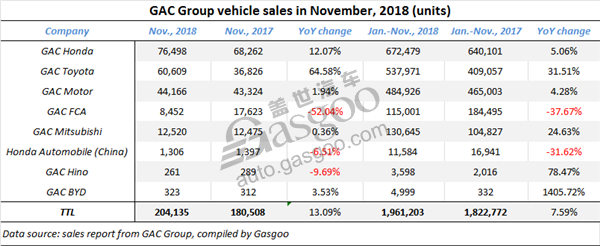

How China’s major automakers perform in Nov. amid overall vehicle sales go downhill

China's vehicle sales in November reached 2,547,800 units, climbing 7.05% over a month ago, while presented year-on-year (YoY) decline of 13.86%, according to the data released by the China Association of Automobile Manufacturers (CAAM). For the first eleven months, the year-to-date (YTD) vehicle sales for the world's largest auto market edge down 1.65% from the year-ago period, showing YoY downturn the second time of the year.

Gasgoo hereby summarizes the sales data released by several major Chinese automakers as usual. Annual sales outcomes for these carmakers are getting more and more clear with the new year approaching.

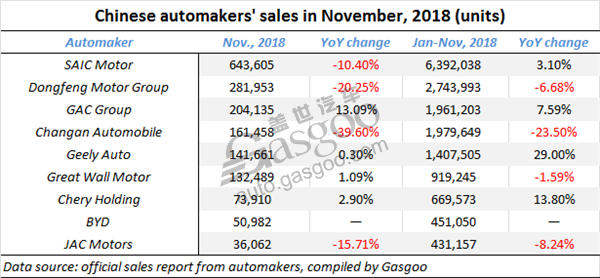

SAIC Motor

The top 3 subsidiaries by Nov. sales for SAIC Motor were still SAIC Volkswagen, SAIC GM and SAIC-GM-Wuling whose monthly sales all presented YoY downturn for the third month in a row. Apart from SAIC Motor PV, Naveco and Sunwin Bus, the other subsidiaries all faced negative YoY growth last month.

SAIC Motor PV has maintained a blooming growth momentum this year. The Roewe i5, hitting the market on October 26, had a sales volume of 12,000 units in November. Besides, the sales of the MG HS SUV have exceeded 10,000 units after it went on sales at the end of September.

In November, SAIC Volkswagen still achieved a positive month-on-month (MoM) sales growth of 10% despite its YoY decrease. Aside from such hotter-selling models as the Lavida and the Tiguan, the sales of the new-generation Passat reached nearly 17,000 units with a YoY jump of 22%. The Volkswagen Tharu SUV, launched by the joint venture on the last day of October, pushed the sales to a higher level to some degree.

By the end of November, SAIC-GM has suffered YoY decrease for 6 straight months.

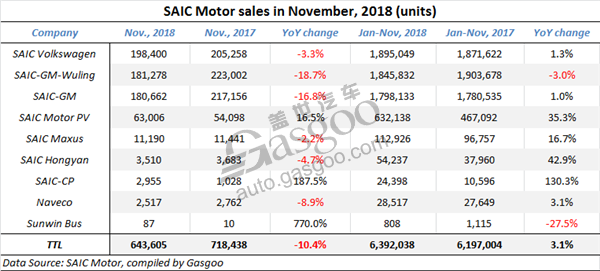

Dongfeng Motor Group

By the end of November, Dongfeng Motor Group has seen its YTD sales present YoY drop for five consecutive months. Meanwhile, the YoY drop has been increased to 6.68% in November from 0.24% in July.

As to the Nov. sales, the automaker also suffered an obvious YoY decline of 20.25%. Certainly, as its sales mainstay, the PV business sector faced apparent downturn regarding both Nov. sales and Jan.-Nov. sales. Especially, the SUV sales in Nov. plunged 33.46% over a year ago.

From the above table itemizing the sales data of each business unit, we can be noted that a large part of subsidiaries faced negative YoY sales growth last month. Dongfeng Honda's sales climbed 6.96% from the previous year, while the other major Sino-Japanese joint venture Dongfeng Nissan saw its Nov. sales slide 8.65%. Two Sino-French joint ventures Dongfeng Renault and DPCA met with striking YoY dip of 81.57% and 68.56% respectively.

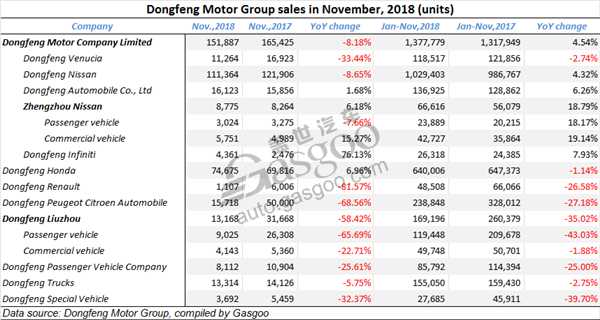

GAC Group

GAC Motor boasted a YoY increase of 4.28% in year-to-date (YTD) sales. The sales driver Trumpchi GS4 had suffered substantial decline in the first half of the year under the fierce competition against such rivals as the Haval H6 and the Geely Boyue who promoted their change-over or facelift, while it saw the sales pick up after its facelift was launched in June. By the end of November, the sales of the Trumpchi GS4 have aggregated over 220,000 units.

GAC Honda has completed 89.66% of its 750,000-unit yearly sales target. The Accord, the Fit and the CRIDER were quite popular with their sales amounting to 18,648 units, 11,442 units and 13,779 units last month. Besides, all three models achieved double-digit YoY increase in November sales, according to Honda's China sales report.

The other two major Sino-Japanese joint ventures—GAC Toyota and GAC Mitsubishi both accomplished double-digit YoY growth in Jan.-Nov. sales.

As to CV arms, both GAC Hino and GAC BYD have fulfilled their original annual sales goal.

Changan Automobile

Changan Automobile announced that its Nov. sales tumbled 39.6% over a year earlier to 161,458 units, the seventh month in a row for the automaker to face year-on-year drop.

The sales of Changan Automobile's self-owned brand amounted to 118,902 units in the past November among which 5,278 units were new energy vehicles.

As to the performance of specific models in November, the sales of the CS55 and CS75 SUVs reached 15,777 units and 12,036 units respectively. The CS35 Series had a sales volume of 12,751 units. Meanwhile, a total of 9,343 EADO sedans were delivered last month. The automaker didn’t reveal the sales of the Raeton sedans.

Changan Ford saw its YTD sales halved over the previous year to 359,972 units. Changan Ford's annual sales peaked at around 957,000 units in 2016, yet failed to keep the rising momentum or even stay flat afterwards with its sales dropping 14% YoY to around 827,000 units in 2017. After compiled the sales data released by Changan Automobile each month, Gasgoo found out that Changan Ford has experienced YoY drop for 11 consecutive months from the beginning of 2018.

Geely

For the first eleven months, Geely saw its YTD sales jump 29% from the year-ago period to 1,407,505 units, completing 89% of the 1.58 million-unit annual sales target.

There were a total of 9 models whose Nov. sales exceeded 10,000 units. However, apart from the Geely Binrui and the Binyue which hit the market on August 30 and October 31 respectively as well as the Vision X3, the other six models all presented YoY decline in monthly sales, among which the Emgrand, the all-new Vision, the Boyue, the Emgrand GS and the Vision SUV all had double-digit YoY decline. In spite of the negative growth of several sales drivers, Geely still accomplished positive YoY increase last month thanks to the favorable performance made by certain new models.

The sales of Lynk & Co 01, 02 and 03 reached 5,302 units, 3,008 units and 4,011 units respectively last month. By the end of November, the premium car brand has delivered 114,629 vehicles this year.

In addition, a total of 10,575 NEVs were sold by the automaker in November.

Chery Holding

Chery Holding posted an evident MoM sales growth of 16% with 73,910 vehicles sold in November, hitting a new high in monthly sales of the year, the group said.

Last month, the group saw its NEV sales leap 86.7% year on year (YoY) to 11,382 units and export volume climb 5% over a year ago to 10,675 units.

By the end of November in 2018, Chery Holding sold 669,573 vehicles in total, a YoY increase of 13.8%. It is worth mentioning that its cumulative export volume jumped 18.7% from a year ago to 118,017 units, which has already surpassed the total volume for 2017. The NEV is the fastest-growing business sector that gained a splendid YoY growth of 211.4% with 81,266 units sold through November.

It is reported that Chery has formed its own NEV R&D system and expects to achieve a NEV sales volume exceeding 200,000 units by 2020.

Great Wall Motor

Up until now, Great Wall Motor (GWM) has completed 79.25% of its 1.16 million-unit annual sales goal.

SUVs, the product sector GWM relies on most, had a sales volume of 117,769 units last month with a slight YoY growth of 0.08%. This was the fourth month in a row for WEY brand to see sales exceeding 10,000 units this year.

It is worth mentioning that the Haval F Series obtained an impressive sales performance last month. The sales of the Haval F5, which was available for sale from September 26, evidently grew 12.77% compared with the previous month to 7,065 units. The Haval F7 gained a sales volume of 6,067 units within three weeks after hitting the market.

GWM's pickup sales had surpassed 10,000 units for 4 consecutive months. The Wingle 7 boasting ICV features formally entered the market on November 7.

The NEV brand ORA witnessed the sales of its first model—the ORA iQ sedan leap 46.9% from a month ago to 1,043 units. The ORA R1—the NEV brand's second model is going to hit the market on December 26.

BYD Auto

BYD Company Limited sold 50,982 vehicles in November, which made its YTD sales grow to 451,050 units. The PV sales in November reached 49,645 units, climbing 9% over a year earlier.

Last month, BYD sold 20,906 fuel-burning vehicles, among which 3,781 units were cars, 7,093 units were SUVs and 10,032 units were MPVs. For the first eleven months, the company saw its fossil fuel-powered vehicle sales aggregate 249,889 units.

The NEV sales in November were 30,076 units. A total of 28,739 new energy PVs were delivered last month with a significant YoY leap of 123%, of which the BEV sales and PHEV sales were 15,347 units and 13,392 units respectively. From January to November, BYD has already sold 201,161 NEVs in total. With regard to the Nov. sales of each model, the sales of the all-new BYD Tang SUV amounted to 10,152 units, surpassing 10,000 units for four straight months. The sales of the BYD Song MAX MPV reached 10,032 units, surpassing 10,000 units for the 13th month in a row.

Besides, the all-new BYD Song compact SUV and the Yuan EV360 had monthly sales of 7,656 units and 6,188 units respectively. The sales of the BYD Qin family totaled 7,456 units in November.

JAC Motors

JAC Motors sold 36,062 vehicles in November with a YoY dip of 15.71%. With 431,157 vehicles delivered through November, the automaker’s YTD sales fell 8.24% from the year-over period.

Last month, the sales of the SUV, MPV and sedan sectors slipped 27.81%, 24.84% and 17.98% YoY respectively to 6,634 units, 4,700 units and 4,602 units. Speaking of Jan.-to-Nov. sales, only the sedan sector attained a YoY increase of 32.79%, yet the other two PV sectors both had double-digit decline.

Meanwhile, the export volume tumbled 34.5% in November compared with the same period a year ago. On the contrary, the cumulative volume by November jumped 21.05% to 72,363.

Sales of all-electric PVs remarkably grew 38.83% to 7,858 units in November and its YTD sales reached 52,489 units, almost doubled over the year-ago period.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth