Review of mainstream premium auto brands’ China deliveries in first quarter

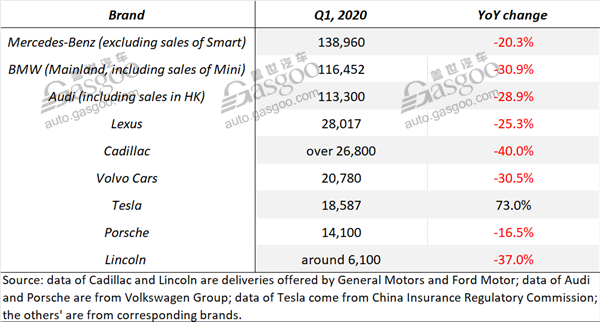

For the first quarter of 2020, premium brands still outpaced the overall auto market in sales volume, while were also slapped with evident decrease as a result of the coronavirus outbreak.

Gasgoo summarizes the retail sales volume from automakers' official sales report. The pandemic didn't shake the leadership of the three German premium brands. Among the so-called second-tier brands, Lexus topped others.

Tesla made a significant progress in China after it kicked off the scale delivery of the China-built Model 3. Since the automaker didn't report the concrete deliveries for China, we hereby use the data of vehicle insured acquired from the China Insurance Regulatory Commission.

Germany's big three

The Germany's big three premium brands all posted double-digit year-on-year decline in their first-quarter China deliveries. Mercedes-Benz was honored the champion with a volume of 138,960 units (excluding the sales of Smart). The runner-up BMW outnumbered Audi by 3,152 units.

Mercedes-Benz's gain of the championship was closely associated with the earlier work resumption of Beijing Benz. The joint venture asked in early February the government to allow its suppliers to resume production in the northern Chinese port city of Tianjin, warning of a big revenue loss if the factory shutdown continued.

Thanks to its proactive efforts, Beijing Benz was ranked sixth in Feb. and fifth in Mar. among automakers in China by monthly PV wholesale volume (“PV hereby refers to China-built cars, SUVs, MPVs and minibuses), according to the China Passenger Car Association (CPCA).

BMW handed over 116,452 vehicles (including Mini-branded cars) in China for the first three months, suffering a year-on-year slump of 30.9% as the sales nosedived in Feb. due to the coronavirus spread. Since March, the orderly work resumption has helped its operations get back on their feet.

According to Volkswagen Group, Audi's Q1 China deliveries sank 28.9% from a year ago. The impact of coronavirus is temporary, while the competition against Mercedes-Benz and BMW may be a long-term pressure.

With regard to product offensive, BMW Group intends to roll out 17 new models in China, of which the all-new BMW X5 M and X6 M hit the market on April 27. Other fuel-burning models include the all-new BMW M5 and the all-new M8 four-door coupe. Besides, Mercedes-Benz and Audi also attempt to bring 18 and 23 new models into the world's largest auto market.

Second-tier brands

With 28,017 units delivered, Lexus posted a 25.3% drop for the first quarter. Without any locally-produced model, the Toyota-owned premium brand still saw its China sales jump 25% to 200,521 units in 2019, mainly buoyed by its outstanding brand reputation and excellent quality and service supporting systems.

General Motors announced that over 26,800 consumers in China took delivery of the Cadillac's vehicles from January to March, a year-on-year plunge of 40%. Aside from the coronavirus factor, the market release of the refreshed Cadillac XT5 and CT6 somewhat led to the sales downturn.

In April, the Cadillac CT4 went on sale, which is expected to get more market share in the mid-sized sedan segment by virtue of its lower position and price.

Volvo Cars' China sales during the quarter reached 20,780 cars, down by 30.5% as compared with the same period, primarily because of the flagging sales in Jan. and Feb. The automaker said showroom traffic in the region started to pick up pace and four manufacturing plants there were reopened in March.

It would be remiss not be mention the performance of Tesla.

During the first quarter, a total of 18,587 consumers in China bought the Mandatory Liability Insurance for Traffic Accidents of Motor Vehicle (MLI) for Tesla-branded vehicles, of which 16,015 were for the China-built Model 3. The BEV-focused automaker has been regarded as a spoiler to the landscape of China's second-tier premium auto brands. Besides, it still features a substantial growth potential with the increase in the proportion of locally-produced auto parts and the delivery of the China-made Model 3 Long-range RWD in the second half of the year.

With a delivery volume of 14,100 units, China was still Porsche's largest single market for the first quarter, according to Volkswagen Group's press release. In spite of the coronavirus-caused troubles, the retail sales of the Panamera and the all-new 911 still grew 68.5% and 10.5% over a year ago respectively.

Lincoln saw its China retail sales in the first quarter dwindle 37% to nearly 6,100 units, of which 2,650 units were sold in March, said Ford Motor.

The brand began its local production process with the first Chinese-spec model, the all-new Lincoln Corsair, hitting the market on March 12. Offered in five variants in total, the compact SUV is priced between RMB246,800 and RMB345,800.

However, the domestic production might not play a powerful role in driving the future sales growth as Lincoln, as a U.S.-born luxury brand with limited influence in China, remains far behind its rivals in producing homegrown products, said a senior analyst at the Gasgoo Auto Research Institute.

Related Article

- Sri Lanka rubber exports retains bounce on Coronavirus crisis

- Shanghai to resume continuous trading of futures and options

- Asset sales bring profits to natural rubber firms, not their farms

- ANRPC foresee downward trend in global demand for natural rubber in April

- Triangle Tire posts 75.38% of net growth in 2019

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth