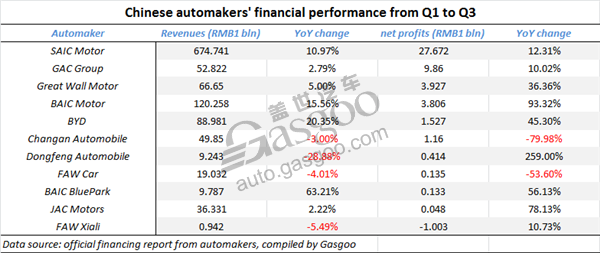

Chinese automakers profit performance from Q1 to Q3

For the first three quarters, SAIC Motor sustained the leadership with its net profits rising 12.31% to RMB27.672 billion. Aside from Changan Automobile and FAW Car, the other automakers tabulated here all accomplished positive year-on-year (YoY) increase in Jan-Sept net profits. Although FAW Xiali failed to earn profits, its profit loss was clearly narrowed down over a year ago.

SAIC Motor

From January to September, SAIC Motor's revenues totaled RMB674.741 billion, climbing 10.97% over the previous year and the net profits attributable to shareholders grew 12.31% YoY to RMB27.672 billion, the automaker announced on October 30. The basic earnings per share were RMB2.37, 11.64 percentage point higher than that of a year ago.

The financial report showed that SAIC Motors' expenses on R&D aggregated RMB9.402 billion for the first nine months, which was RMB2.308 billion more than that of the previous year.

The automaker said the R&D expense increase partly resulted from the incremental investment in technology R&D over self-developed models, new energy vehicles (NEV) and intelligent connectivity. Besides, Huayu Vision Technology (Shanghai) Co., Ltd. was included in the scope of consolidated financial statements of Huayu Automotive Electric Drive System Co.,Ltd, a subsidiary of SAIC Motor, so that the group's R&D expenses were accordingly increased.

GAC Group

GAC Group posted a YoY growth of 2.79% with its revenues for the first three quarters totaling RMB52.822 billion. Meanwhile, its cumulative net profits attributable to shareholders rose 10.02% over a year ago to RMB9.86 billion, according to the official financial report released on October 30.

In the third quarter, the automaker saw its quarterly operation revenues fell 3.67% from a year earlier to RMB16.116 billion and the net profits attributable to shareholders reached RMB2.947 billion with a YoY increase of 6.03%.

GAC Group attributed its profit growth to the continuous increase in the sales of self-owned models, the improvement in R&D capability and the faster launching of new products. Besides, the joint ventures also generated blooming economic benefits thanks to the overall sales growth driven by such lucrative models as the eighth-generation Camry and the Outlander.

Great Wall Motor

Great Wall Motor reported revenue of RMB66.65 billion for the first three quarters with an increase of 5% year on year while the net profit attributable to the shareholders of the listed company jumps 36.36% to RMB3.927 billion during the period.

However, the automaker's revenue in the third quarter fell 19% from a year ago to RMB 17.966 billion. Its net profit attributable to the shareholders of the listed company was nearly halved to RMB231 million compared with the same period last year.

Official price reduction on some models and sales promotion may contribute to the profit drop in the third quarter. What's more, WEY, the automaker's premium brand, needs much more money for greater publicity.

Vehicle sales decline exerted great influence on its profits. In September, Great Wall sold 86,700 new vehicles, down 15% year on year. For the first nine months, the company's vehicle sales totaled 676,700, only, 58.33% of its 1.16-million annual sales target. In consequence, Great Wall saw its profit decline.

BAIC Motor

BAIC Motor reported that it earned RMB120.258 billion in revenues for the first three quarters of the year, achieving a YoY growth of 15.56%. For the first nine months, the company's operating profits jumped 32.69% over a year ago to RMB17.019 billion and its net profits attributable to shareholders amounted to RMB3.806 billion, strikingly surging 93.32% from a year earlier.

According to sales data released by the China Passenger Car Association (CPCA), Beijing Benz witnessed its sales evidently grew 16.02% year on year to around 41,000 units last month. Beijing Hyundai delivered around 80,000 vehicles in September, suffering a YoY drop of 5.86%. By the end of September, the joint venture saw its cumulative sales jump 15.57% from a year ago to 561,200 units.

BYD

From January to September, BYD's revenues totaled RMB88.981 billion, a YoY increase of 20.35%. However, its cumulative net profits attributable to shareholders slumped 45.3% from the previous year to RMB1.527 billion, the automaker announced on October 30.

In the third quarter, the company gained RMB34.83 billion in revenues with a YoY growth of 20.54%, while saw its net profits attributable to shareholders fell 1.92% over a year ago to RMB1.048 billion.

BYD said its net profit decline should be attributed to the phase-out of the NEV (new energy vehicle) subsidy, which led to the evident YoY decrease in the overall profits of NEV businesses, including electric buses and new energy passenger vehicles.

Changan Automobile

Changan Automobile's sales revenue totaled RMB 49.85 billion in the first nine months, down 3% compared with the same period of last year. During the period, the automaker's net profit plunged nearly 80% to RMB 1.16 billion.

For the third quarter, the company posted sales revenue of RMB 14.21 billion, falling 20.51% year on year while the net profit nosedived to RMB 450 million by 137.51 percent from a year ago.

Sales decline is the main contributor to the result. In the first nine months, Changan sold 1,647,616 new vehicles, down 20% compared with 2,058,204 of the same period last year. The company's self-owned brand and joint ventures both saw stagnant sales.

Dongfeng Automobile

Dongfeng Automobile Co., Ltd (Dongfeng Automobile) claimed that its Jan-Sept. revenues shrank 28.88% compared with the year-ago period to RMB9.243 billion, while the net profits attributable to shareholders zoomed up 259% YoY to RMB 414 million.

The automaker said that the revenues from Zhengzhou Nissan were excluded in this financial report, thus led to a sharp decline in cumulative revenues. From November, 2017, Zhengzhou Nissan would no longer be included in the scope of consolidation of Dongfeng Automobile's consolidated financial statements.

FAW Car

FAW Car's revenues for the first three quarters amounted to RMB19.032 billion, a YoY drop of 4.01%. The net profits available to equity shareholders shot up 53.6% over the previous year to RMB135 million with the earnings per share standing at RMB0.083.

In the third quarter, the automaker gained RMB5.553 billion in revenues with a YoY decline of 13.57%. The quarterly net profits attributable to shareholders soared 160.96% YoY to RMB54.207 million.

The company stated that the downturn in revenues and gross margin was partly caused by the sales decline, the fluctuation in raw material price and the adjustment of self-owned product lineup.

BAIC BluePark

BAIC BluePark New Energy Technology Co.,Ltd released the first financial report since it went on public, which said that the company attained a remarkable YoY growth of 63.21% with its revenues for the first three quarters reaching RMB9.787 billion. Meanwhile, the net profits available to shareholders leapt 56.13% from a year ago to RMB133 million.

Its subsidiary Beijing Electric Vehicle Co.,Ltd. (BAIC BJEV) delivered 11,560 vehicles in September, achieving a YoY jump of 35.22%. For the first nine months, the subsidiary saw its year-to-date sales surged 61.40% from a year ago to 81,678 units.

On October 18, BAIC BJEV announced its 2025 mid-long term technology development planning and elaborated on the brand-new artificial intelligence auto system, the Darwin System.

JAC Motors

JAC Motors witnessed its Jan-Sept revenues edged up 2.22% from the previous year to RMB36.331 billion. However, it came across a steep YoY reduction of 78.13% with the cumulative net profits attributable to shareholders amounting to only RMB48 million.

The profit plunge should be partly ascribed to the sales decline. From January to September, the automaker sold 361,559 vehicles in total, suffering a YoY decrease of 5.53%. Additionally, the change of NEV policy and product lineup resulted in a YoY drop of 3.3% in main businesses’ incomes. The fluctuating exchange rate and rising financing cost led to a larger financial expenditure, which was RMB71.83 million more than that of a year ago.

FAW Xiali

For the first nine months, Tianjin FAW Xiali Automobile Co., Ltd. earned RMB942 million of revenues with a YoY drop of 5.49%. Meanwhile, the company saw its net profit loss shrink to RMB1.003 billion, 10.73% lower than that of a year earlier.

FAW Xiali announced on September 28 that it transfers 100% stake in its wholly-owned subsidiary FAW Huali (Tianjin) Automobile Co. Ltd to Future Mobility Corporation (FMC), the Nanjing-based company behind the all-electric car brand BYTON with a value of RMB 1. The transaction will make BYTON qualified to produce passenger vehicles (PV).

FAW Xiali plans to transfer its 15% stake in Tianjin FAW Toyota to FAW Group Corporation, another stakeholder of Tianjin FAW Toyota, the automaker said on October 29.

Related Article

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth