Income and net profit growth for Chinese automotive manufacturing enterprises over the first three quarters of 2015

The Chinese automotive market has seen previously high growth rates fall in 2015, with negative growth being reported in certain months. However, on the whole the market still managed to achieve positive year-on-year growth over the first three quarters of the year. The majority of domestic own brand automotive manufacturing enterprises have achieved positive year-on-year growth over the first three quarters of the year, with BYD seeing its net profits over quintuple from the previous year. At the other end of the spectrum, FAW Xiali saw its net deficit decrease even further.

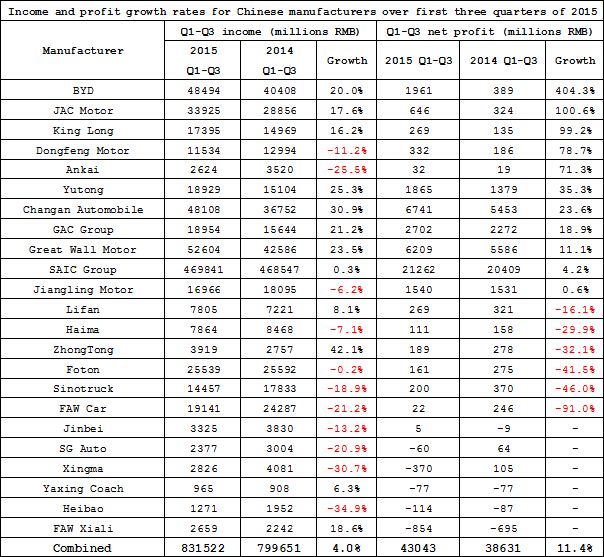

According to statistics from Gasgoo.com (Chinese), the top 23 listed automotive manufacturing enterprises generated respective totals of 831.52 billion RMB in income and 38.63 billion RMB in net profits over the first three quarters of the year combined. The two figures represented year-on-year growth of 4% and 11.4%, respectively. The average net profit growth rate for these manufacturers was 5.2%, up 0.4 percentage points from similar figures reported the previous year.

BYD’s performance in terms of net profits was very commendable. The manufacturer’s net profit grew 404.3%, year-on-year, placing it ahead of all other own brand manufacturers. The manufacturer generated 48.49 billion RMB in income over the first three quarters of the year, representing positive year-on-year growth of 20%. BYD has benefited from the rapid development of its new energy vehicle division.

Leading own brand manufacturer Changan Automobile also posted respectable numbers. The manufacturer generated 48.11 billion RMB of income over the first three quarters of the year, up 30.9% from last year, while its net profit totaled 6.74 billion RMB, up 23.6% from the previous year. The manufacturer’s net profit is second only to SAIC Group in terms of volume. Changan’s sales grew 35.3% over the three quarter period, exceeding the 700,000 unit mark.

SAIC Group, as the largest own brand manufacturer, has seen its income and profits grow slightly from previous year. Its income and net profits totaled 469.84 billion RMB and 21.26 billion RMB, respectively, representing year-on-year growth of 0.3% and 4.2%.

At the other extreme was FAW Xiali, whose net deficit grew from 695 million RMB over the first three quarters of 2014 to 854 million RMB over the first three quarters of this year. Despite a 18.6% year-on-year increase in its income, he manufacturer is still suffering from a lack of competitiveness in the market. Fellow FAW-affiliated brand, FAW Car, has also posted poor numbers this year, with its income and net profits decreasing 21.2% and 91%, year-on-year.

SG Auto and Xingma have also posted negative year-on-year growth rates in the double digits, with their former net profits becoming net deficits. ZhongTong, Foton and Sinotruck also suffered negative year-on-year net profit growth of over 30%.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth