Summary of premium car brands’ China sales in April

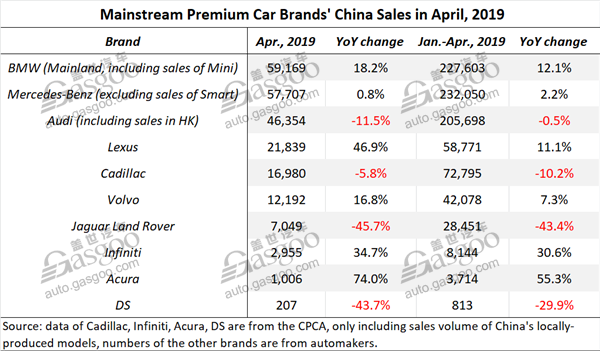

According to the China Passenger Car Association (CPCA), China’s premium car brands’ retail sales in April edged up 2.1% to 167,360 units. From January to April, a total of 674,753 premium cars were delivered in the world’s largest auto market with a year-on-year growth of 4.5% (the CPCA only reports sales of locally-produced models).

Although the premium car brands mentioned by the CPCA only includes Mercedes-Benz, BMW, Audi, Cadillac, Jaguar, Land Rover, Volvo, Infiniti and Acura, Gasgoo hereby added the data of Lexus and DS for a wider coverage. Such brands as Cadillac, Infiniti, Acura and DS didn’t give official data, so we used the CPCA’s data and hope that they would show a general trend even if the imported vehicle sales were not included.

BMW

BMW (including Mini brand) outsold Mercedes-Benz and Audi with its April sales in China jumping 18.2% year on year to 59,169 units.

With its Strategy NUMBER ONE > NEXT, BMW Group is to substantially expand its product lineup in 2019. In the first quarter, the group rolled out the BMW i8 Roadster, the new BMW i3 with a range increased to 340km and the BMW X1 PHEV with enhanced range. At the Auto Shanghai 2019, the automaker launched the BMW X7 full-sized SUV and the all-new BMW 3 Series. Besides, the all-new BMW X3 M and the X4 M will also be unveiled this year.

Mercedes-Benz

It seems that the dispute between a Mercedes-Benz 4S dealership and a local customer in Xi'an rarely brought any negative impact on the German automaker. Last month, Mercedes-Benz’s China sales hit a new high of 57,707 units. Its year-to-date sales have aggregated 232,050 units, topping other premium brands so far this year.

Audi was not that lucky. In April, it suffered a double-digit year-on-year sales decline of 11.5% in China, only better than Jaguar Land Rover and DS. Affected by the relatively big monthly downturn, the automaker’s Jan.-Apr. sales in this country also edged down 0.5% over the previous year.

Changeovers with volume models such as the A6L dampened deliveries to customers. However, sales volume for such models as the Audi A4 (14,221 units, +11.9%), the A5 (1,424 units, +133.1%) or the Audi Q7 (units cars, +24.0%) still rose vigorously.

Lexus

Last month, Lexus saw its monthly sales in China surpassed 20,000 units for the first time, outperforming Cadillac as the champion of so-called second-tier premium car brands. Meanwhile, it is worth mentioning that the sales of Lexus hybrid models reached 7,863 units in April, accounting for 36% of total monthly sales. Besides, the sales mainstay Lexus ES had a sales volume of 10,629 units.

Cadillac

Cadillac maintained a sliding momentum in April. It was still the champion second-tier car brand by Jan.-Apr. sales, while only around 14,000 units more than that of Lexus.

According to the China Passenger Car Association (CPCA), the April retail sales of Cadillac CT6 sedan and the XT5 SUV slumped 20.4% and 55% respectively to 1,073 units and 2,785 units.

Volvo

Last month, Volvo also obtained a double-digit growth in China sales thanks to high demands of the locally-produced XC60 and S90.

The CPCA’s data showed that the retail sales of the Volvo S90 sedan and the XC60 SUV significantly grew 16% (to 3,475 units) and 50.5% (to 5,233 units) compared with the year-ago period.

Jaguar Land Rover

Jaguar Land Rover’s China sales in April were almost halved over a year earlier. As to year-to-date sales, it still faced a sharp decrease of 43.4%.

Infiniti & Acura

According to the CPCA’s data, locally-produced models of Infiniti and Acura presented 30.6% and 55.3% sales surge respectively for the first four months partly thanks to the launching of the all-new Infiniti QX50 and the all-new Acura RDX.

The CPCA said retail sales of the QX50 SUV totaled 5,155 units through April, skyrocketing 4421.9% from the year-ago period.

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth