Indian imports TBR from China increasing

Indian Truck and Bus Radial Tyre import from China has gone up by 30% in the first half of FY 2016-17 against the year-ago period, said Automotive Tyre Manufacturers Association (ATMA). The apex body representing Indian tyre makers blame on the incrasing influx of Chinese Import.

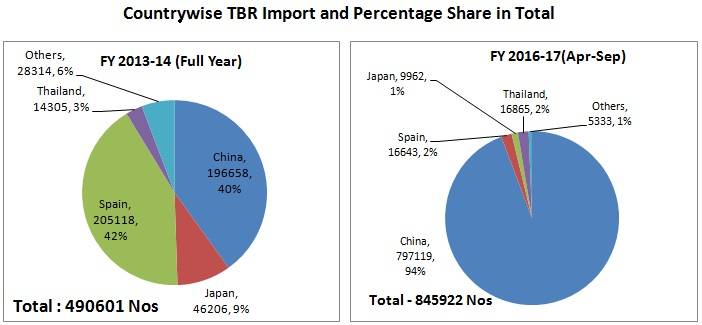

Import of TBRs has crossed the level of 1.4 lakh units per month in FY2016-17 from 40 thousand units per month in FY2013-14 an increase of about 400% in three years.

“There is no reprieve from indiscriminate import and dumping of radial tyresespecially truck & bus radials (TBRs) from China. Such large scale imports are gravely hurting the domestic manufacturing of TBR”, stated K M Mammen, Chairman ATMA.

Most of the new investments of Rs 35000 crore by tyre industry in India in the last 3-4 years has been directed towards setting up TBR capacities as TBR is seen as the growth driver for the industry. Unfortunately, dumping in TBRs is touching new highs even as domestic capacities are going on stream. With expansion in capacity, the capacity utilization levels have come down to 60-65% in TBR manufacturing from 80-85% a couple of years ago.

Currently more than 40% of the replacement demand in TBR is being met by imports while domestic capacities are faced with the prospects of ever declining utilization, ATMA has stated in a communication to Ministry of Commerce & Industry.

China dominates as the source country for import of TBR in India with a share of 94% in 2016-17. China’s share in total TBR import was 40% in 2013-14, 70% in 2014-15 and 90% in 2015-16.

ATMA has alleged that most of the TBR import from China is being dumped into India as TBR export prices from China are significantly lower than the prices of such tyres in Chinese domestic market and also prices of similar exports originating from countries such as Thailand and South Korea. The per unit import price from China is even less than the cost of raw materials that go into the making of the tyres.

According to ATMA, India’s position as a target country by China has become further vulnerable with US imposing severe dumping and anti-subsidy duties against Chinese tyre imports to the US. Slowdown of the domestic Chinese economy is feared to cause further dumping of tyres in India since India offers a ready and growing market with very low import duties in finished rubber products, such as tyres.

While import duty on natural rubber is 25% in India, import of tyres from China attracts just 7% duty.

Dumping of TBR tyres at such a large scale is also adversely affecting the interests of rubber growers in India. Truck & bus tyres are primary consumers of domestic natural rubber. However domestic demand for tyres being increasingly met by Chinese imports, the offtake of natural rubber by tyre industry has been seriously impacted.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth