China BD demand softens on operating rates cut at downstream units

Chinese butadiene (BD) demand is expected to soften as downstream sectors cut operating rates due to cost pressure.

In a rare occurrence BD price approached or briefly exceeded that of downstream products; styrene butadiene rubber (SBR) and polybutadiene rubber (PBR) in early August, forcing downstream players to rethink buying BD.

According to ICIS data, BD spot market weekly prices were assessed at CNY10,500-10,900/tonne DEL (delivered) east China on 9 August, while SBR1502 and PBR were at CNY10,500-10,850/tonne and CNY10,650-10,950/tonne ex-warehouse (EXWH) respectively.

Some market players said that recently BD and synthetic rubber market followed different trends, leading to this unusual situation.

BD maintained a short-term uptrend strong on limited supply, whereas the synthetic rubber market came under pressure because of higher BD costs.

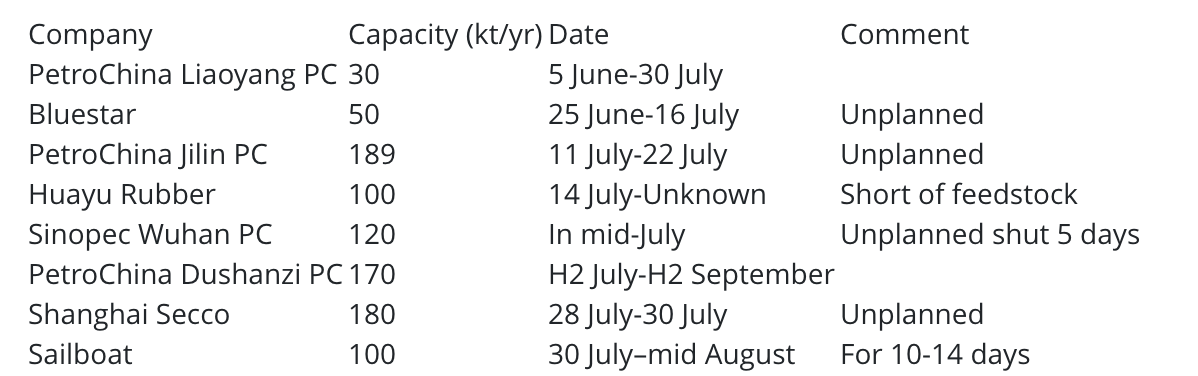

BD supply tightened on the back of unexpected shutdowns of some domestic plants and weaker run rates at some units.

Market uncertainly was further supported by the non-ending trade spat between China and the United States.

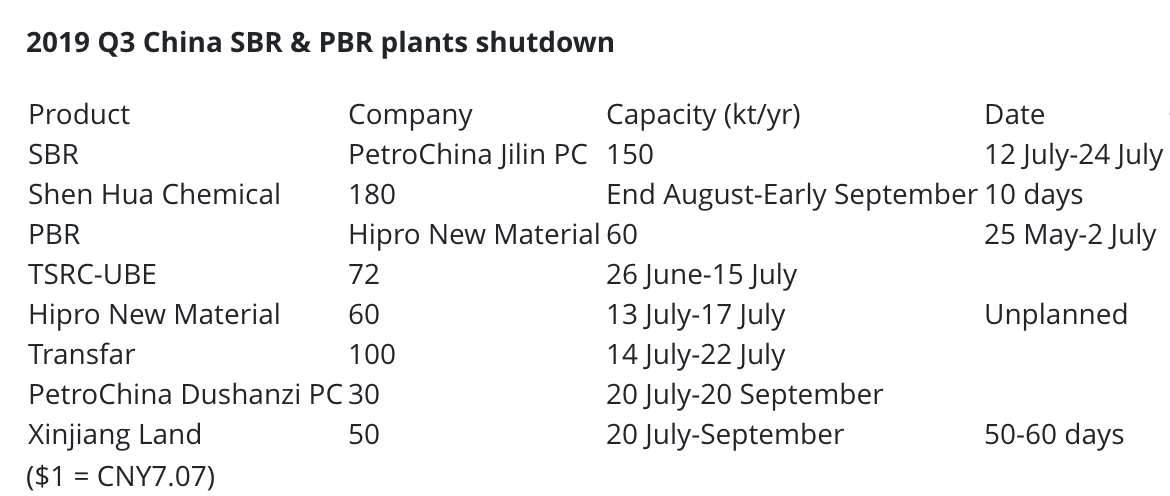

Downstream Chinese synthetic rubber market was dragged down by the low price of natural rubber (NR) and sluggish performance of downstream tyres and automobile industry.

2019 Q3 China BD plants shutdown

China's new producer, Nanjing Chengzhi started trial runs at its 100,000 tonne/year BD plant at the end of July.

On August 11, the butene-to-butadiene plant, built by Wison Engineering, produced on-spec BD, but commercial availability is yet to be announced.

Another new BD producer, Jiutai Energy Group, started providing product for the local spot market from May 2019. The 70,000 tonne/year BD unit is running at lower operating rate.

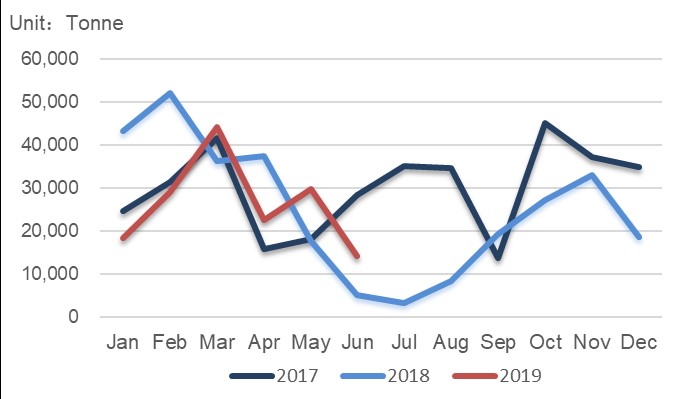

The domestic supply tightness is also accompanied by a contraction in import volumes of BD.

According to the ICIS Supply & Demand Database, China’s BD imports decreased by 53% month on month to 14,126 tonnes in June 2019.

Some industry sources expect that imports would remain low through July and August, based on high import prices.

2017- June 2019 China BD import

While BD gained on supply tightness, SBR and PBR were dragged lower by competitor NR and further downstream markets.

SBR1502 were assessed at CNY10,700-10,850/tonne EXWH, while PBR at CNY10,850-10,950/tonne EXWH on 12 August, ICIS data showed.

According to market players, at the same time, spot prices of NR were at CNY10,700-10,800/tonne EXWH.

According to the China Association of Automobile Manufacturers (CAAM), for the first half, the accumulated production and sales were 12.132 million and 12.323 million, down 13.7% and 12.4% respectively year on year.

From August, synthetic rubber factories would have further production cuts due to cost pressure.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth