Profile of China's rubber industry by CRIA

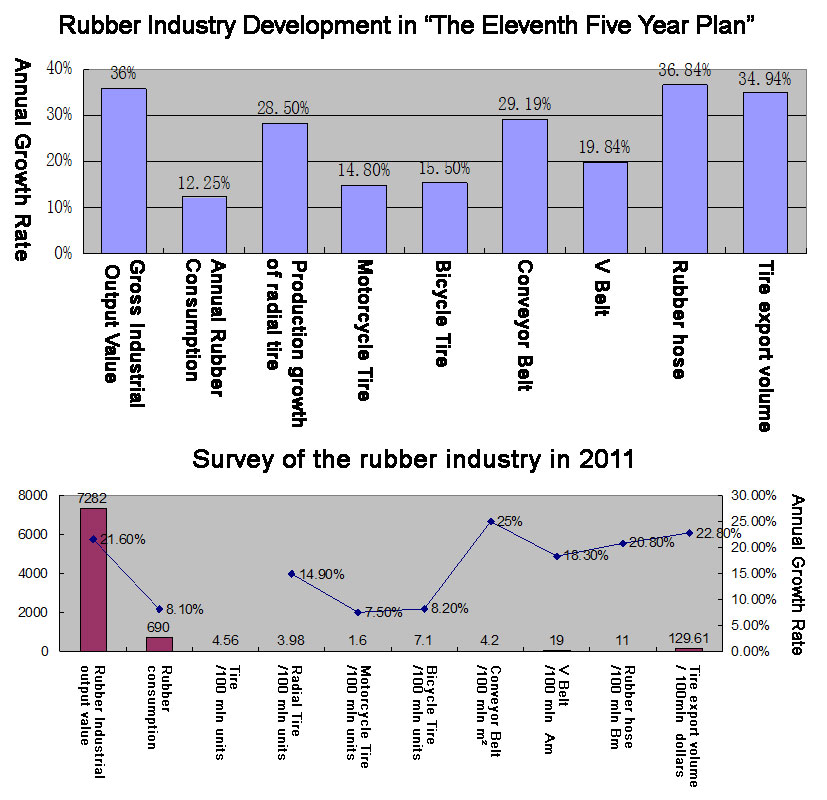

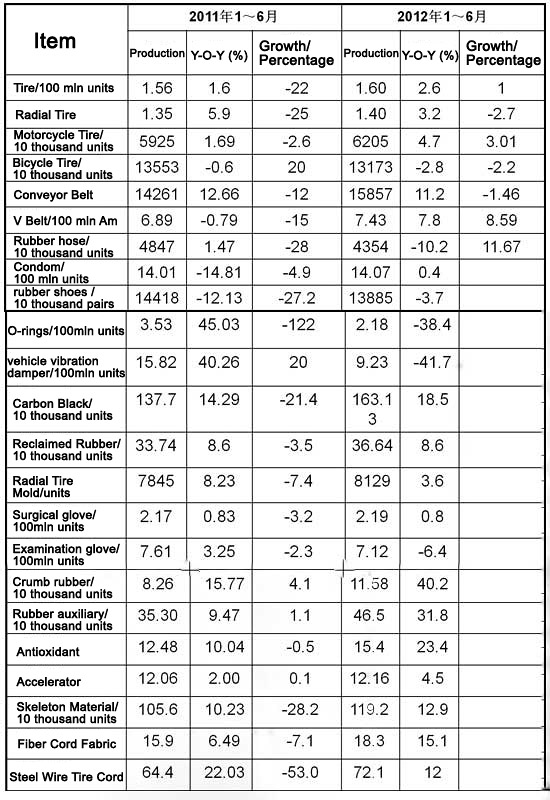

During 2006-2011,China’s rubber industrial output value reached 36% of annual growth rate and 12.25% of annual consumption growth. Amongst, radial tire’s annual growth rate reached 28.6%, and export growth reached 34.94%.

China has become one of fastest developed country in global rubber industry, according toChina’s Rubber Industry Association (CRIA).

In 2011,China’s rubber industrial output value posted 728.2 billion yuan, consuming 6.9 million tons of rubber, producing 456 million units of tires and completing 12.961 billion dollars.

At the same time,China’s rubber additives industry begun to promote “green additives”, and reached 90% of popularization. Besides, utilization of wasted tire rubber reached 85%.

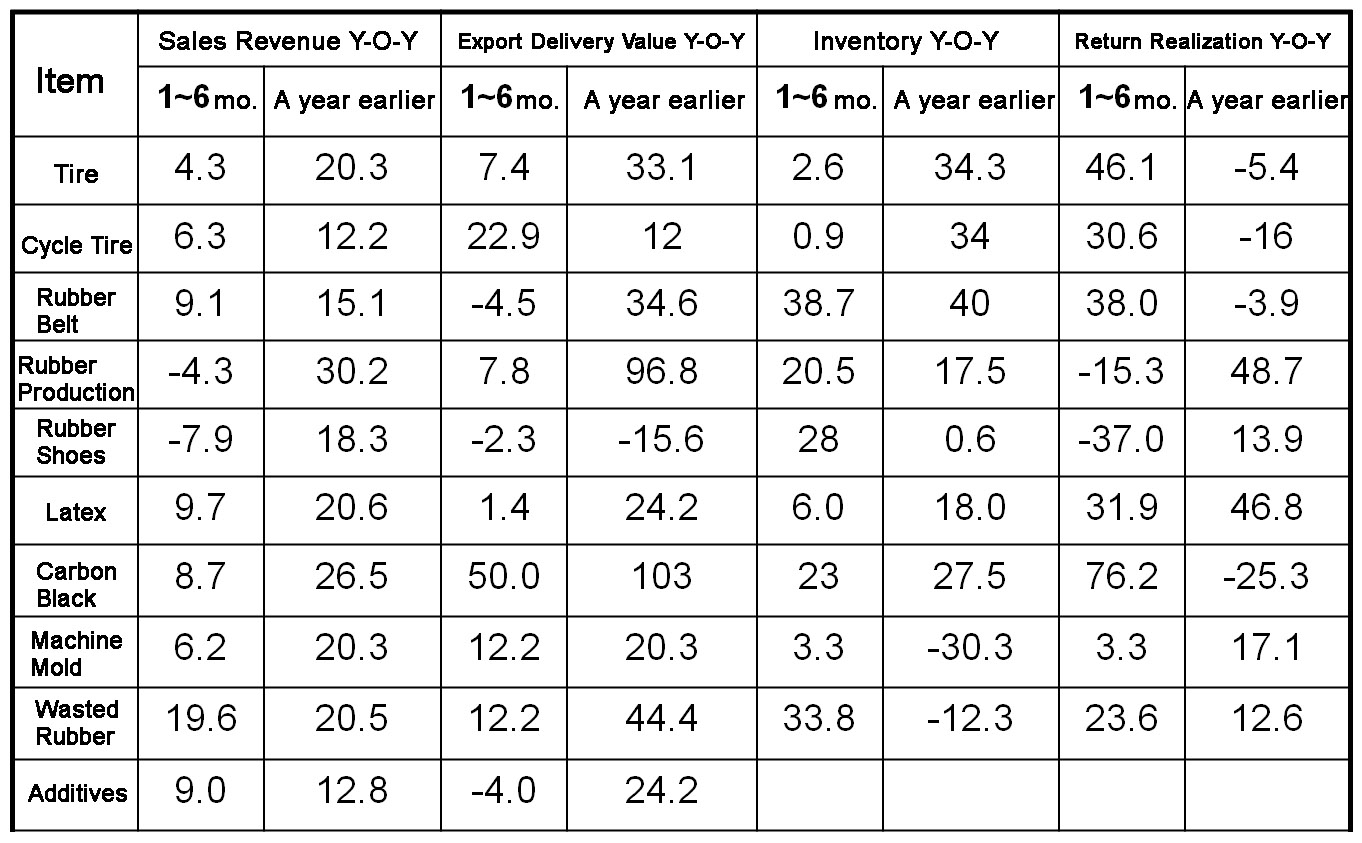

Rubber Industry’s economy performance

Since 2012,China’s rubber industry has following features:

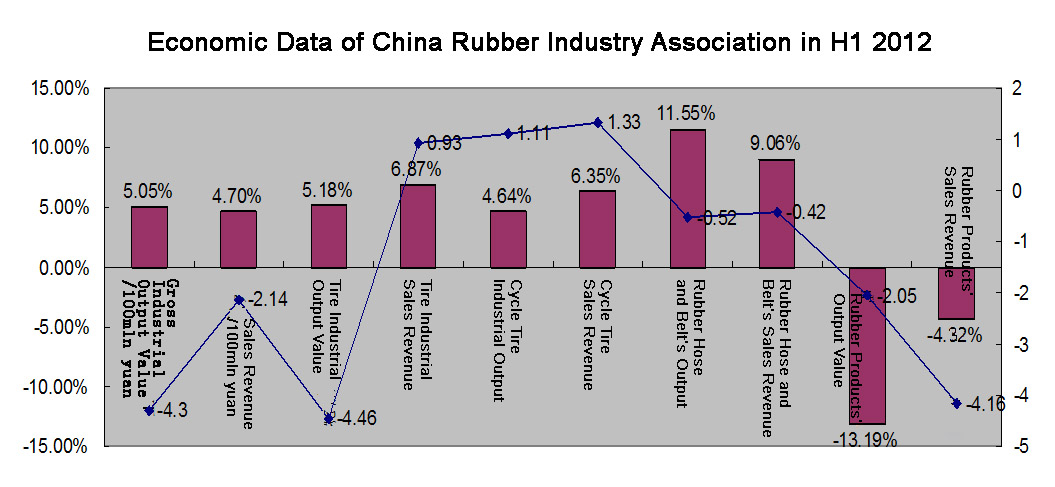

Firstly, economy growth decreased.China’s rubber industry kept slightly decrease in the first half year of 2012, but obviously better than decrease of last two years.

Secondly, rubber export largely jumped. In January, industrial export delivery value stood at -8.58%. Although the value steadily up in the following months and reached 14.01% of growth in April, the value fell in May and June.

In the first half year of 2012,China’s rubber industrial export delivery value ramped up 7.87%, 25.49 percentage points narrowed compared to the same period of last year.

Amongst, some rubber productions’ export grew, but export value fell, due to European economy recession and international trade frictions.

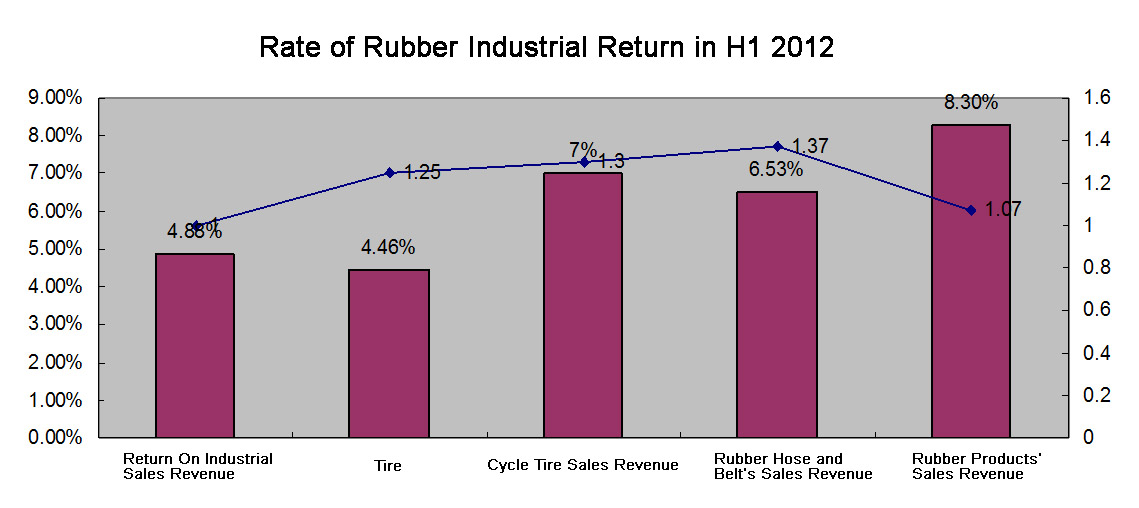

Thirdly, Industry profit limited increased. With raw material price fluctuated and production cost uncontrolled, rubber productions’ price slid down. The industry profit rate stood at over 40% in March, but slid to current 32%, which shows that the industry return was narrowed steadily.

Besides, with market demand fell, rubber companies’ inventory stayed high since 2012. The whole industry’s product inventory value posted 23 billion yuan, year on year increasing 7.9%.

Major trends of China’s rubber industry in coming years

China’s rubber industry is basically confronted with several problems: first, lack of capability in R&D and technological innovation; secondly, comparatively low industry concentration; thirdly, high independence on major raw materials and primary rubber products; fourthly, uncoordinated development between upstream and downstream industries; and last but not least, deficiencies in its growth pattern, industry observers point out.

In light of these problems, achievements are anticipated to be made in the following five aspects, which could also reflects some of the major trends in the country’s rubber industry:

Firstly, technological innovation is urged to strengthen the capacity of rubber enterprises. Analysts noted that the trend that is gathering momentum in the industry is to realize the industrialization of “green” tires, develop advanced equipments and techniques, and step up the construction of tire testing labs.

Specifically, the industry shall work hard to develop more suitable conveyor belts, put more efforts on the R&D of high-end automotive rubber tubes, step up the infrastructure construction in the industry, encourage independent development of rubber products, and gradually form a trans-regional enterprise group with specialized products and efficient management mechanisms.

As for raw materials, market observers urged that more rubber substitutes shall be explored and developed, such as polyisoprene rubber and eucommia ulmoides rubber. Moreover, the R&D and application of functional carbon black products shall be stepped up to meet the diversified market demand. More support is also anticipated in promoting the research and development of environmentally friendly auxiliaries and specialized carbon black materials.

Secondly, mergers and acquisitions (M&A) will be promoted in the industry. The number of enterprises associated with the China Rubber Industry Association (CRIA) is huge compared with its counterparts in other countries, but most of the enterprises are small ones with almost no brands that are internationally well known. It is believed that the M&A would be a crucial path for the industry to grow from the current seemingly big to actually strong in the future.

Thirdly, the industry shall constantly beef up automation and communications in the industry. During the process, more software products shall be developed to help enterprises better handle procurement of raw materials, production plans, finance, sales, and after-sale serves. Moreover, it is urged to adopt more digital management approaches in rubber-related manufacturing process.

Fourthly, huge efforts shall be made to develop energy-saving technologies and materials. This step would include developing more fuel-efficient equipments and recycling technologies of waste tires, as well as more various rubber materials, substitutes, and auxiliaries.

Last but not least, the industry shall strengthen quality control and brand building, and at the meantime cultivate a number of influential domestically-produced brands to better upgrade the traditional industry. This is the basic approach to optimize the industry’s development patterns, say industry observers.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth