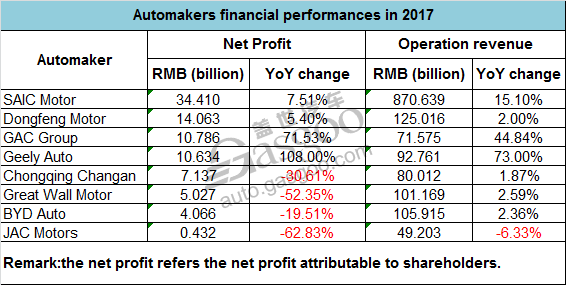

Summary: Profitability of Chinese Automakers in 2017

According to the financial reports released by corresponding automakers, SAIC Motor became the champion in both operation revenue and net profit among all Chinese automakers. Besides, Geely Auto did an impressive performance by achieving a year-on-year net profit surge of 108%. However, JAC Motors suffered year-on-year loss in both operation revenue and net profit. Among the 7 automakers cited below, JAC Motors is the only one whose net profit was below RMB 1 billion.

SAIC Motor

SAIC Motor reported operation revenue up to RMB 870.639 billion, jumping 15.10% year on year. Meanwhile, the net profit attributable to shareholders increased 7.51% from the previous year to a record high of RMB 34.41 billion, ranking first in China's auto industry. Besides, the automaker proposes to assign dividend of RMB 18.30 (including tax) per 10 shares with an annual dividend ratio up to 62.13%, exceeding 50% for 5 consecutive years.

China achieved annual sales of 29.11 million vehicles last year with a year-on-year growth of 3.3%, which was 9% lower than that of the same period in 2016. Although the overall industry faced a tepid growth situation, SAIC Motor delivered a total of 6.93 million vehicles, rising 6.8% over the previous year and accounting for 23.2% of total auto sales in this country. In addition, the company exported and delivered in overseas markets 170 thousand units in total, surging 31.8% year on year and continuously ranking first nationwide.

Dongfeng Motor

Dongfeng Motor accomplished total revenue of RMB 125.016 billion in 2017, edging up 2% year on year. In the meantime, the profit attributable to the parent company's equity holders rose 5.4% over the previous year to RMB 14.063 billion. The basic earnings per share increased to RMB 1.63 on an annual basis from the RMB 1.55 of 2016. The company proposed distributing the annual dividend of RMB 0.25 per share. From the financial report, Dongfeng Trucks' sales income growth contributed a lot to the company's revenue increase.

In 2017, Dongfeng Motor delivered a total of 3.2842 million vehicles with a year-on-year growth of 4.1%. Among that, its PV sales were slightly up 1.5% over the previous year with 2.8292 million units delivered last year. Besides, the annual deliveries of CVs jumped 23.9% year on year to 455 thousand units. It is noteworthy that the automaker made a breakthrough in new energy vehicle sales which boasted a remarkable year-on-year sales surge of 118% to 55 thousand units. Such growth rate was much higher than that of overall industry.

GAC Group

GAC Group reported the operation revenue up to RMB 71.575 billion in 2017, jumping 44.84% year on year. What's more, the net profit attributable to shareholders of the parent company reached RMB 10.786 billion, soaring 71.53% over the previous year.

The output and sales of GAC Group reached 2.017 million units and 2.001 million units respectively in 2017, jumping 21.54% and 21.27% year on year respectively, completing the output and sales targets ahead of schedule. Among them, NEV annual output and sales totaled 794 thousand units and 777 thousand units respectively with year-on-year growth of 53.8% and 53.3%. In 2017, GAC Group occupied 2.7% of NEV market share in China, up 0.9% year on year.

Geely Auto

Thanks to the improved product portfolio and the increased average sales price, Geely achieved total revenue up to RMB 92.761 billion in 2017, jumping 73% from a year ago. Meanwhile, the automaker's net profit skyrocketed 108% to RMB 10.634 billion. The earnings per share were RMB 1.19 while the final dividend of the period was proposed at RMB 0.29.

In 2017, Geely annual sales reached a record high of 1,247,116 vehicles, soaring 63% from the previous year. At the same time, the Hangzhou-based automaker aims to sell 1.58 million vehicles this year, jumping 27% compared with 2017.

Chongqing Changan

Chongqing Changan released its 2017 financial report on March 29 showing that the company achieved operation revenue of RMB 80.012 billion last year, edging up 1.87% year on year. Besides, the net profit attributable to shareholders slumped 30.61% from a year earlier to RMB 7.137 billion.

According to the financial report, the company's annual sales of self-owned brands decreased 5.66% over the previous year. The automaker attributes its operation revenue growth to the rising average price of updated products. Meanwhile, Chongqing Changan ascribed the net profit plunge to the declining investment income from joint ventures.

In accordance with the 2017 sales data released before, Chongqing Changan suffered a year-on-year annual sales decrease of 6.23% to 2,872,456 vehicles last year, which failed to accomplish its initial sales target of 3.3 million units.

Great Wall Motor

Great Wall Motor, the Chinese largest SUV and pickup marker, announced that the company achieved operation revenue of RMB 101.169 billion in 2017, increasing 2.59% year on year. The net profit attributable to shareholders slumped 52.35% from a year earlier to RMB 5.027 billion last year. According to the financial report, the basic earnings per share were RMB 0.55. The company proposed distributing cash dividends of RMB 0.17 per share to shareholders.

According to the financial expectation released before, the automaker attributed its net profit slump to the excessive sales promotion, rising advertising and publicity expenses and increasing investment in products' R&D.

Great Wall Motor delivered a total of around 1.07 million vehicles last year, decreasing 0.4% year on year, which was far less than its initial annual sales target of 1.25 million vehicles. In terms of the unsatisfied sales performance last year, the automaker lowered its sales target to 1.16 million units in 2018.

BYD Auto

BYD earned revenue of RMB 105.915 billion in 2017, up 2.36% on an annual basis, according to BYD's 2017 financial report released on Mar. 28. The net profit attributable to the shareholders reached RMB 4.066 billion, slumping 19.51% over the previous year. Basic earnings per share dropped 25.53% year on year to RMB 1.41.

Specifically, revenue of vehicles and vehicle-related business reached RMB 56.624 billion, down 0.68% year on year. Mobile phone parts and assembling business saw YoY revenue growth of 3.53% to RMB 40.473 billion. Revenue of secondary rechargeable battery and photovoltaic business totaled RMB 8.767 billion, jumping 19.37% over the previous year. The NEV business gained revenue of RMB 39.06 billion with a YoY growth of 12.83%, accounting for 36.88% of BYD's total revenue.

JAC Motors

JAC Motors announced that the company achieved a total of operation revenue of RMB 49.203 billion in 2017, falling by 6.33% year on year. The net profit attributable to the shareholders nosedived 62.83% from a year ago to RMB 432 million.

Affected by the profit downturn, the members from the operational team received punishment of pay cuts. The salaries of senior executives and members of the board were halved averagely.

JAC Motors delivered a total of 510,900 units of vehicles (including chassis) in 2017, slumping 20.58% year on year. The company's sales decline was mainly affected by the sales downturn of SUVs. According to the data released by the automaker, JAC Motors delivered 121,300 SUV models throughout 2017 which was 154,200 units less than that of in 2016. The automaker attributed the sales depression to the S3's sales falloff and the disappointing S7's sales after it hit the market. In addition, the phase-out new energy vehicle (NEV) subsidiary and the rising raw material prices also led to the sales frustration to some degree.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth