Top 5 Chinese EV startups all gain robust MoM growth in Sept. insurance registrations

In September, consumers in China bought the Mandatory Liability Insurance for Traffic Accidents of Motor Vehicles (MLI) for over 111,000 homegrown new energy passenger vehicles (NEPVs), representing a remarkable surge of roughly 110% from the year ago, according to China Insurance Regulatory Commission (CIRC).

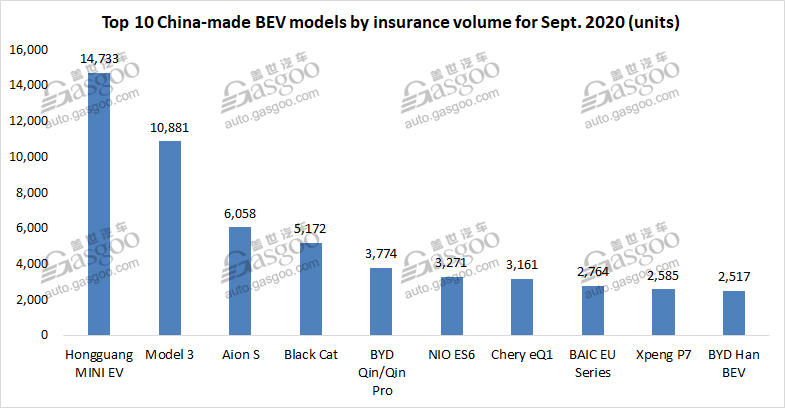

There were 90,505 all-electric PVs registered last month. In terms of the Sept. volume, the Hongguang MINI EV outperformed the Model 3 to be the best-selling China-made BEV model. For the Jan.-Sept. period, the Tesla-branded vehicles firmly held the championship with a year-to-date registration volume of 80,400 units.

The insurance registrations of startup-made NEVs topped 17,000 units last month, leaping from the roughly 13,000 units for the previous month, according to the CIRC.

Among the top 10 BEV models by Sept. registrations, there were two models—the NIO ES6 and the Xpeng P7—from startups, which were ranked sixth and ninth respectively.

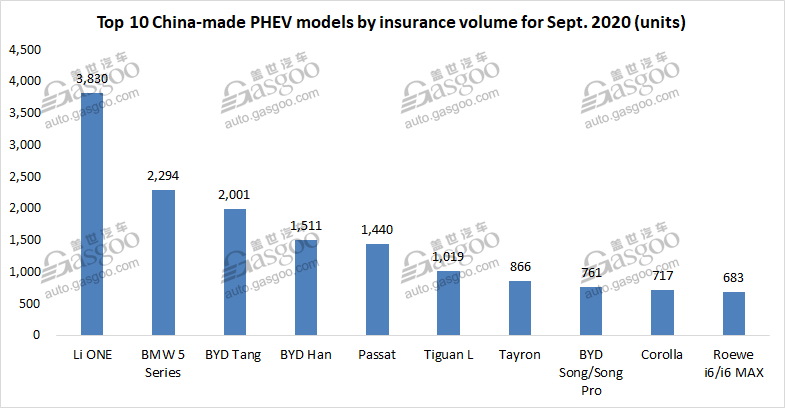

Unlike the car's predominance over the top 10 BEV model list, the top 10 PHEVs were evenly occupied by cars and SUVs. The Li ONE was still the hottest-selling PHEV model, outnumbering the BMW 5 Series by 1,536 units.

In September, the top five NEV startups by monthly insurance registrations were still NIO, Li Auto, Xpeng Motors, WM Motor and HOZON Auto. All of them posted robust growth compared to the previous month.

NIO starts delivery of third model EC6 in Sept.

A total of 4,780 NIO-branded vehicles got registered in September, representing 21.66% growth over the previous month.

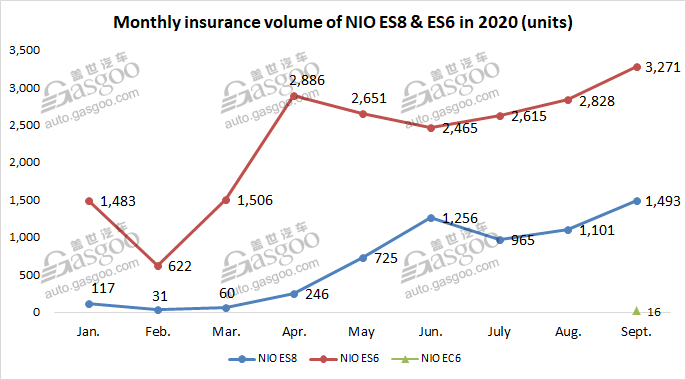

The registrations of the ES6 SUVs stood at 3,271 units last month, showing month-on-month increase for the third month in a row, while the volume of the ES8 successively grew to 1,493 units from 965 units in July.

It is noteworthy that the EC6, NIO's third production model, appeared in the CIRC's data for the first time. With the delivery kicking off in Sept, the EC6's first-month registrations were 16 units.

The upward movement was significantly associated with NIO's launch of BaaS (Battery-as-a-Service) model, which benefits NIO users with lower initial car purchase prices, flexible battery upgrade options and assurance of battery performance.

By the end of Sept., NIO had set up 167 sales and service outlets across China, including 22 NIO Houses and 145 NIO Spaces, and had launched 155 battery swapping stations.

In the latest list of the 100 companies that will change the world in 2020 released by Fortune magazine, NIO was the only auto company for launching the BaaS, sitting at the No. 47 spot.

Li Auto still holds runner-up place among startups with only one model for sale

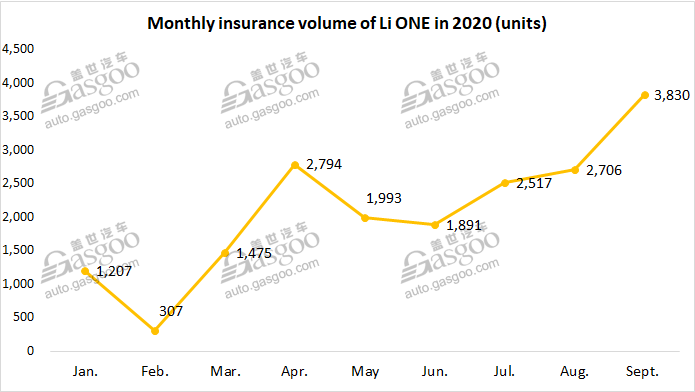

Last month, the insurance volume of the Li ONE PHEV reached 3,830 units, surging 41.54% over the previous month.

The sales hike in Sept. should be largely credited to the rapid expansion of sales network. As of Sept., Li Auto has deployed a total of 35 retail outlets in 30 cities. In the fourth quarter of 2020, the automaker will further upsize its retail system by opening stores in such provinces as Shanxi, Jilin, Inner Mongolia, Hainan, Guangxi, Jiangxi, Qinghai and Ningxia.

The startup said the cumulative deliveries of the Li One exceeded 20,000 units as of October 18, only ten months after the delivery kicking off. The milestone also made Li Auto create a record-breaking speed among Chinese startups.

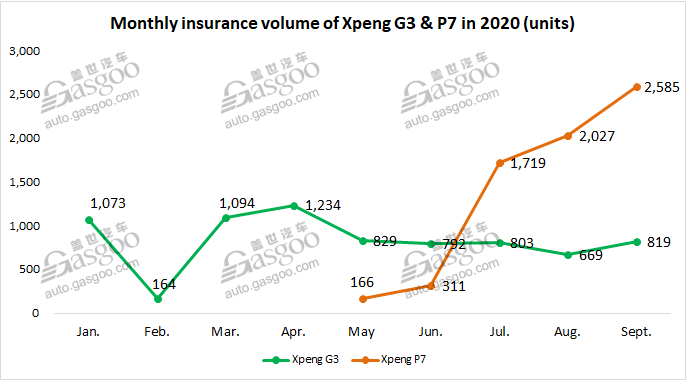

Both Xpeng G3, P7 have month-on-month increase in Sept. registrations

Xpeng Motors saw its registrations vigorously grow to 3,404 units in September from 2,696 units in August, scoring month-over-month growth for four straight months.

With 2,585 units registered, the Xpeng P7 accounted for 76% of the startup’s total registrations. The Xpeng G3 had a registration volume of 819 units, 150 units more than that of the previous month.

Following NIO's release of BaaS model, Xpeng Motors launched on September 1 its battery leasing service to lift its sales by lowering car purchase prices for consumers.

According to Xpeng's plan, a consumer who uses the battery leasing service can buy an EV without the battery pack at a price much lower than the original price and pay the battery usage fee in 84 installments on a monthly basis. After 7 years, the consumer can entirely have the ownership of the battery pack.

As part of continued efforts to ramp up production capacity, Xpeng Motors celebrated on Sept. 28 the first spade cut for its ICV intelligent manufacturing base at Guangzhou Knowledge City, its second complete vehicle production plant following the Zhaoqing one.

Meanwhile, the EV manufacturer announced the cooperation agreement signed with Guangzhou GET Investment Holdings Limited, who will provide 4 billion yuan ($598,327,600) worth of fund for Xpeng Motors speeding up business expansion and purchasing relevant facilities.

WM Motor's insurance registrations soar 25.54% MoM in Sept.

WM Motor also boasted a remarkable month-over-month registration growth in the selling season. Its registrations in Sept. were 1,696 units, leaping 25.54% from a month earlier.

Of the vehicles registered last month, 1,636 units were the WM EX5 SUVs. For the first nine months, the insurance volume of the EX5 totaled 9,613 units.

WM Motor announced on Sept. 22 the completion of its Series D round financing, which raised 10 billion yuan ($1.47 billion) from a group of state-backed investors, the highest-ever amount for a single round of fundraising launched by EV startups.

The proceeds from the financing will be primarily used for the R&D of intelligent technologies, brand construction, digital marketing and sales channel expansion.

The D round is likely to be the last round of financing before WM Motor going public on China's science and technology innovation board (STAR Market) in 2021, said a source briefed on the company's matter. The startup has already started its pre-listing tutoring procedure.

In Sept., WM Motor opened another 37 retailing and service stores, forging ahead with the actions targeting “thousand cities and thousands stores”.

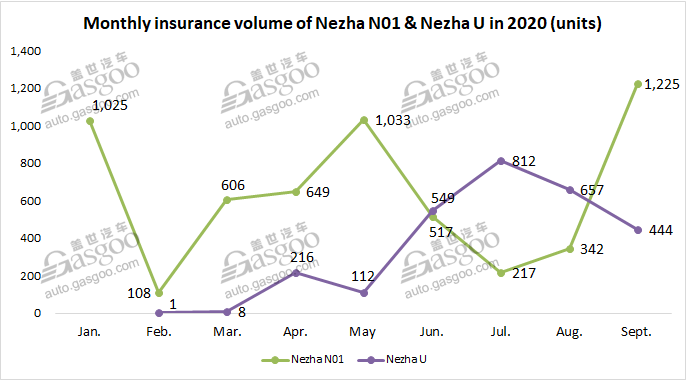

HOZON Auto sees registrations of Nezha N01 up 258.19% MoM

Nezha, the EV brand belonging to HOZON Auto, had a registration volume of 1,669 units in Sept., a remarkable month-on-month hike of 67.07%.

The impressive growth should be completely attributable to the precipitous increase in the Nezha N01 insurance number. A total of 1,225 consumers bought MLI for the N01 SUVs, skyrocketing 258.19% over a month ago. Nevertheless, the volume of the Nezha U slid to 444 units from 657 units in August.

While achieving sales increase, Nezha has made headway in its funding progress. The startup is in all likelihood to raise over 3 billion ($447,047,250) from its Series C round of financing, which overfills its target, according to Zhang Yong, HOZON Auto's president.

He also revealed that the company's gross margin is expected to turn positive due to a substantial sales growth and a low level of operational cost.

At the Auto China 2020, the startup offered the first glimpse of the Nezha V, its third production model, which is set to hit the market in this year's fourth quarter.

At the same time, HOZON Auto unveiled the concept Eureka 03. Zhang Yong disclosed that the mass-produced version is likely to be launched in 2022, retaining over 90% of the concept's features.

On Sept. 27, the EV manufacturer opened direct-sale experience centers in seven cities at one go, namely, Beijing, Guangzhou, Tongxiang, Wezhou, Wuhan and Shijiazhuang, making its products and services accessible to wider regions.

Related Article

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth