (ABS) as well as synthetic rubbers like styrene-butadiene-rubber (SBR) and styrene-butadiene-latex (SBL).

The weakness in SM values resulted in price declines in its downstream products as well.

ABS prices have also eased as buying momentum slowed down in tandem with weaker feedstock SM prices but downside was seen limited as demand was expected to lend support, according to traders and producers.

Several ABS suppliers cut offers to $1,400/tonne CFR China, down from $1,420-1,430/tonne CFR China in a bid to spur buying interest.

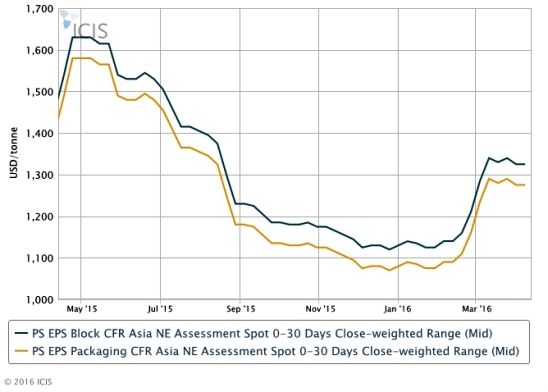

Similarly the Asian expandable polystyrene (EPS) prices have also remained under downward pressure this week because of weak performance of the feedstock SM sector.

EPS offers were heard at around $1,270/tonne CFR (cost & freight) northeast (NE) Asia and around $1,280/tonne CFR southeast (SE) Asia in the week, around $10/tonne lower than previous quotations.

A build in shore tank inventories of SM along eastern China also fuelled talk of weak buyers’ offtake in the near term.

Volumes in the tank swelled to 170,400 tonnes this week, up from 156,400 tonnes last week.

“Buyers have been mostly cautious since last week as there seems little catalyst to lift prices,” said a trader in Korea.

The lack of definitive prices direction since early April have worried a number of traders, prompting them to liquidate some long positions.

Meanwhile, some market players remained cautiously optimistic that the market will stabilise soon and prices would firm again in the weeks ahead.

Plant maintenance in the region coupled with reduced inflow of deep-sea cargoes are expected to keep availability snug.

Plant issues in Asia and the Middle East are also deemed by a number of players to be instrumental in tightening supply into May.

“Market players are mostly on the sidelines this week and not actively taking any positions,” said a broker in Singapore.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth