NDRC imposes record fines on 12 Japanese auto parts and bearing manufacturers

Introduction

Six years after the implementation of the Anti-monopoly Law, the National Development and Reform Commission (NDRC) – the agency responsible for supervising price monopoly – continues to strengthen its enforcement efforts with an antitrust crackdown that has swept across a number of industries and companies, leading to record fines. Since 2013 the NDRC has investigated a number of high-profile cases, including LCD panels,(1) Moutai and Wuliangye,(2) baby formula,(3) Shanghai gold jewellers(4) and spectacle lenses.(5) The NDRC has also launched investigations into US high-tech giants InterDigital and Qualcomm. The InterDigital investigation has been suspended,(6) while Qualcomm(7) has manifested its willingness to cooperate with the NDRC and has submitted relevant commitments.

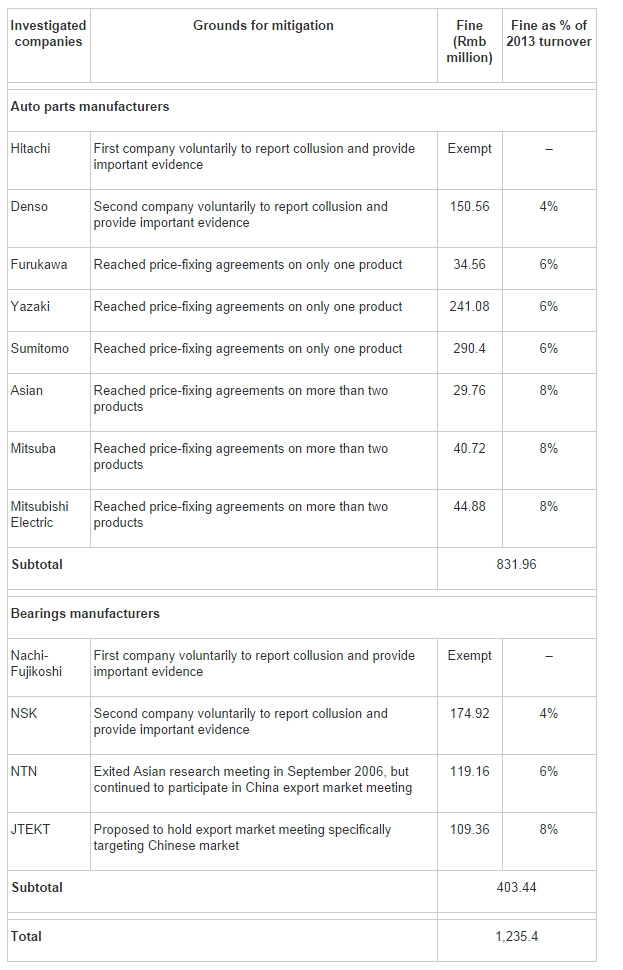

The antitrust actions in the automobile and auto parts industries are undoubtedly the most prominent cases recently. Under the pressure of antitrust law enforcement, a number of major foreign automobile manufacturers (including BMW, Benz, Audi, Toyota and Chrysler) have recently announced price cuts for their auto parts. On August 20 the NDRC announced penalties imposed on 12 Japanese auto parts and bearing companies which engaged in price-related monopolistic behaviour.(8) Eight auto parts manufacturers are facing fines totalling Rmb831.96 million (Hitachi is exempt from the penalty), while four bearing manufacturers are facing fines totalling Rmb403.44 million (Nachi-Fujikoshi is exempt from the penalty). The combined amount of the fines totals Rmb1.24 billion, a record under the Anti-monopoly Law.

This update analyses the actions and trends in anti-monopoly law enforcement by the NDRC, the application of the leniency programme and the impact of companies' actions (including responses to investigations and illegal conduct) on the fines imposed, and makes suggestions for companies dealing with antitrust investigations.

Monopolistic behaviour

According to the NDRC's announcement, from January 2000 to February 2010 eight auto parts manufacturers (Hitachi, Denso, Furukawa Electric, Yazaki, Sumitomo, Asian Industry, Mitsuba and Mitsubishi) held frequent meetings in Japan. The purpose of the meetings was to negotiate price quotations to minimise competition in order to win auto parts contracts at the most advantageous price from automobile manufacturers. They reached agreements on price quotation on multiple occasions and acted accordingly. The price negotiations involved 13 products (including starters, alternating current generators, throttle bodies and wire harnesses) that were sold in China. The parts and components were used in more than 20 models of cars made by companies including Honda, Toyota, Nissan, Suzuki and Ford. The eight auto parts manufacturers continued to supply related auto parts in accordance with collusion agreements in the Chinese market until the end of 2013.

From 2000 to June 2011 Nachi-Fujikoshi, NSK, NTN and JTEKT held a number of meetings in both Japan and Shanghai. The meetings were held to discuss price increase strategies, the timing and range of price increases of bearings in the Asian and Chinese markets, and the implementation of price increase strategies. The four manufacturers increased the price of bearing products in China based on pricing information exchanged or collusion reached at these meetings.

The NDRC concluded that the manufacturers had reached price-fixing agreement related to auto parts and bearings. The illegal conduct lasted for 10 years and violated the Anti-monopoly Law by restricting and excluding competition in the relevant markets and exerting undue influence on the price of auto parts and bearings in China. This impaired the interests of downstream manufacturers and Chinese consumers. The NDRC listed the fines in detail and the proportion of the fines in relation to the enterprises' annual turnovers, as well as providing the relevant basis for any reduction in or exemption from penalties (see table below).

Factors considered by NDRC

As well as granting leniency to companies based on voluntary reporting and the importance of evidence provided, the NDRC considers the nature, gravity and duration of the illegal conduct in determining the specific amount of fines.

In this case the NDRC imposed heavier penalties based on the gravity of the conduct, which lasted for 10 years. However, the Anti-monopoly Law was introduced only six years ago. Thus, it seems overly harsh to identify conduct that occurred before the implementation of law as illegal under the principle of non-retroactivity.

The NDRC treated the companies differently based on the nature and gravity of their illegal conduct:JTEKT received the highest penalty among the bearings manufacturers (8%) because it proposed to hold an export meeting that specifically targeted the Chinese market.Three auto parts manufacturers (Asian, Mitsuba and Mitsubishi Electric) received penalties of 8% because they had reached price-fixing agreements on more than two products.The other three auto parts manufacturers (Yazaki, Furukawa Electric and Sumitomo) received lighter penalties (6%), since they reached price-fixing agreements on only one product.International trends

The companies fined in this case have already been investigated in other countries and most of them have been punished elsewhere too. This is the second case since the LCD panel in which the NDRC has fined companies that had already been investigated and fined in other countries. It is also the second case in which penalties have been imposed on foreign companies whose major illegal conduct occurred outside China.

In September 2012 the US Department of Justice imposed fines of up to $745 million on nine companies and their senior management for price-fixing agreements (Hitachi, JTEKT, Mistuba, Mitsubishi Electric, NSK, Mitsubishi Heavy Industries, T.RAD, Valeo and Toyo Rubber). In July 2013 Yazaki and its European subsidiary Leoni, Sumitomo and Furukawa Electric were fined a total of €142 million following a European Commission investigation into price fixing (Sumitomo was the amnesty reporter and so was exempt from fines). Later, auto parts suppliers NFC, NSK and NTN confessed to the European Commission a conspiracy to set up a bearing cartel. Finally, in June 2014 NSK, Nachi-Fujikoshi and JTEKT were fined for a cartel in Australia.

The NDRC closely monitors trends in international antitrust law enforcement and coordinates with competition authorities in other jurisdictions (especially those in the United States, the European Union, Japan and Korea). More investigations into companies that have been investigated in other countries are expected. In such cases the relative ease of law enforcement and evidence collection enables the NDRC to be more confident in identifying the facts and application of relevant laws. Therefore, companies that are involved in international monopolistic behaviour, especially those already being investigated in other countries, are urged to take responsibility for their conduct, take appropriate action and report to the NDRC in a timely manner if necessary. Multinationals should be aware that their monopolistic conduct will be subject to scrutiny by the NDRC, provided that it has a direct or indirect impact on the Chinese market – even if the conduct occurred outside China. Further, the possibility that the NDRC will take the initiative in pursuing such illegal conduct cannot be ruled out.

Comment

This record penalty decision demonstrates the NDRC's determination to intensify its antitrust law enforcement. Six years after the implementation of the Anti-monopoly Law, the NDRC has taken a more active and aggressive approach, targeting a wider range of industries. This case is merely the start of tighter enforcement in industries that affect daily life which have always been under the antitrust radar, such as petroleum, healthcare, telecommunications, pharmaceuticals, automotive, banks and consumer goods.

In its announcement the NDRC indicated that it will conduct further investigations following the leads uncovered in this case. Thus, the companies involved should pay particular attention to any potentially monopolistic conduct related to this case and take necessary action in a timely manner. They are strongly encouraged to report to the NDRC as early as possible in order to obtain an exemption from or a reduction in fines.

The NDRC has adopted a more stringent approach in its application of the leniency programme. It has ranked the leniency applicants in order and granted them fine exemptions and reductions accordingly. Companies should seek professional advice in making leniency applications in order to establish appropriate strategies to secure first place by submitting key evidence to the NDRC quickly and cooperating with the NDRC in its investigation.

The current antitrust enforcement strategy has posed unprecedented compliance challenges to all types of company, including foreign, domestic and even state-owned companies. Companies should implement the following proactive measures to control and minimise the risks associated with antitrust compliance:Companies should conduct internal antitrust audits to inspect and evaluate potential antitrust risks with the assistance of external counsel. They should also provide up-to-date and tailored antitrust training for senior management and employees, and promote awareness of antitrust compliance.Companies that may have already violated the Anti-monopoly Law should voluntarily report to the antitrust law enforcement agencies as soon as possible and undertake rectification measures after seeking professional advice. These may cover a rectified sales policy and sales agreement that involves price fixing and the correction of price fixing or collusive bidding conduct. Such measures should be sufficient to maintain competition in the market and to benefit consumers.Companies that have been the subject of dawn raids by the antitrust law enforcement agencies should deal with the investigation appropriately, defend their legitimate interests and be proactive depending on the situation (eg, propose a defence regarding the gravity of the conduct and the calculation of fines). In the case at hand, Sumitomo submitted a written defence within one week of receipt of the prior notice of administrative penalty issued by the NDRC. The defence addressed the miscalculation of the joint venture turnover. The NDRC accepted the defence and reduced the fine by Rmb52.32 million.(9) Thus, a proactive approach can help companies to avoid or mitigate penalties.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth