China Sunsine Chemical Posts Record Earnings in Q2' 2018

Listed in 2007, China Sunsine Chemical Holdings Ltd (SGX:CH8) is a specialty chemical producer selling rubber accelerators, insoluble sulphur and antioxidants used for the production of rubber tyres. According to the company, it is the largest rubber accelerator producer in the world and biggest producer of insoluble sulphur in China, serving globally-recognised tyre makers such as Bridgestone, Michelin and Goodyear.

After many years under the radar, investors this year have started to take notice of the stock, with its share price surging 48% since the turn of the year. Much of the increase in its share price has been because of anticipated earnings growth for 2018. Investors have also finally stood up to take notice of the company that operates in a somewhat obscure industry, but has managed to grow its net profit at an impressive 45.2% each year over the past five years.

With that, here’s a quick overview of its latest results, which was released on Monday.

Impressive revenue and earnings growth

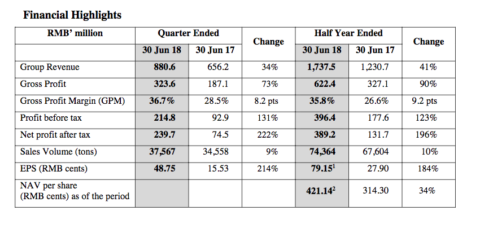

As is with the first quarter of 2018, China Sunsine once again delivered a strong set of results for the second quarter. Revenue rose 34% year-on-year to RMB 880.6 million from RMB 656.2 million recorded a year ago. Gross profit increased 73% to RMB 323.6 million and net profit after tax surged more than threefold to RMB 239.7 million. Earnings per share came in at 48.75 RMB cents.

Below is a table summarising the important financial results of the company for the second quarter and the first half of 2018:

Source: China Sunsine Chemical Holdings Ltd 2018 Q2 Earnings Press Release

What’s behind the numbers?

The growth in revenue was largely driven by a 23% year-on-year increase in average selling prices. The group benefited from a short supply situation in the quarter due to more stringent environment enforcement in the industry, propelling the group’s average selling price and volume. Total sales volume increased 9% year-on-year to 37,567 tons.

The higher average selling prices boosted gross and net profit margins. Gross profit margins hit 36.7% compared to 28.5% in the corresponding period last year. In addition, its main subsidiary, Shandong Sunsine, was granted “High-tech Enterprise” status and was credited RMB 48 million in tax expense, boosting its bottom line further.

For the first half of 2018, earnings per share rose an impressive 184%, while net asset value increased by 34%.

The group continues to have a good mix of clients, with approximately 34% of its sales coming from international clients such as the global tyre makers mentioned above. The remaining sales were to China players such as Hangzhou Zhongce and Giti Tyres.

Robust financial position

China Sunsine Chemical has maintained a robust financial position. It has a cash hoard of RMB 566.4 million with zero debt. Total equity was RMB 2,070 million at the end of the quarter.

On top of that, the company generated RMB 144.1 million in cash from its operations and had net capital expenditures of RMB 34.3 million. Free cash flow for the company was a healthy RMB 109.8 million.

Project updates

China Sunsine Chemical continues to increase its production capacity to meet the growing demand for its products. As of the latest quarter, it is awaiting the approval from the government for the trial run of the new phase 1 10,000-tob TBBS production line and new 10,000 to insoluble sulphur production line. The table below details the group’s production capacity over the last five and a half years:

Source: China Sunsine Chemical Holdings Ltd 2018 Q2 Earnings Press Release

What lies ahead?

Xu Cheng Qiu, executive chairman of the firm, mentioned:“… [A]s China’s economy is facing a slowdown in its growth amidst trade war tensions, China’s tire capacity utilisation rate is falling. Some players will resume their production after successfully complying with environmental and safety regulations. As such, we expect the selling price of rubber chemical to continue to normalise. In addition, as the Chinese government continues to enforce stringent environmental protection regulations and conduct frequent inspections under “The Battle for a Blue Sky”, this may materially affect all chemical companies in China, including our Group.”

The Foolish conclusion

China Sunsine Chemical has had a stellar start to 2018. Its track record of growth over the last few years, clean balance sheet and strong cash flows are all positive aspects for the company. However, Xu did highlight a few challenges that lie ahead for the company, including government inspections that might affect the group’s operations.

At the time of writing, China Sunsine Chemical is trading at S$1.37, which gives a reasonable price-to-book value of 1.63 and an annualised price-to-earnings of 4.3.Meanwhile, there are 28 surprising and important things we think every Singaporean investor should know--and we've laid them all out in The Motley Fool Singapore's new e-book. Packed with information and insights, we believe this book will help you be a better, smarter investor. You can download the full e-book FREE of charge--simply click here now to claim your copy.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth