How automakers in China start their year of 2020?

Automakers in China must spend an extremely unforgettable Spring Festival holiday accompanied by the coronavirus outbreak. According to the China Association of Automobile Manufacturers (CAAM), China's auto sales in January were estimated to drop 18% from the previous year. However, it is not fair to entirely impute the downturn to the epidemic because the month embracing the Lunar New Year holiday is supposed to be a slack season for auto sale.

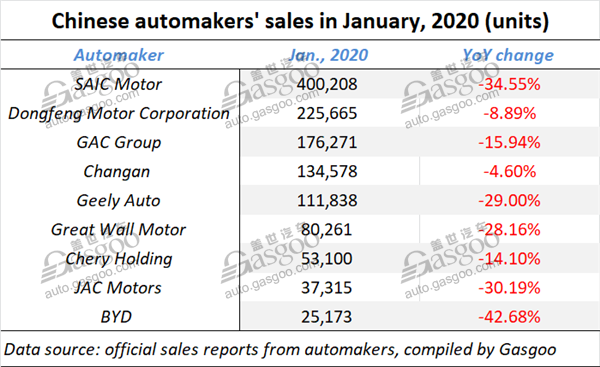

Gasgoo hereby summarized the Jan. sales volumes offered by nine mainstream automakers. Seven of them suffered double-digit decrease. It is worth mentioning that Dongfeng Motor Corporation, which is headquartered in the epidemic center Wuhan, was one of two automakers that featured single-digit decrease. We will describe the performance for each automaker one by one, and find out the bright spots amid the general sliding trend.

SAIC Motor

SAIC Motor saw its sales in January tumbled 34.55% over a year ago. Despite the overall downturn, the group still boasted growth in sales of indigenous brands. The combined sales of Roewe and MG aggregated 60,025 units, making SAIC Motor PV gain a slight year-on-year growth of 0.04%.

SAIC Maxus started its year of 2020 with a remarkable growth of 11.42%. The balanced development strategy for PVs and CVs and the consumer-centric customized marketing business model should owe much to its blooming sales.

However, the sweeping downturn that hit joint ventures still brought the overall sales down. SAIC Volkswagen, SAIC-GM and SAIC-GM-Wuling respectively suffered year-over-year plunge of 40.53%, 30.49% and 51.10%. It is noteworthy that SAIC-GM-Wuling recently earned much “likes” among users by producing the urgently needed face masks to combat the virus.

As for the CV sector, the sales of SAIC-IVECO Hongyang Commercial Vehicle and Naveco Ltd. shrank 38.51% and 6.24% from the previous year respectively.

Dongfeng Motor Corporation

Dongfeng Motor Corporation, whose most businesses are located in the hardest-hit Wuhan, didn't suffer a horrendous plunge. The group sold 225,665 new vehicles in January, only 8.89% less than that of the prior-year period.

The decrease entirely resulted from the slide in PV sales. With 193,262 units sold, the PV sector posted a 10.39% year-on-year drop. However, CV sales edged up 1.28% to 32,403 units, slightly offsetting the PV sales downturn.

Among subsidiaries, Dongfeng Honda, Dongfeng Liuzhou, Dongfeng Passenger Vehicle Company and Dongfeng Trucks all saw their sales rise over the previous year. Notably, Dongfeng Honda sold 67,510 vehicles, only outnumbered by Dongfeng Motor Company Limited. Thus, the 1.85% growth the joint venture gained was rather vital to the limited decline in Dongfeng's overall sales.

Besides, Dongfeng Motor Company Limited saw Jan. sales fall 12.4% with none of its branches posting growth. Both Dongfeng Renault and DPCA were still mired in sharp slump.

GAC Group

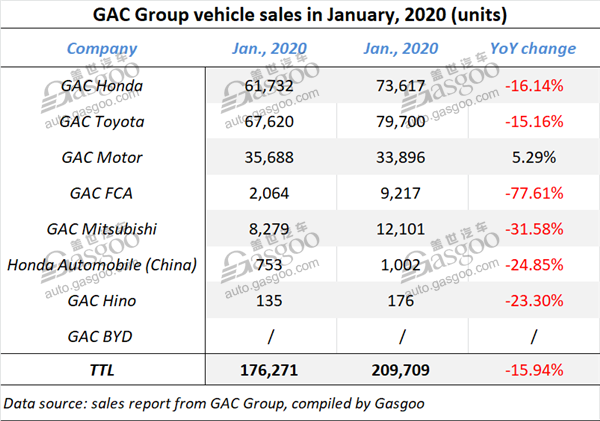

GAC Group announced it sold 176,271 new vehicles in January, a decrease of 15.94% compared to the same period in 2019.

In terms of wholesale volume, joint ventures were all hit by double-digit decrease. Of those, GAC Honda and GAC Toyota saw their sales slide 16.14% and 15.16% respectively. The Sino-French joint venture GAC FCA suffered a plunge of up to 77.61%.

Affected by the Spring Festival holiday and the outbreak of novel coronavirus, China faced a 21.6% downward movement in Jan. locally-produced PV wholesale volume, according to the China Passenger Car Association (CPCA). Nevertheless, GAC Motor still defied the overall sliding trend with a sales growth of 5.29%.

GAC Group's auto outputs in Jan. slumped 24.31% year over year to 138,004 units. The volume of GAC Honda, GAC Toyota and GAC NE all exceeded their original targets, reaching 45,392 units, 53,671 units and 3,015 units respectively.

NEV sales have maintained a rising impetus, said GAC Group. In January, the group sold 4,894 NEVs (+111% YoY), of which 3,002 units (+53% YoY) were the contribution made by GAC NE.

Changan

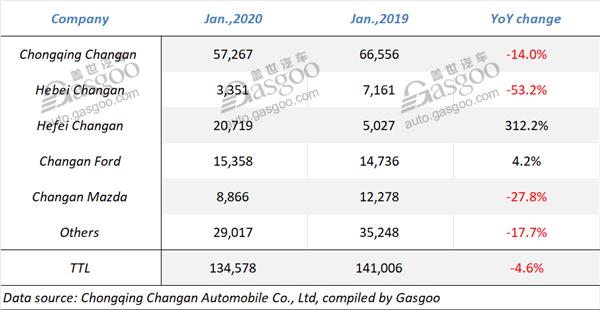

Chongqing Changan Automobile Co., Ltd (Changan) announced it sold 134,578 new vehicles in January, a year-on-year downward movement of 4.6%.

Among the vehicles sold last month, 103,899 units belong to Changan's indigenous brands, the group reported via its WeChat account. Of those, the sales of Changan-branded PVs amounted to 79,708 units.

There were three SUV models whose Jan. sales exceeded 10,000 units. The CS75 boasted a year-on-year surge of 56% with 25,773 units sold, only 641 units less than that of the best-seller Haval H6. The sales of the CS55 and the CS35 reached 10,952 units and 10,253 units respectively. Besides, the volume of the EADO sedans totaled 6,560 units.

As for the performance of subsidiaries, Heifei Changan gained a splendid increase of 312.2%. It is noteworthy that the joint venture Changan Ford saw its sales climb 4.2% over a year ago, maintaining the upward trend from Dec. 2019.

In overseas markets, Changan sold a total of 5,007 new vehicles, 11.4% more than that of the prior-year period.

Geely Auto

Geely Automobile Holdings Limited (Geely Auto) claimed it vehicle sales (including the volume of Lynk & Co brand) totaled 111,838 units in Jan. 2020, a year-on-year decrease of 29% and a month-on-month drop of 14%, completing 8% of its 1.41 million-unit annual sales target.

Of those, the sales of new energy of electrified vehicles (NEEVs) amounted to 4,762 units. The respective sales of the Boyue, the Emgrand, the Emgrand GS and the Binyue all exceeded 10,000 units.

Besides, the automaker also exported 2,265 vehicles last month, a plunge of 68% over the year-ago period.

Of new vehicles sold last month, 68,765 units and 41,901 units were SUVs and cars respectively. In addition, there were 1,172 MPVs sold during the same period.

Lynk & Co saw its Jan. sales volume amount to 9,008 units. As of Jan. 2020, the premium car brand has put roughly 257,000 vehicles onto the market.

Great Wall Motor

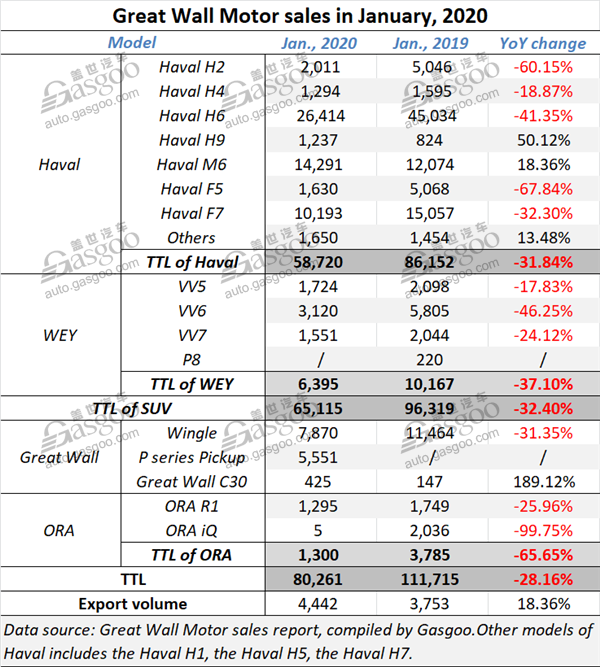

Great Wall Motor (GWM) reported a 28.16% year-on-year drop in its Jan. new vehicle sales. Meanwhile, the outputs for the month also slumped 31.79%.

The combined sales of two SUV brands, Haval and WEY, sharply shrank 32.4% compared to the year-ago period. Among 58,720 Haval-branded SUVs sold last month, 26,414 units were from the biggest sales contributor Haval H6. However, the well-received SUV model was hit by a 41.35% sales plunge. Besides, the respective sales of both Haval H2 and F5 represented decline of over 60%.

WEY, the brand bearing GWM's ambition to move upscale, suffered a double-digit decrease as well with none of models achieving increase.

The automaker sold a total of 13,846 pickups in January. The P Series Pickup, a young brand just launched in last August, saw its sales volume amount to 5,551 units, versus 7,020 units for the previous month. As of Jan. 2020, the sales of the P Series Pickup aggregated 23,850 units.

The BEV-focused ORA suffered a steep decrease of 65.65%. The nosedive in the ORA iQ sales was the main factor bringing the whole sales down.

Chery Holding

Chery Holding's new vehicle sales reached 53,100 units in January, dropping 14.1% compared to the same period a year ago.

Of those, 20,798 units were from the Tiggo series, representing a year-on-year increase of 10.8%. The sales volume of the all-new Tiggo 8 climbed 9% to 11,005 units, and the volume of the Tiggo 5x remarkably surged 76.5% to 5,496 units.

Moreover, Jetour, which targets an annual sales volume of 200,000 units, sold 11,870 vehicles last month with a year-over-year jump of 18%.

Chery Holding exported 8,957 vehicles in January, achieving a slight month-on-month growth of 1.2%. The combined volume of Chery Automobile, the group's indigenous brand possessing such popular models as the Tiggo 7, the Tiggo 5x, the Tiggo 8 and the Arrizo GX, reached 7,976 units, soaring 93.4% from a year ago.

JAC Motors

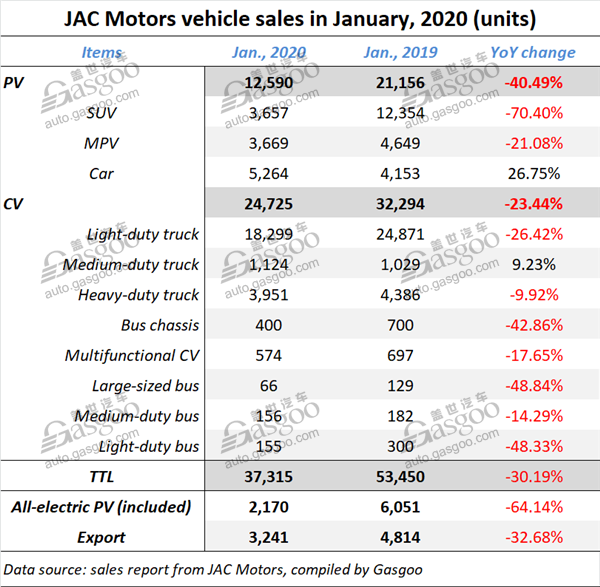

JAC Motors witnessed its Jan. sales tumbled 30.19% over the previous year to 37,315 units. To be specific, PV sales plummeted 40.49% to 12,590 units and CV sales also showed a steep dip of 23.44%.

Nevertheless, there were still some bright spots. For instance, car sales vigorously rose 26.75% to 5,264 units. In the CV unit, the sales of medium-duty trucks conveyed a 9.23% upward movement.

There were 2,170 all-electric PVs included in the new vehicles sold last month. However, the sector was hit by a plunge of 64.14%. The auto exports also dwindled 32.68%, versus the 0.25% decrease for December 2019.

BYD

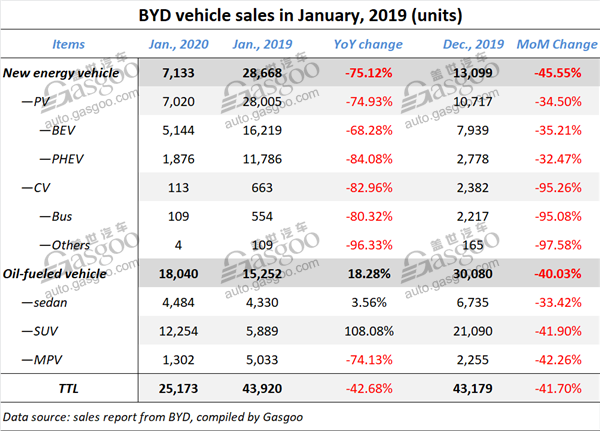

BYD said its new vehicle sales in Jan. 2020 tumbled 42.68% year on year to 25,173 units.

The plunge in NEV sales should be completely blamed for the overall sharp decrease. Last month, the company sold only 7,133 NEVs, a steep decrease of 75.12% over the year-ago period. Of that, the decrease in PV and CV sales stood at 74.93% and 82.96% respectively.

Among the new energy PVs sold in Jan., the sales of BEVs and PHEVs reached 5,144 units and 1,876 units, plummeting 68.28% and 84.08% from the prior-year period.

Despite the cloudy market climate, BYD still saw its oil-fueled vehicle sales jump 18.28% to 18,040 units. The significant increase owes much to the surging SUV sales, which were more than doubled over a year ago. In addition, the fuel-burning sedan sales also climbed 3.56% to 4,484 units. The rising performances in both sedan and SUV sectors successfully offset the plunge in MPV sales.

Related Article

- CAAM proposes to delay implementation of China Ⅵ emission standard

- China's tire export realized weak growth in 2019

- Pirelli expects 80% sales decline in Feb. due to China's coronavirus

- Guangzhou, Shenzhen encouraged to increase quotas of car license plate lottery

- China plans to launch policy to alleviate coronavirus impact on automobile spending

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth