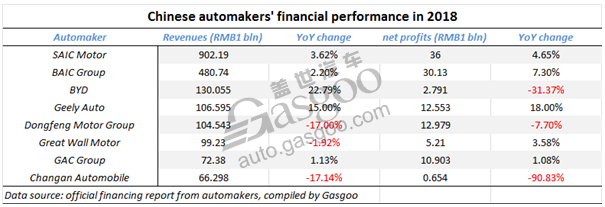

Summary: profitability of Chinese mainstream automakers in 2018

In 2018, China's automobile market was struck by a negative growth for the first time since 1990. As for automakers in this country, the downturn not only somewhat depressed their sales performance, but also acted on financial performance.

Gasgoo compiled financial data released by most Chinese major auto groups and found out that the growth rates of both revenue and net profit for most automakers listed here were less than that of the previous year or even the first three quarters in 2018. For example, SAIC Motor, taking the championship by a landslide, gained a 3.62% year-on-year increase in 2018 revenue, while significantly less than the 15.1% growth for the previous year.

SAIC Motor

SAIC Motor announced its 2018 annual performance on April 1, saying its full-year revenue grew 3.62% year on year to RMB902.19 billion and the net profit attributable to shareholders of the company climbed 4.65% to over 36 billion.

Besides, the automaker posted basic earnings of RMB3.082 per share, compared to RMB2.959 for 2017.

SAIC Motor witnessed a robust growth of its self-owned car brands despite the overall downturn of the auto market last year. In 2018, it Roewe and MG brands achieved total annual sales of around 730,000 units, up 36.5% over a year ago, and its Maxus hit 126,000 units, a year-on-year increase of 14.5%.

Besides, new energy vehicles (NEVs) and oversea business shored up the development of the automaker's self-owned brands. SAIC Motor saw its NEV sales skyrocket 120% from the previous year to around 142,000 units in 2018. Of that, Roewe and MG NEVs sales aggregated up to 97,000 units, surging 119% year on year.

BAIC Group

Last year, BAIC Group earned RMB480.74 billion in annual revenues with a year-on-year growth of 2.2% and RMB30.13 billion in full-year net profits, an increase of 7.3%.

BAIC Group sold 2.402 million vehicles throughout 2018. It is ambitious to sold 2.45 million vehicles in 2019 and gain a yearly revenues of RMB500 billion. The sales targets set for such joint-venture brands as Beijing Benz, Fujian Benz and Beijing Hyundai are 560,000 units, 28,500 units and 900,000 units respectively.

BAIC Group will strive to build its own competitive intelligent-connected new energy vehicles. Besides, it will accelerate the development of self-owned core brands by shaping a global leader image for the ARCFOX premium EV brand and building the Beijing BJ into China's No.1 off-road vehicle brand. The group will also firm the Foton Motor's position in CV market.

BYD

BYD announced that its gross revenues in 2018 jumped 22.79% year on year to RMB130.055 billion, the sixth consecutive yearly increase. However, its net profits attributable to shareholders of listed company only reached RMB2.791 billion, significantly dropping 31.37% from a year ago.

BYD faced negative growth in net profits for the second year in a row. In 2017, its net profits attributable to shareholders slid 19.7% to RMB4.066 billion.

The company ascribed its profit decrease to four major reasons as below:

1) The fierce competition caused by the overall industrial downturn somewhat affected its profitability in fuel-burning vehicle business despite the general stable development in this sector, thus brought pressure on company's profitability.

2) The orders and profits of mobile phone parts and assembly businesses were somewhat struck by the weakened industrial demand and intensifying market competition.

3) Influenced by policy fluctuation and impairment losses on assets, the photovoltaic business faced a widened annual loss.

4) The increase of financial expense caused by the rising funding cost also impacted BYD's overall profitability to some degree.

Geely Auto

Geely Automobile Holdings Limited reported on March 21 that its annual revenue in 2018 grew 15% year on year to RMB106.595 billion and the full-year net profit attributable to equity holders jumped 18% over a year ago to RMB12.553 billion.

Besides, the automaker reported basic earnings per share of RMB1.4 and proposed a final dividend of HK$0.35 per ordinary share.

The annual report said total net profit of the group grew 18% from RMB10.74 billion in 2017 to RMB12.67 billion in 2018 thanks to the increase in overall sales volume and better profit margin during 2018.

Moreover, the group's average ex-factory selling price was up only 1.1% over the same period of the previous year due to the launch of a few lower-priced compact SUV models since the second half of 2017 and the exclusion (from the calculation) of the higher-priced “Lynk & Co” vehicles, which were sold under its 50%-owned joint venture.

Dongfeng Motor Group

In 2018, Dongfeng Motor Group's annual revenue shrank around 17% to RMB104.543 billion, the lowest volume for the latest four years. Meanwhile, the full-year net profit attributable to parent company's shareholders reached a new low for the past three years, declining 7.7% over the previous year to RMB12.979 billion.

The group sold nearly 3.0522 million vehicles throughout 2018, posting a year-on-year decrease of 7.06%, which was also the first-time drop since 2012. The annual sales of PVs and CVs fell 8% and 6% respectively to 2.6116 million units and 440.5 thousand units.

Dongfeng Motor said the decrease in revenue, profit and sales should be mainly ascribed to such factors as macro economy slowdown, the phase-out of vehicle purchase tax preferential policy and lack of consumers' confidence.

Great Wall Motor

Great Wall Motor (GWM) gained total operation revenue of RMB99.23 billion in 2018 with a slight year-on-year drop of 1.92%. Its net profit attributable to shareholders climbed 3.58% over a year ago to around RMB5.21 billion. Basic earnings per share were RMB0.57, higher than RMB0.55 for 2017. Besides, gross profit margin was decreased by 1.40 percentage points compared with the previous year to 17.5%.

According to the annual report, the group's principal products are pick-up trucks, SUVs and sedans. Moreover, it also engages in the production and sale of major automotive parts and components used in the above mentioned products. During 2018, GWM’ sales volume of automobile were 1,043,707 units, remaining basically the same as that of the former year. However, the sales proportion of new products with relatively higher selling prices continued to rise.

GAC Group

GAC Group announced on March 29 that its full-year consolidated revenue in 2018 edged up 1.13% year on year to around RMB72.38 billion and its net profit attributable to shareholders of parent company slightly climb 1.08% over the previous year to RMB10.903 billion.

Besides, the automaker posted earnings of RMB1.07 per share, 10.83% less than that of a year ago.

The Board decides to recommend payment of a final dividend of RMB2.8 per 10 shares (including tax). Along with an interim dividend of RMB 1 per 10 shares (including tax) that has been distributed, the group will pay a total of RMB3.887 billion in full-year dividend to shareholders, a year-on-year increase of around 2.64%. Up until now, GAC Group has distributed over RMB12 billion worth of cash dividends since it went public.

Changan Automobile

Chongqing Changan Automobile Co., Ltd (Changan Automobile) reported on April 15 that its full-year revenue in 2018 reached RMB66.298 billion, declining 17.14% over a year ago. Its annual net profit attributable to shareholders of the listed company plunged 90.83% from the previous year to around RMB654 million.

On the same day, the automaker released a review of its performance in the first quarter of 2019, with an expected net loss of around RMB1.7 billion to RMB2.5 billion attributable to shareholders of the public company, nosediving 222.14% to 279.62% compared with RMB1.39179 billion net profit earned in the same period a year earlier.

The automaker mainly ascribed the Q1 net profit slump to the sales decrease. For the first three months of the year, Changan Automobile saw its cumulative sales tumble 31.8% year on year to 448,811 units.

Related Article

- India Rubber: Hits 1-wk high on bargain buying, tracking TOCOM gains

- CNPC starts building $1.4 bln ethylene plant in northwest China -state media

- US levies antidumping duties on Chinese steel trailer wheels

- China to focus on radial tire development in Yunnan Province

- Electric vehicle growth will impact tire manufacturing, Smithers Rapra research says

- Tireworld Insight: Domestic tire makers eye overseas expansion

- Tireworld Insight: Price disparity severe between China's rubber exports and imports

- Tireworld Insight: China tire exports dependent on US market performance

- Tireworld Insight: SHFE rubber expected to move in tight range in short-term

- Tireworld Insight: Rubber futures to test near-term resistance at 15,000 yuan/tonne

- Tireworld Insight: China’s tire industry on track of rapid growth