Asian butadiene at 3 1/2-year low on weak demand, rubber glut

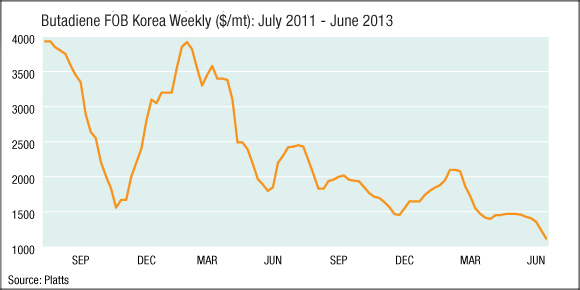

Asian butadiene prices are at a 3-1/2 half year low amid weak demand and a glut of synthetic rubber stocks, Platts data showed.

The FOBKoreabenchmark for butadiene stood at $1,350/mt on June 17.

The last time butadiene prices were lower was on November 20, 2009, when they stood at $1,285/mt

The weak demand was reflected in statistics from South Korea whose exports of the synthetic rubber feedstock fell 32% month-on-month in May to to 16,458 mt.

Also pressuring prices lower has been thin demand from theUSthis year. From January to May,South Koreashipped 9,006 mt of butadiene to theUS, down 74% on the 2012 period.

Producers and end-users said rubber demand was poor from tire makers, especially inChina, resulting in a build-up of overall domestic rubber stocks.

On May 8, Japanese tiremaker Bridgestone said production in the first quarter stood at 45,000 mt, compared with 47,000 mt in Q1 2012.

Commenting on its quarterly results, Bridgestone said sales of passenger car and light truck tires in Europe andJapanfell, citing a decline in original equipment tires.

Similarly, on April 22 French tiremaker Michelin posted Q1 net sales of Eur4.88 billion ($6.37 billion), down 8% from the 2012 period, attributing the lower sales to a weak market in theUSand poor demand for passenger car and light truck tires inEurope.

Meanwhile, overall rubber stocks atQingdaowarehouses totaled 350,700 mt Friday, down 3% from May 30, the Qingdao International Rubber Exchange said.

Synthetic rubber stocks accounted for 56,400 mt of the overall stocks, or about 16%, up from 55,600 mt on May 30, which has also dampened spot prices for various synthetic rubber grades.

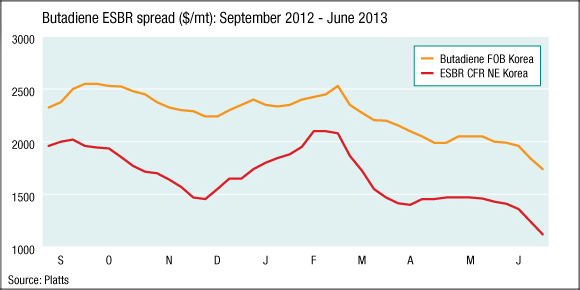

Weekly spot prices for SBR 1502 (styrene-butadiene-rubber) stood at $1,960/mt CFR Northeast Asia, their lowest since Platts started assessing the grade on September 7, 2012.

End-users in China said spot prices for butadiene could fall further as bids hovered about $1,300/mt CFR and lower.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth