China's homegrown PV deliveries fall 5.3% YoY in June 2021

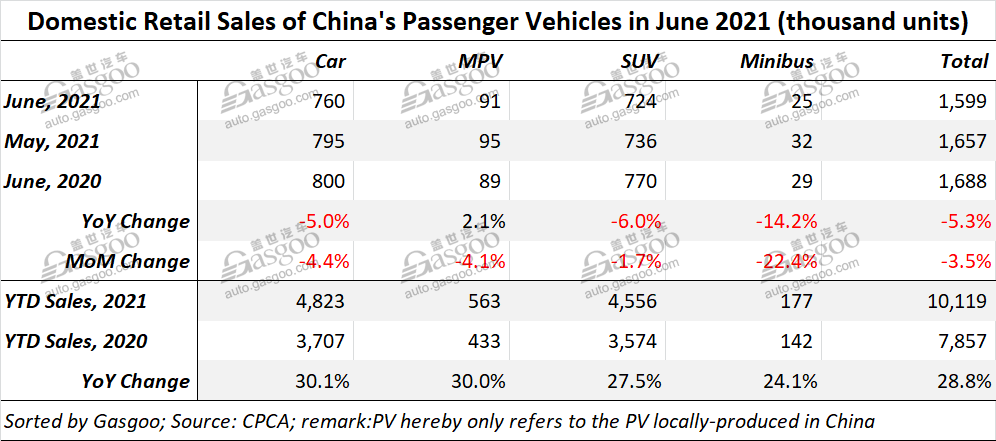

For the first half of 2021, around 10.119 million locally-produced PVs (referring to cars, MPVs, SUVs, and minibuses) were handed over to consumers in China, representing a 28.8% robust year-on-year growth thanks to the year-ago low base and a greater contribution from new energy vehicle (NEV) business, according to the China Passenger Car Association (CPCA).

Monthly China-made PV deliveries amounted to 1.599 million units in June, dropping 5.3% from the previous year, while also falling 3.5% from the previous month.

Many factors accounted for the decrease in June PV retail sales. According to the CPCA, the post-pandemic economic recovery boosted the global car shopping demands, especially the rebound in the demands of European and American auto markets which further heightened global chip supply constraint and led to more-than-expected production loss at some Chinese plants.

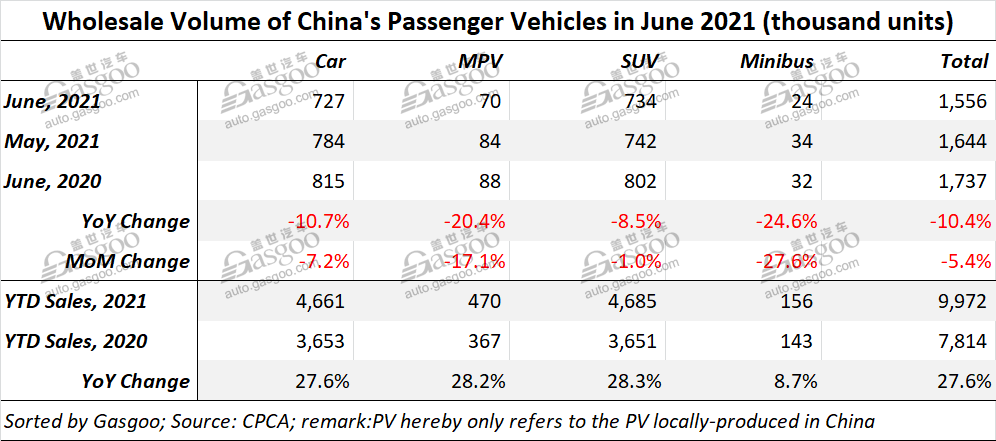

Last month, China PV wholesales dwindled 10.4% year over year to 1.556 million units. Due to the fall in June PV wholesales, some dealers of joint-venture car brands faced imbalance between wholesale and delivery, as well as demands and inventories, partly leading to the weaker retail sales as well, said the CPCA.

In addition, the car showrooms' footfall slid in June as many visitors were attracted to watching the UEFA Euro 2020, which was put off by one year to June 2021. The intensified measures for pandemic prevention and control in Guangdong province and Shenzhen also temporarily affected the showroom traffic.

In June, the deliveries of China-made luxury vehicles reached around 250,000 units, edging down by 1% from the previous year, while leaping 28% compared to May 2019. The blooming upward movement reflected the robust demands of replacing old cars with premium ones.

The retail sales of Chinese indigenous PV brands amounted to about 600,000 units in June, up 16% from the prior-year period, while also dropping 6% compared to June 2019. Such brands as BYD, GAC Aion, Hongqi, and Chery all scored high year-on-year growth thanks to their strenuous efforts to overcome the chip shortage, and to strengthen product, marketing and service quality.

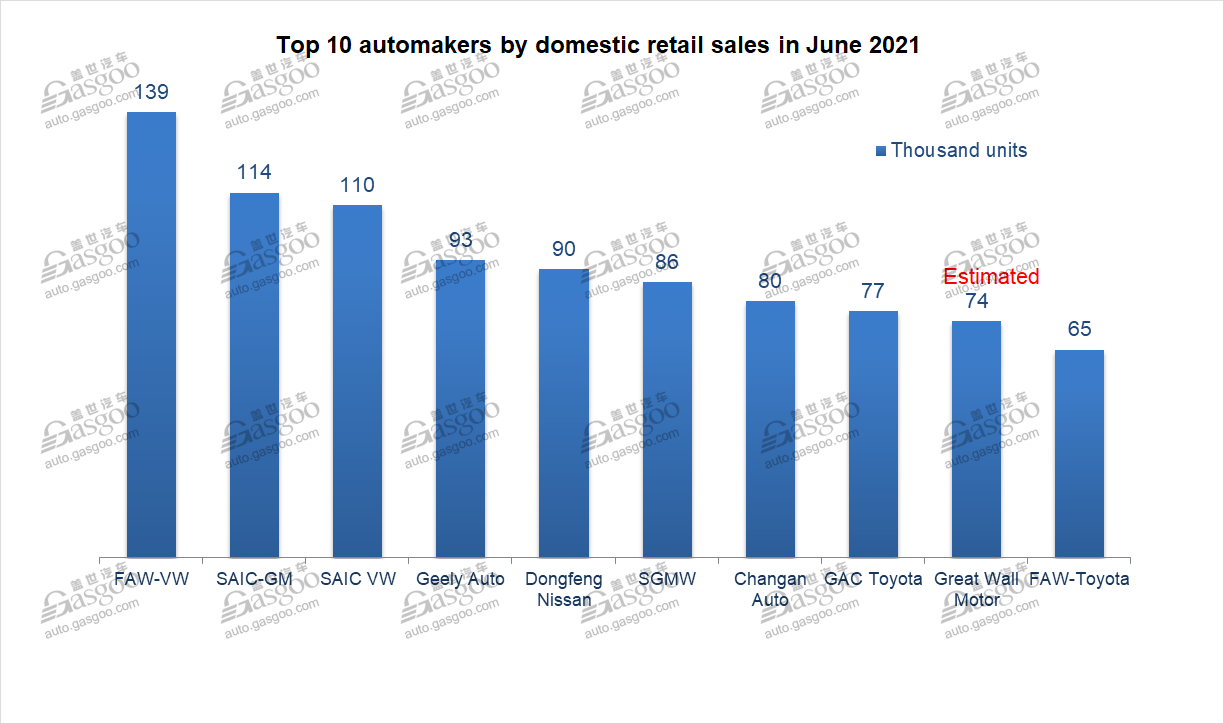

Among the top 10 rankings by June retail sales, the top three spots were still grabbed by FAW-VW, SAIC-GM, and SAIC VW. In terms of China-owned brands, Geely Auto, SAIC-GM-Wuling, Changan Auto, and Great Wall Motor ranked fourth, sixth, seventh, and ninth respectively.

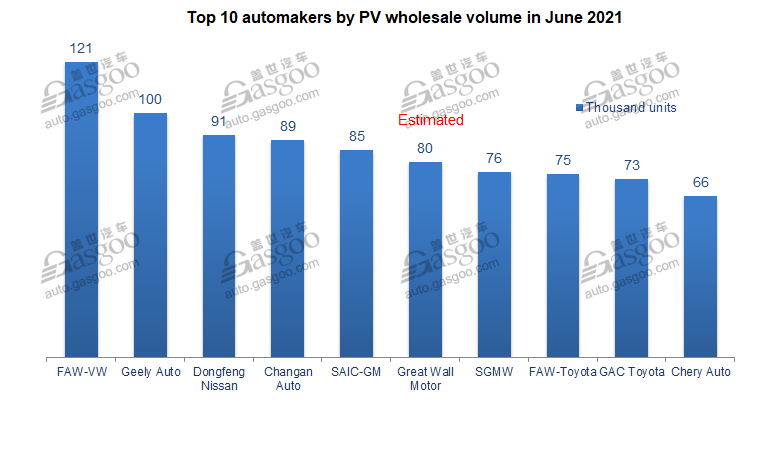

Regarding the June wholesales, FAW-VW was also honored the champion. Compared to the previous month, Geely Auto and Dongfeng Nissan moved up one and three spots respectively to the second and third places. FAW-Toyota ranked eighth, immediately followed by the other Chinese joint venture of Toyota. Notably, Chery Auto, which was rarely seen on the list, entered the top 10 rankings last month.

Related Article

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth