Chinese tire companies suffering in 2016

With the arrival of 2016, three tire companies in Dongying, Shandong province, confronted bankruptcy.

How the tire companies will be in 2016? Whether we are going to witness more tire companies being eliminated by the industry because of bankruptcy?

Tireworld made a questionnaire through the website and WeChat interactive platform over the reshuffle of China’s tire industry.

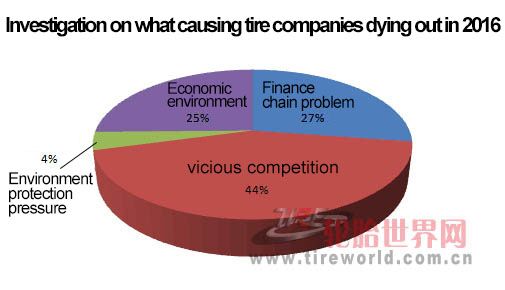

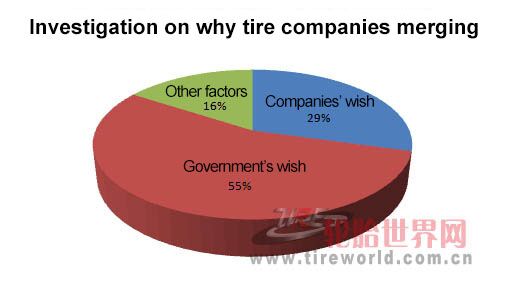

The survey shows that 65% interviewees believe a large number of Chinese tire companies will quit the industry in 2016; 44% interviewees considered cutthroat competition was the primary reason for Chinese tire companies going into bankruptcy; and more than a half of the interviewees held that M&A in tire industry would be pushed by the government.

Large number of tire companies to become obsolete

Looking backward to 2015, Deruibo Tire and Beijing Capital Tire announced bankruptcy in succession. After that, news about bankruptcy and reshuffle of tire companies were heard from time to time.

Survey conducted by Tireworld shows that 65% interviewees believe a large number of Chinese tire companies will quit the industry in 2016.

Some industry insiders asserted that in Guangrao county of Dongying, only two to three tire companies may survive bankruptcy.

About 31% interviewees believe the market will eliminate a small part of tire companies; while only 4% interviewees think only a few tire companies will be become obsolete.

Conclusion could be drawn that most tire companies are pessimistic about 2016.

Cutthroat competition: key factor for bankruptcy

With regard to the reason for bankruptcy of tire companies, over 40% interviewees attributed it to cutthroat competition.

Wang Guomei, a senior figure with tire export, said that companies will usually do anything to grab market share. She reckons that Chinese tire companies contend for market and orders with low prices, which has little effect and great harm even for themselves.

Some industry insiders said “price war” hurt many tire companies. Such action is not different than drinking slow-acting poison for both companies and the market.

The consequence of such cutthroat competition is most companies becoming profitless and facing cash flow problem.

About 27% interviewees believe bankruptcy of tire companies is triggered by cash flow problem.

Moreover, about 25% interviewees attribute bankruptcy to sluggish macro-economy. Only 4% interviewees consider pressure from environmental protection affected the tire companies.

Under macro-economic slowdown, overcapacity, restrained bank lending, and international financial risks, not many firms can operate easily.

Government: the main booster for M&A

Around 55% interviewees believe M&A in China tire industry is boosted by the government.

Government indeed played a vital role in the course of M&A of tire companies. An industry insider from Dongying told Tireworld that so-called reshuffle or incorporation in the city were mandatory from local government.

Deruibo Tire once asked the government of Guangrao county to reorganize the company. Local officials also confirmed that the government did intervene in the issue and help look for buyers.

Actually, the central government is boosting M&A. Prime Minister Li Keqiang said recently at an executive meeting of the State Council that means such as asset reorganization, property rights transfer and bankruptcy should be applied to companies losing money for over three years and are not in accordance with the direction of structure adjustment.

Obviously, many domestic tire companies are completely qualified.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth