China’s PV capacity utilization rate may shrink to 46% in 2019

Recently, Gasgoo Auto Research Institute (GARI) launched a series of surveys about China's current auto market situation and future trend, and then output the resultant analysis in the form of Data Talk (or "D-talk"). We shall start this data series with the present PV capacity utilization performance for the world's largest auto market.

By the end of June 2019, China's auto market has suffered year-on-year downturn for 12 straight months. However, many PV manufacturers in China have not slowed the pace to expand their production capacities in the cloudy market environment, thus may exacerbate the problem of overcapacity.

After compiling and analyzing the vehicle outputs and production & products planning released by respective PV manufacturers in China, GARI hereby described the fact and relevant forecast about China's PV capacity utilization in aspects of the national status and brand origins:

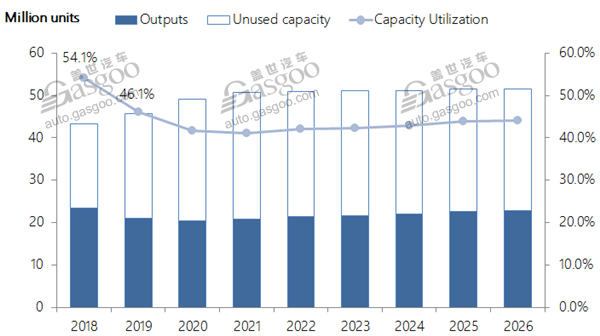

A large amount of Chinese carmakers are scrambling to ramp up vehicle capacities despite the overall sales downturn, making the overcapacity an established issue for China's PV industry. GARI forecasts that total annual capacity of China's PV manufacturers will rise 7% compared with 2018. With the auto sales volume further sliding, the average PV capacity utilization rate in China may decline to 46.1% in 2019 from 54.1% in 2018.

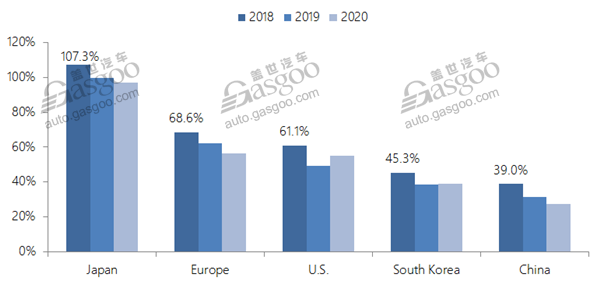

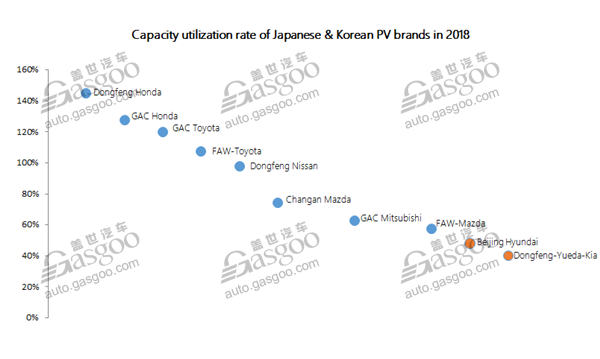

However, the overcapacity is not a universal problem vexing each PV manufacturer in this country. GARI found out that the capacity utilization of brands originating from Japan (hereby shortened as Japanese brands) reached at roughly 107.3% in 2018 and is expected to slightly shrink to 99.7% in 2019, still remaining at a high level.

Generally speaking, capacities of Japanese PV brands are being well utilized. Particularly, Honda- and Toyota-branded vehicle makers are operating at full capacity. Nevertheless, Korean PV brands are getting their capacity utilization less than 50%.

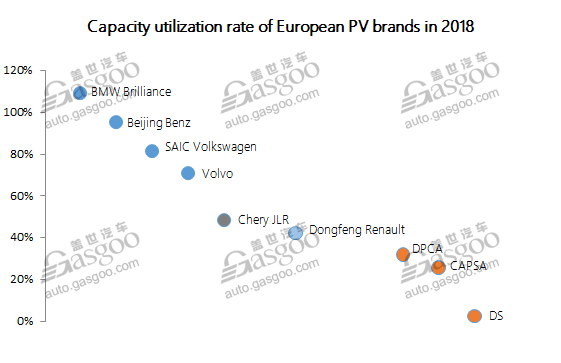

Premium car sales still maintain a rising momentum despite the overall sluggish market climate. Thanks to the continuous sales growth, capacities of premium carmakers have been maximized. For instance, the annual capacity utilization of BMW Brilliance exceeded 100% in 2018, while Beijing Benz came on the heel of the BMW's Chinese joint venture.

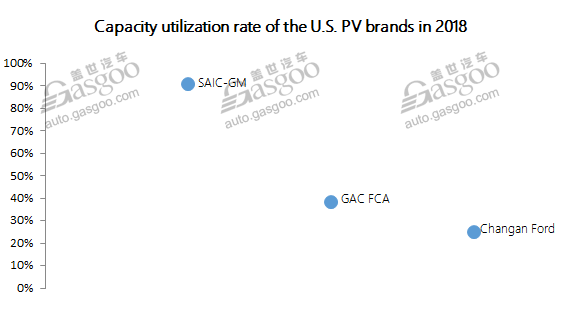

Among the U.S.-born PV brands delivered in China, Ford features a particularly low capacity utilization rate—only 9.4% for the first half of 2019—with its sales tumbling in China. Changan Ford has said it planned to roll out over 30 new models over the next three years and at least 50 new models by 2025, so as to boost its sales performance and enhance capacity utilization.

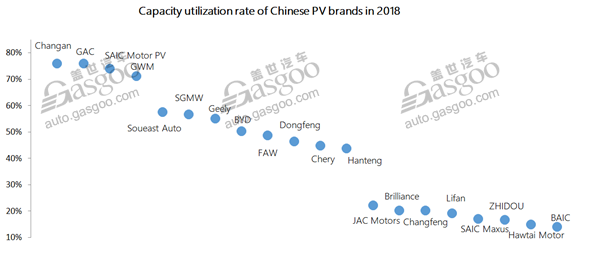

In 2018, combined capacity of PV brands solely owned by Changan Automobile, GAC Group and SAIC Group were all over 70% utilized. However, considering the audacious capacity expansion, capacity utilization rates of most China-owned PV brands are projected to be fewer than 50% in 2019 except Changan Automobile, SAIC Motor, Great Wall Motors and BYD.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth