The Top 10 M&A Cases in Tire Industry in 2016

In the quick-shift world of global tire industry, news about break down, merger and incorporation were heard from time to time.

Reshuffle of assets represents changes in the tire market structure as well as continuous development of the industry.

Following are the top 10 merger and acquisition cases in the tire industry last year.

Yokohama Rubber Buys out India-based ATG

Yokohama Rubber Co., Ltd., purchased in Apr. 2016 all the shares of Alliance Tire Group B.V. (ATG), the proprietary company of India-based Alliance Tire Group for 1.18 billion U.S. dollars.

The acquisition helps expanded the product category of Yokohama Rubber’s commercial vehicle tires by adding agricultural and forestry machinery tires; Yokohama’s progress of globalization has also been boosted.

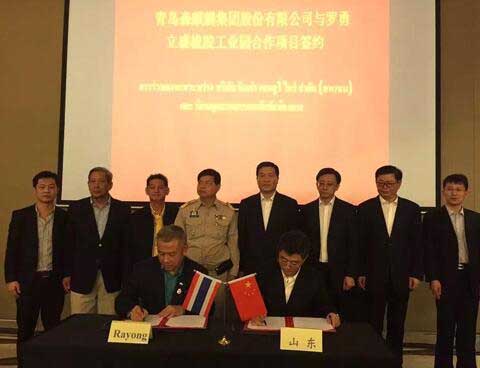

Sentury Merges with LK-RICH Rubber Industrial Park

Qingdao Sentury Group Co., Ltd. officially merged with Thai LK-RICH Rubber Industrial Park on Apr. 11, 2016.

According to Sentury, the industrial park is expected to bring in 10 tire processing companies and 10 supporting companies, to build the park into a multifunctional park focusing on rubber industry.

Sentury invested 3.5 billion Thai baht in the transaction, which is an important move for the company in exploiting international market and is a good example for Chinese tire companies “going abroad”.

Trelleborg Buys CGS Holdings

Swedish Trelleborg Group purchased CGS Holdings in Jun. 2016 for 10.9 billion Swedish kronor (about RMB 7.97 billion by cash.

The brand Mitas of CGS is a world’s leading manufacturer of agricultural tires and special-purpose tires.

The combined sales volume of the two firms totaled 30 billion kronor at the end of 2015.

The acquisition helps Trelleborg establish its position as the world’s leading manufacturer of agricultural tires and has greatly improved its status in the tire manufacturing sector.

More Than One Pair of Eyes Fixed on Kumho Tire

The largest creditor and shareholder of Kumho Tire decided in Sep. 2016 to sell its 42% stake in the company, which valued about 1 trillion won (about 5.9 billion yuan).

So far, a total of five companies offered their quotations. The offerors include Shanghai Aviation Industrial (Group), Doublestar Tire, and Indian Apollo Tyres.

But the board chairman of Kumho Asiana Group wouldn’t reconcile to the situation and was making effort to raise fund and repurchase the company.

Bridgestone Buys Stake in French Tire Chain Retailer

Bridgestone announced in Sep. 2016 that it has completed the equity transaction with French tire chain retailer Pneu à bas prix.

After that, Bridgestone’s retail outlets in France will increase by about 450 and its market network is to expand further.

Aeolus, Pirelli Hand in Hand

Aeolus Tire purchased a 10% stake in Pirelli Industrial Tyre and relevant procedure was completed on Oct. 26, 2016.

ChemChina purchased Pirelli as a whole in Oct. 2015 and integrated it with Aeolus Tire.

Aeolus Tire merged with Double Happiness Tyre Industrial and Qingdao Yellowsea Rubber, and integrated them with Pirelli.

After a series merger and acquisition, Aeolus Tire is to become a large multinational tire company.

Michelin Buys Brazilian Tire Manufacturer

Micheline Group purchased Levorin Pneus e Camaras, a Brazilian bicycle and motorcycle tire manufacturer, in Aug. 2016.

As of 2015, Levorin owned 2,000 employees in its Sao Paulo and Manaus plants, and the sales volume totaled 155 million U.S. dollars.

The acquisition enhanced Michelin’s production capacity in South America and further extended its production line.

Continental Corp. Acquires Hoosier Tire & Rubber

Continental Corp. purchased Hoosier Tire & Rubber in Nov. 2016 for about 126 million euros.

Hoosier Tire & Rubber is the world’s leading manufacturer of land-speed tires. All of its tires are made in the U.S. and the product categories are more than 1,000.

The acquisition helps Continental Corp. add a stronghold in America and further enhances its production capacity of sports tire.

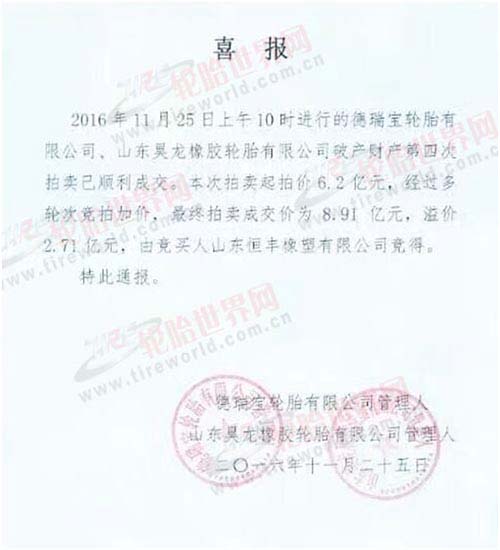

Hengfeng Rubber & Plastic Takes down Deruibao

Part of assets of Shandong Deruibbao Tire Co., Ltd. and Shandong Haolong Rubber & Tire Co., Ltd. was auctioned on Nov. 25, 2016.

Shandong Hengfeng Rubber & Plastic Co., Ltd. bought the assets in the bid for 891 million yuan.

Before going bankruptcy in Feb. 2015, Deruibao Tire’s annual capacities were all-steel tires of six million and semi-steel tires of 12 million, ranking the world’s 75th.

After the purchase of Deruibao Tire, the tire capacity of Hengfeng Rubber & Plastic has increased significantly.

Cooper Tires Incorporates with GRT

Cooper Tires announced on Dec. 1, 2016 that it has completed the purchase of a 65% stake in Qingdao Geruida Rubber. The New company was officially named as Cooper (Qingdao) Tire Co., Ltd.

After the acquisition, Cooper Tires added another stronghold in China and had one more source of all-steel tires.

At the same time, Cooper Tires’ global production system has constituted eight tire production plants.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth