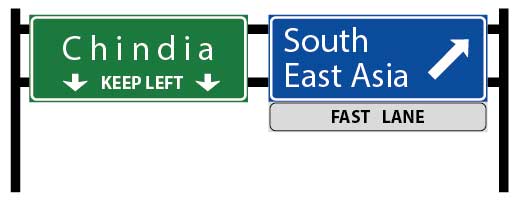

While all eyes were on "Chindia', tremendous growth opportunities have emerged

In the past decade Auto manufacturers have focused all their efforts on capturing a share of the fast growing Automotive markets in China and India. China is after allthe largest automotive market in the world now and India was seeing year on year double digit growth rates… all in a context of European and American market recession.

A new market has emerged, almost unnoticed

So while everybody was slugging it out in China and India, a new market emerged, almost unnoticed. Let me quickly describe this market - population of over 600million, GDP of over 2,333 billion USD with rapid growth, car penetration in the single digits, imports prevalent as demand outstrips supply and a car is still the most aspirational product that is a visible indicator of personal and professional success and status. Surprised??

You would be even more surprised when you realize that this market offers opportunities for all price ranges -from entry level vehicles to premium, all body types - hatchbacks, sedan, MPVs and pickups and all manufacturers - Local, Regional and Global. If you have a product to sell, chances are you will find a market here!

South East Asia has emerged and its time you sat up and took it seriously

South East Asia (SEA) is a collection of eleven countries (Brunei, Cambodia, East Timor, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam) in close geographical proximity. Indonesia, Thailand and Malaysia account for nearly 90% of the total SEA automotive sales volume and will account for over 3.3million cars sold by 2020. Each of these three markets will demonstrate a fundamental change in how their automotive market is structured and that presents a tremendous growth opportunity.

Tremendous growth opportunities

In Indonesia, MPVs will remain the largest segment, but lose share to A/B/C segments due to rising fuel costs, improving road infrastructure, eco-car projects and smaller family size vehicles. Toyota (with Daihatsu) will continue to be dominant, although other brands will gain share.

In Thailand, A and B segments will grow rapidly and take share from pick-ups. This will be driven by increasing congestion in urban centers and a government supported move towards more eco-friendly cars. Business owners, traders and farmers will still want a pickup but even in that segment we will see demand for sleeker designs and more comfort-oriented features to make it a desired family vehicle.

In Malaysia, A/B/C segments will continue to dominate the market but the dominance of local manufacturers Proton and Perodua will come under threat from global manufacturers - primarily the Japanese majors.

However, success is by no means guaranteed in these markets.

There are significant infrastructure and regulatory challenges to overcome with varying access and availability of reliable partners. However, the biggest challenge will be a deep understanding of the evolving consumer needs, motivations, brand perceptions and growth drivers. Are you prepared for South East Asia?

Related Article

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth